USD/CAD ANLAYSIS & TALKING POINTSFlying US dollar hampering CAD upside of recent.US economic data crucial for next steps.Bearish divergence, mean

USD/CAD ANLAYSIS & TALKING POINTS

- Flying US dollar hampering CAD upside of recent.

- US economic data crucial for next steps.

- Bearish divergence, mean reversion and long wicks in favor of CAD bulls.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

The Canadian dollar has been at the mercy of US specific factors, with particular emphasis on soaring US Treasury yields that have bolstered the greenback against all major currencies. Even the resilience of crude oil prices due to production limits has been overpowered by a rampant USD, leaving the loonie vulnerable. From a bearish perspective, crude oil dynamics will remain tight (supply) throughout 2023 so any weakness in US data could see the CAD garner support.

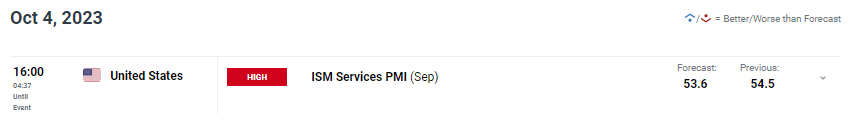

The upcoming week is comparatively mild from an economic calendar standpoint (see below) but will be hard hitting with a few key releases including today’s ISM services PMI (important as the US is largely a services driven economy), Canadian & US (NFP) jobs reports and US PPI. Of recent, the US labor market has not shown any sign of weakness and if this trend is to continue, we may see further weakness in the CAD and vice versa.

USD/CAD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Moving Averages

Recommended by Warren Venketas

USD/CAD DAILY CHART

Chart prepared by Warren Venketas, IG

Technically, daily USD/CAD price action is exhibiting multiple technical analysis proposals with the first and most important being a retest of the longer-term trendline resistance (black) coinciding with the 1.3700 psychological level. This resistance zone has held from October 2022 and a confirmation breakout will be ominous for the CAD; however, the long upper wicks being presented could suggest yet another defense of this zone by USD/CAD bears. Another positive for subsequent downside is the presence of bearish/negative divergence where prices move in the opposing direction to the Relative Strength Index (RSI).

Post the golden cross (blue), the upside rally has moved away from the mean (moving averages) and could now revert back toward the mean. In summary, upcoming fundamentals as well as central bank speak (centered around the Fed) will be the catalyst for the next leg in USD/CAD.

Key resistance levels:

Key support levels:

- 1.3500

- 200-day MA

- 50-day MA

- 1.3373

- 1.3300

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently net SHORT on USD/CAD, with 71% of traders currently holding short positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect USD/CAD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com