AUD/USD, Australian Greenback, US Greenback, Inventory Markets – TALKING POINTSUS Greenback promoting stress persisting regardles

AUD/USD, Australian Greenback, US Greenback, Inventory Markets – TALKING POINTS

- US Greenback promoting stress persisting regardless of a rising variety of geopolitical dangers

- Shares rose after housing knowledge confirmed remarkably better-than-expected statistics

- AUD/USD close to multi-month swing-high as RSI divergence reveals worrying indicators

Wall Avenue fairness markets principally closed larger, with the S&P 500 and Nasdaq indexes up 0.23 and 0.73 %, respectively. The latter closed at one other all-time excessive and helped cement the narrative that the know-how sector has disproportionately outperformed its friends within the pandemic. In the meantime, the industrial-leaning Dow Jones closed 0.24 % decrease, with the overwhelming majority of losses within the power sector.

In foreign money markets, the petroleum-linked Norwegian Krone together with the haven-linked US Greenback had been the deepest within the pink. In the meantime, the Brexit-sensitive British Pound and growth-anchored New Zealand Greenback had been the session’s champions. The previous might have risen partially from optimism about EU-UK talks, with GBP/USD additionally being propelled by swelling promoting stress within the Dollar.

Really helpful by Dimitri Zabelin

Enhance your buying and selling with IG Consumer Sentiment Information

The precise catalyst behind the rise of fairness markets on Tuesday is unclear, however an element could also be basic market optimism regardless of quite a lot of geopolitical roadblocks. Excellent housing begins and constructing permits might have contributed to the preliminary rise on Tuesday, particularly contemplating how that sort of knowledge has far-reaching implications for the US financial system. Learn extra about it right here.

Wednesday’s Asia-Pacific Buying and selling Session

Strong threat urge for food might amplify Wall Avenue commerce’s market dynamics, doubtlessly organising the US Greenback for an additional spherical of losses and giving a tailwind for AUD/USD forward of a key technical degree. NZD might rise together with commodities. Credit score default swap spreads on sub-investment grade company debt might slender and additional amplify threat urge for food.

Really helpful by Dimitri Zabelin

Foreign exchange for Rookies

AUD/USD Evaluation

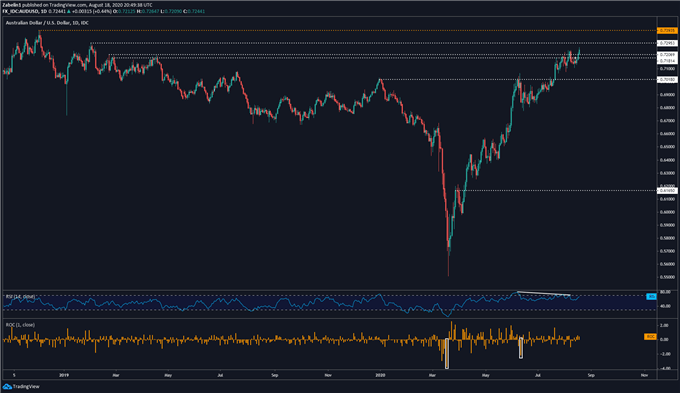

AUD/USD might try to understand the January 2019 swing-high ledge at 0.7295 because the pair continues so as to add onto its +20 % rise since bottoming out in March. Clearing that ceiling with follow-through might open the door to retesting one other multi-month high at 0.7393. Having mentioned that, adverse RSI divergence is exhibiting that upside momentum is slowing.

AUD/USD – Day by day Chart

AUD/USD chart created utilizing TradingView

Whereas this doesn’t essentially recommend {that a} pullback is inevitable, its formation forward of key resistance might make some merchants nervous. Consequently, worth motion might change into extra timid as AUD/USD approaches it.

— Written by Dimitri Zabelin, Forex Analyst for DailyFX.com

To contact Dimitri, use the feedback part under or @ZabelinDimitri on Twitter