Australian Greenback, AUD/USD, China-Australia Relations, Iron Ore – Speaking FactorsAUD/USD rises to recent multi-year highs aft

Australian Greenback, AUD/USD, China-Australia Relations, Iron Ore – Speaking Factors

- AUD/USD rises to recent multi-year highs after iron ore futures surge

- British Pound sinks as UK PM Johnson forged doubt on EU-UK deal

- U.S. stimulus talks make little progress amid rising Covid circumstances

The New York buying and selling session was combined on Thursday as stimulus negotiations on Capitol Hill got here to an in depth for the week after lawmakers failed to succeed in an settlement. Republican and Democratic home members made progress within the newest spherical of talks when a formulation to disperse state and native assist totaling $160 billion was reached. Nevertheless, legal responsibility safety for firms is seen to be the final sticking level earlier than shifting ahead. The Dow Jones and S&P 500 ended modestly decrease, whereas the Nasdaq Composite and Russell 2000 superior. 10-year Treasury yields fell again close to the .90 deal with because the safe-haven bonds attracted risk-averse buyers.

In the meantime, the UK’s ongoing negotiations with the European Union seem no higher off than these within the U.S. Congress. UK Prime Minister Boris Johnson mentioned Thursday that there’s a “sturdy risk” that an settlement with the European bloc wouldn’t be made. The British Pound fell sharply on the feedback as a no-deal Brexit is seen leaving the UK at an economically deprived place. Key points equivalent to fisheries and governance stay a sticking level for the 2 sides.

S&P 500, Nasdaq 100, 10-Yr Treasury Yield 30-Min Chart

Chart created with TradingView

Friday’s Asia-Pacific Outlook

Asia-Pacific markets begin the day with the Australian Greenback rising to recent multi-year highs in opposition to the US Greenback. The Australian Greenback is almost 10% greater in opposition to the Dollar this 12 months after vaccine-driven sentiment helped propel the risk-sensitive foreign money. The Aussie-dollar’s current power has paced greater regardless of rising tensions with China, Australia’s largest buying and selling accomplice. On a macroeconomic scale, the current worth motion seems counterintuitive at face worth.

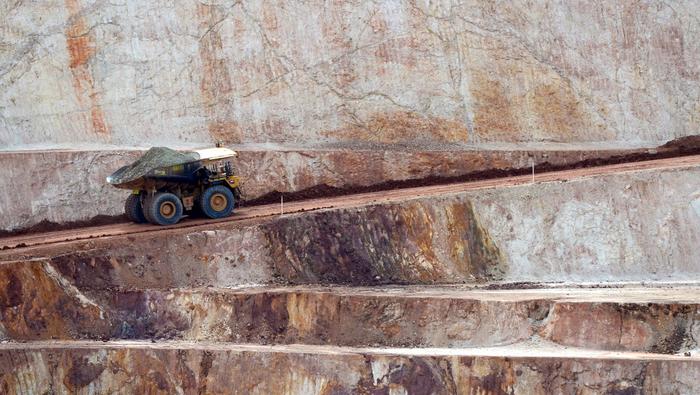

Whereas it might be true that Chinese language and Australian relations proceed to hit new low factors, the Australian Greenback is benefiting from the nation’s iron ore exports to the previous. These exports may also help offset among the woes of a worsening relationship. The primary being that China is ramping up stimulus-driven infrastructure spending because the world seems to be forward to a post-Covid panorama, and iron is a key ingredient required within the nation’s financial engine.

Furthermore, China’s choices to import iron ore are severely restricted on condition that Australia is the world’s prime producer. China has tried to diversify its import portfolio, however supply-chain limitations prompted partly by Covid-19 depart too giant of a provide hole to be crammed with out Australian iron. On the similar time, China’s stock ranges proceed to drop, indicating that the nation may have to extend its imports additional, or face iron shortages which might severely hamper its financial output.

Beneficial by Thomas Westwater

What does it take to commerce round information?

The connection between AUD/USD and iron ore futures (chart beneath) highlights the correlation between Australian Greenback power and costs within the commodity. Chinese language demand for Australian iron stays comparatively flat. Nevertheless, greater costs within the commodity will doubtless increase Australia’s financial development via a rising commerce surplus. That’s as a result of a optimistic stability provides to GDP development. Whereas a stronger foreign money can also be seen as a adverse for home exports, the reliance on Australian iron acts as a buffer to guard exchange-rate results on export volumes.

AUD/USD vs Iron Ore Weekly Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the feedback part beneath or @FxWestwateron Twitter