Australian Dollar Talking PointsAUDUSD snaps the series of lower highs and lows carried over from last week even as the Federal Reserve delivers a 75

Australian Dollar Talking Points

AUDUSD snaps the series of lower highs and lows carried over from last week even as the Federal Reserve delivers a 75bp rate hike in June, and the exchange rate may stage a larger recovery over the coming days as itappears to be reversing course ahead of the yearly low (0.6829).

AUD/USD Reverses Ahead of Yearly Low with Australia Employment on Tap

AUD/USD quickly retraces the decline following the Federal Open Market Committee (FOMC) interest rate decision as Chairman Jerome Powell tames speculation for a 100bp rate hike, with the central bank head indicating that a 50bp or a 75bp increase could be appropriate at its next meeting in July.

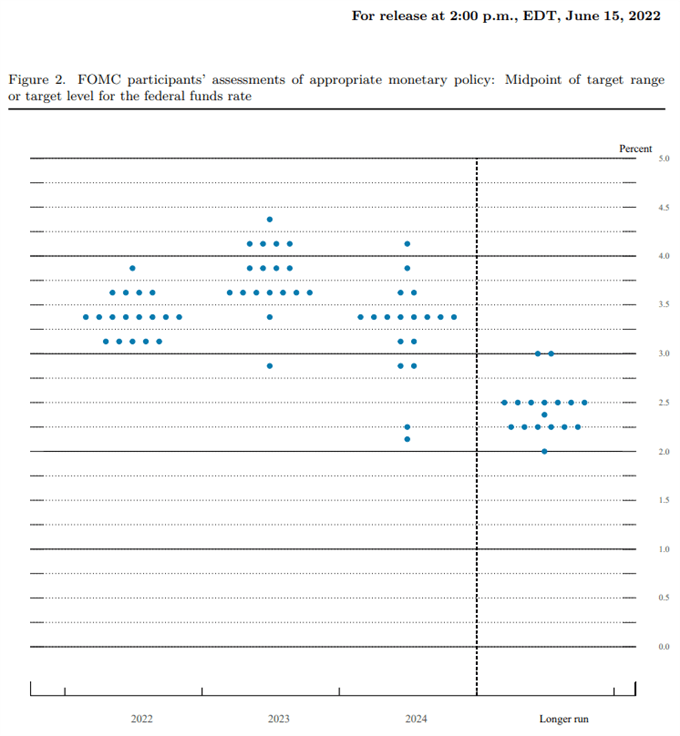

Source: FOMC

The comments suggest the FOMC will moderately adjust its approach in combating inflation as the majority forecast the Fed Funds rate to climb above 3.00% by the end of the year, and it seems as though the central bank will continue to utilize the benchmark interest rate to address the risks surrounding the US economy amid the preset approach in reducing the balance sheet.

Looking ahead, it remains to be seen if Chairman Powell and Co. will continue to adjust the forward guidance for monetary policy as the FOMC shows a greater willingness to carry out a restrictive policy, but the market reaction raises the scope for a larger rebound in AUD/USD as it snaps the series of lower highs and lows carried over from the previous week.

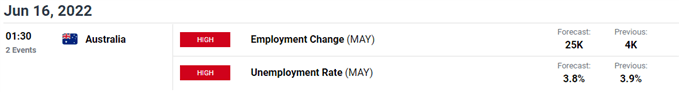

In turn, the update to Australia’s Employment report may fuel the rebound from the monthly low (0.6850) as the economy is projected to add 25K jobs in May, and a further advance in the exchange rate may help to alleviate the tilt in retail sentiment like the behavior seen earlier this year.

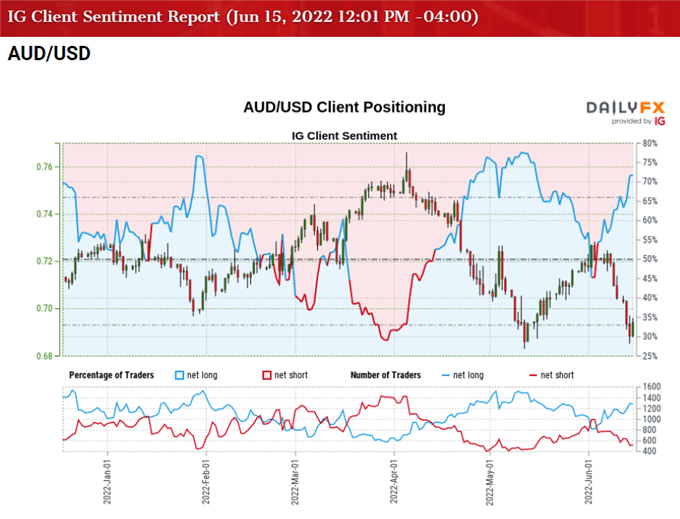

The IG Client Sentiment report shows 70.46% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 2.39 to 1.

The number of traders net-long is 4.02% higher than yesterday and 22.58% higher from last week, while the number of traders net-short is 15.57% lower than yesterday and 28.65% lower from last week. The rise in net-long interest has fueled the crowding behavior as traders were net-short AUD/USD at the start of the month, while the decline in net-short position comes as the exchange rate snaps the series of lower highs and lows from last week.

With that said, AUD/USD may continue to reverse course ahead of the yearly low (0.6829) as the Fed rate decision fuels the rebound from the monthly low (0.6850), and the bearish momentum may continue to abate over the coming days as the Relative Strength Index (RSI) bounces back ahead of oversold territory.

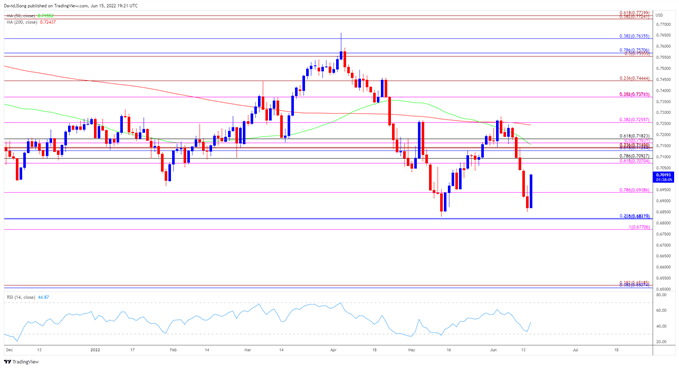

AUD/USD Rate Daily Chart

Source: Trading View

- AUD/USD appeared to be on track to test the yearly low (0.6829) as it snapped the opening range for June, but failure to extend the series of lower highs and lows from last week may push AUD/USD back towards the 0.7070 (61.8% expansion) to 0.7090 (78.6% retracement) region as the Relative Strength Index (RSI) reveres ahead of oversold territory.

- A break/close above the 0.7070 (61.8% expansion) to 0.7090 (78.6% retracement) region opens up the Fibonacci overlap around 0.7130 (61.8% retracement) to 0.7180 (61.8% retracement), which lines up with the 50-Day SMA (0.7155), with the next area of interest coming in around 0.7260 (38.2% expansion).

- However, the recent recovery in AUD/USD may turn out to be a near-term correction as the moving average reflects a negative slope, with a move below the 0.6940 (78.6% expansion) area bringing the overlap around 0.6770 (38.2% expansion) to 0.6820 (50% retracement) back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com