ASX 200, NIKKEI 225, STRAITS TIMES INDEX OUTLOOK:ASX 200 index could rise after a powerful US session, going through key resistan

ASX 200, NIKKEI 225, STRAITS TIMES INDEX OUTLOOK:

- ASX 200 index could rise after a powerful US session, going through key resistance at 6,100 forward

- Nikkei 225 index climbed in early hours, which can lead Pacific shares greater

- Straits Instances index is consolidating at 2,500, ready catalysts for a breakout

ASX 200 Outlook:

Australia’s ASX 200 (ASX) index inventory market benchmark could open mildly greater on Tuesday, in accordance with the futures market. As US expertise shares led a good rebound in US native fairness indices in a single day, that will ship index futures costs greater throughout the Asia-Pacific area.

Because the ASX 200 index lingered round a key resistance zone within the 6,000 – 6,100 space, with Covid-19resurgence dangers serving to comprise danger urge for food. A powerful rally in gold costs this week up to now propelled Australia’s mining sector, which gained 1.70% on Monday. Gold mining shares jumped 4.27% on common.

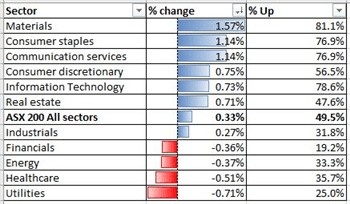

Sector-wise, supplies (+1.57%), shopper staples (+1.14%) and communication providers (+1.14%) had been outperforming, whereas utilities (-0.71%), healthcare (-0.51%) and power (-0.37%) had been lagging.

ASX 200 Sector efficiency27-7-2020

Supply: Bloomberg, DailyFX

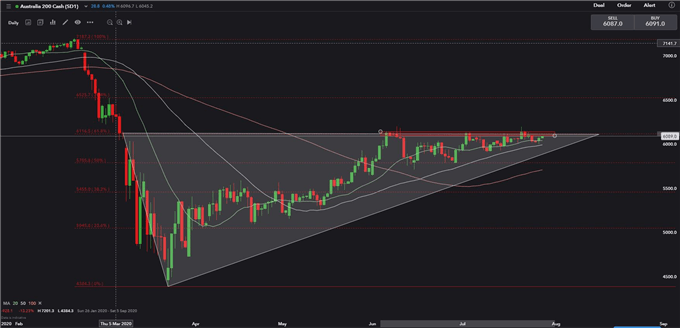

Technically, the ASX 200 index faces a powerful resistance degree at 6,100 – the 61.8% Fibonacci retracement (chart under). Because the index recovered from March’s lows, it has fashioned an ‘Ascending Triangle’ on its day by day chart. The higher sure of the triangle coincides with the 61.8% Fibonacci retracement, reaffirming this crucial resistance. The 20-Day, 50-Day and 100-Day Easy Shifting Averages (SMAs) recommend the general pattern stays bullish.

ASX 200 Index – Day by day Chart

Nikkei 225 Index Outlook:

The Nikkei 225 index could open mildly greater on Tuesday, following a powerful US buying and selling session led by the expertise sector. The upward momentum, nevertheless, is probably contained by persisting Covid-19 pandemic issues and a stronger Japanese Yen. Because the US Greenback Index fell to a two-year low, the Yen has strengthened to 105.3 – the very best degree seen since March this yr. A stronger forex is usually not favorable to Japan’s export and tourism sectors.

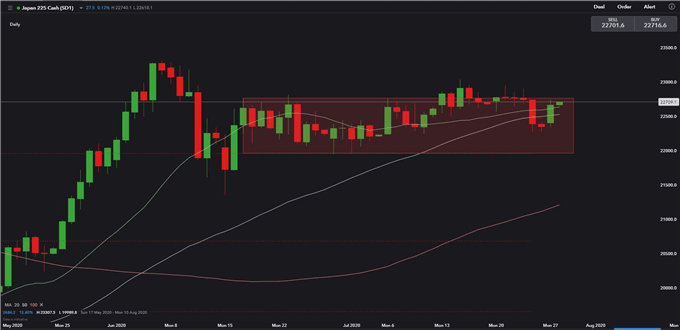

Technically, the Nikkei 225 index is making an attempt to interrupt a key resistance degree at 22,800 – which is the higher sure of the rectangle proven within the chart under. To try greater highs, it additionally must firmly break above the earlier excessive seen in June – 23,300. A right away help degree might be discovered at 22,400 – the 50-Day SMA.

Nikkei 225 Index – Day by day Chart

Straits Instances Index Outlook:

Singapore’s Straits Instances Index is consolidating at round 2,500 – 2,600 since final week, probably forming a ‘Double Backside’ sample in its day by day chart. Second quarter earnings outcomes has been combined up to now. Traders are ready for outcomes from main blue chip firms this week (chart under).

STI Earnings Calendar – week 27th-31st July

|

STI Parts |

Ticker |

Date |

Occasion Kind |

Interval |

Precise |

Estimate |

|

Dairy Farm Worldwide |

DFI SP |

29/7/2020 |

ER |

S1 20 |

||

|

Singapore Airways Ltd |

SIA SP |

29/7/2020 |

ER |

Q1 21 |

(0.397) |

|

|

Hongkong Land Holdings Ltd |

HKL SP |

30/7/2020 |

ER |

S1 20 |

0.18 |

|

|

Jardine Cycle & Carriage Ltd |

JCNC SP |

30/7/2020 |

ER |

Q2 20 |

0.18 |

|

|

Singapore Trade Ltd |

SGX SP |

30/7/2020 |

ER |

Y 20 |

0.425 |

|

|

Keppel Corp Ltd |

KEP SP |

30/7/2020 |

ER |

Q2 20 |

0.10 |

|

|

SATS Ltd |

SATS SP |

30/7/2020 |

ER |

Q1 21 |

(0.008) |

|

|

Jardine Matheson Holdings Ltd |

JM SP |

31/7/2020 |

ER |

S1 20 |

1.68 |

|

|

Jardine Strategic Holdings Ltd |

JS SP |

31/7/2020 |

ER |

S1 20 |

Supply: Bloomberg, Dailyfx

Straits Instances Index – Day by day Chart

Beneficial by Margaret Yang

Don’t give into despair, make a recreation plan

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part under or @margaretyjy on Twitter