AUD/USD turned fairly bullish in October after being actually bearish for round 18 months. The partial commerce deal between US and China improved

AUD/USD turned fairly bullish in October after being actually bearish for round 18 months. The partial commerce deal between US and China improved the sentiment for threat property similar to commodity {dollars} significantly and on high of that, the US ISM manufacturing report confirmed that manufacturing fell deeper in contraction, which despatched the USD decrease and AUD/USD increased.

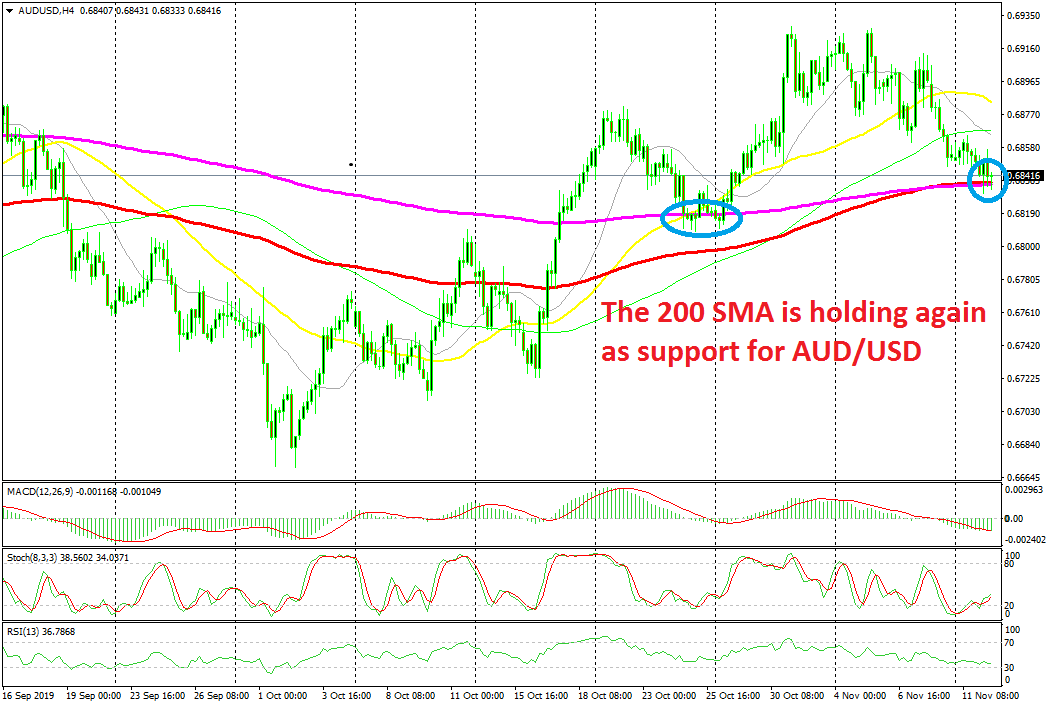

However, the uptrend stopped on the finish of October and this month, AUD/USD turned bearish as soon as once more. However, it’s not sure but if this pair is resuming the bigger bearish development. The take a look at for that now lies on the 2 SMAs which have been offering help for AUD/USD all through the day.

On the H4 chart above, we will see that there are two transferring averages which have converged at round 0.6830-40. The 100 SMA (pink) and the 200 SMA (purple) have been offering help on this time frame because the Asian session and moreover that, the stochastic indicator turned oversold and is now reversing increased. So, sellers have a troublesome battle forward. If the bigger downtrend is to renew, these two transferring averages ought to be damaged. We’re already brief on this pair since yesterday, so we hope that the sellers win this battle.