HANG SENG, CHINA A50, MSCI EM INDEX OUTLOOK:Asian indices could open flat as US sanctions in opposition to the safety legislation

HANG SENG, CHINA A50, MSCI EM INDEX OUTLOOK:

- Asian indices could open flat as US sanctions in opposition to the safety legislation bitter sentiment

- China A50 Index stays in an ascending channel; Caixin PMI beats forecast at 51.2

- The MSCI EM Index has probably fashioned a ‘double high’, signaling extra consolidation

Grasp Seng Index Outlook:

The Hong Okong inventory market is closed for HKSAR Institution day in the present day, and the Grasp Seng Index inventory market index futures are pointing to a muted begin. Buyers in Asia are largely ignoring one other cheerful session within the Wall Avenue, and cautiously assess the implications of US sanctions over Hong Kong.

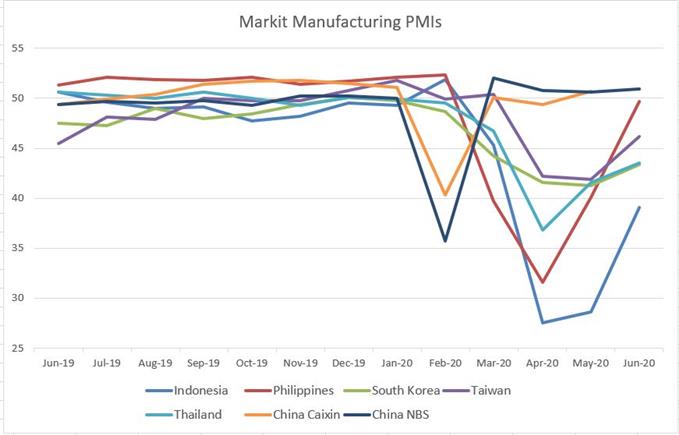

China’s Caixin PMI in June got here in at 51,2, smashing market expectation of 50.5 and former month’s studying of 50.7. Alongside a string of upbeat Markit manufacturing PMIs from different Asian economies (mentioned in later half), this marks a stable rebound in Asia’s manufacturing sentiment and can probably underpin Asian fairness efficiency in the present day.

The approval of a controversial Hong Kong safety legislation appear set to undermine sentiment, because the US will quickly finish exports of protection and dual-use applied sciences to Hong Kong because it does for China. US Commerce Secretary Wilbur Ross stated that “rules affording preferential remedy to Hong Kong over China, together with the supply of export license exceptions, are suspended.”

This most likely marks an escalation of political tensions and protectionism between the world’s two largest economies, a relationship which is essential to international commerce and development. A hawkish stance in Washington and Beijing across the new safety legislation may manifest right into a bearish sign on Hong Kong equities.

A breakdown of the Grasp Seng Index’s efficiency yesterday reveals that expertisecompanies have gotten the brand new safe-haven amid exterior headwinds. China’s gaming and expertise big Tencent (700 HK), which accounts for 11.3% of Grasp Seng’s weighting, was doing the heavy lifting yesterday and contributing to 56% of the index’s acquire. Tencent has largely outperformed the benchmark even regardless of India’s ban on Chinese language apps. Tencent has soared 32% from March’s trough, dwarfing Grasp Seng’s 10% acquire throughout the identical interval (chart under).

Grasp Seng Index –Technical Evaluation

HSI discovered a robust assist at 24,100 – the 38.2% Fibonacci retracement degree. The index has been ranging between 24,000 – 25,000 for 3 weeks, failing to interrupt out above the higher certain. Sideways commerce appears set to proceed in a skinny liquidity week, with US markets closed on Friday for the Independence Day vacation.

A break under assist at 24,000 could open room for extra draw back in the direction of 23,000.

MSCI China A50 Outlook:

Essentially, the ratio of MSCI China Financials Index/MSCI China Index has dropped to its all-time low just lately (chart under), largely as a result of monetary sector’s underperformance in comparison with expertise, healthcare and consumer-linked names. Rising non-performing loans because of the Covid-19 pandemic and a slowdown in abroad demand are weighing on banks’ valuations.

Technically, The MSCI China A50 Index is using an ascending channel since early March, and is going through some resistance at round 13,900. In the present day’s China Caixin PMI and tomorrow’s launch of US non-farm payroll information are key occasions to drive the index’ subsequent transfer.

MSCI EM Index Outlook:

A string of Asian Markit manufacturing PMIs will set the tone for Asia’s rising market buying and selling in the present day. As proven within the chart under, Asia’s main rising economies (ex-Japan) have rebounded sharply in Could from the trough in April (chart under). June’s launch will assist gauge the depth of second-quarter fallout.

Supply: Bloomberg, DailyFX

Technically, the MSCI EM Index has probably fashioned a double high at round 1,030, which now serves as a key resistance degree. Its upward pattern stays intact as highlighted within the green-color channel. A profitable breakout above 1,030 will open room to extra upside in the direction of 1,050 – the 161.8% Fibonacci extension degree.

Beneficial by Margaret Yang

Don’t give into despair, make a recreation plan

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part under or @margaretyjy on Twitter