USD/ZAR Outlook: Bullish above 18.00 Recommended by Tammy Da Costa Get Your Free Top Trading Opportunities Forecast US

USD/ZAR Outlook: Bullish above 18.00

Recommended by Tammy Da Costa

Get Your Free Top Trading Opportunities Forecast

US Dollar Strengthens While the Rand Lacks Clarity – Prices Stall Around 18.200

USD/ZAR is currently hovering around 18.200, finding support above the psychological level of 18.00.

With the emerging market (EM) currency currently on track to achieve six consecutive weeks of gains, the resilient US economy has helped drive the pair lower.

As South Africa continues to suffer from hours of planned electricity outages (known as load shedding), the country has succumbed to the effects of declining productivity.

Although the major power utility Eskom has been granted a $13.9 billion bailout, a strong Dollar and a robust labor market have bolstered demand for the safe-haven greenback. For the volatile Rand, both technical and fundamental factors continue to weigh on price action.

Recommended by Tammy Da Costa

Traits of Successful Traders

USD/ZAR Technical Analysis

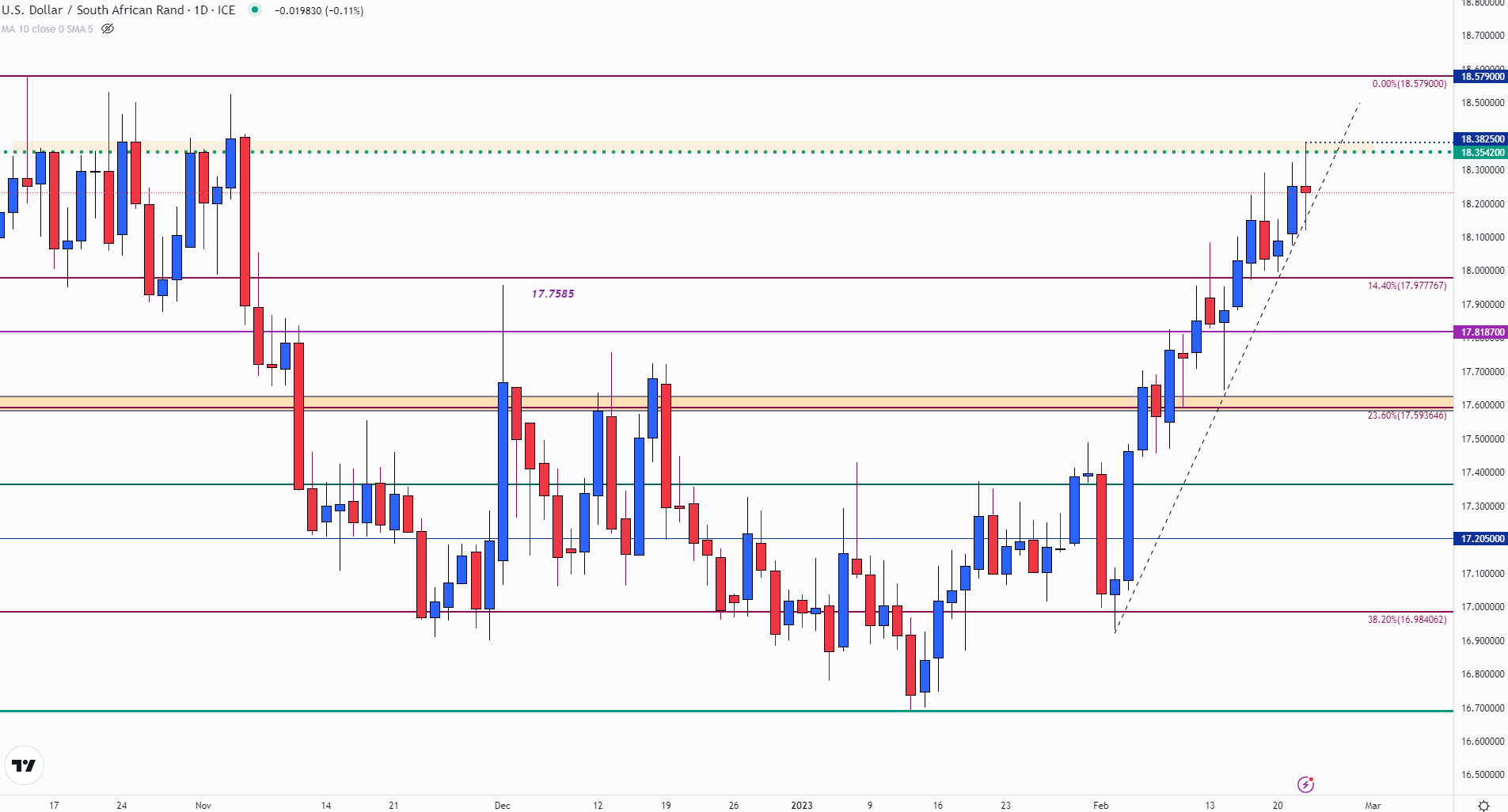

After rising back above 18.00 earlier this month, USD/ZAR has continued to climb toward the October ’22 high, holding as resistance at 18.579. While the pair remains vulnerable to changes in the growth outlook and prospects of higher rates, a shallow-bodied candle has appeared on the daily chart.

USD/ZAR Daily Chart

Chart prepared by Tammy Da Costa using TradingView

With prices currently hovering around 18.200, a move higher could open the door for upside potential. If the Dollar strengthens and the pair holds above 18.400, the October high could remain in sight. As the rising trendline from the current month low remains intact, the pause in today’s price action could be indicative of indecision, suggesting an important zone of technical support and resistance.

Although technical levels suggest that the pair may continue to rise, the 18.00 handle remains key. If South Africa continues to face more power outages, the upside could be supportive of additional gains.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com