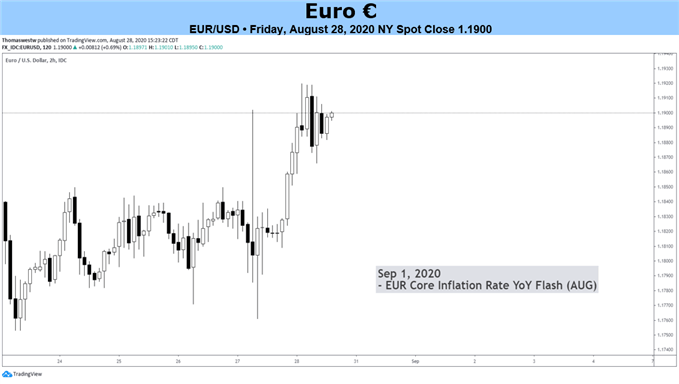

Chart Created with TradingViewEUR/USDFUNDAMENTAL HIGHLIGHTS:Fed Delivers as Anticipated, USD Promoting Exacerbated by Month-Finis

Chart Created with TradingView

EUR/USDFUNDAMENTAL HIGHLIGHTS:

- Fed Delivers as Anticipated, USD Promoting Exacerbated by Month-Finish Flows

- Euro Tailwinds Have Eased

- Stretched Euro Positioning Reduces the Attraction within the Brief Time period

Fed Delivers as Anticipated, USD Promoting Exacerbated by Month-Finish Flows

As broadly anticipated, Fed Chair Powell introduced that the Fed will shift in the direction of AIT (Common Inflation Goal), in brief, this may primarily imply that the Fed endorse a decrease (charges) for longer strategy through a reactive operate versus a beforehand pre-emptive operate when normalisation coverage. In response, the theme of US Greenback promoting remained, albeit, exacerbated by month-end rebalancing. Whereas the long term image for the USD stays decrease, there are short-term dangers to a doable snapback in opposition to the Euro.

| Change in | Longs | Shorts | OI |

| Day by day | -14% | 17% | 5% |

| Weekly | -24% | 15% | -1% |

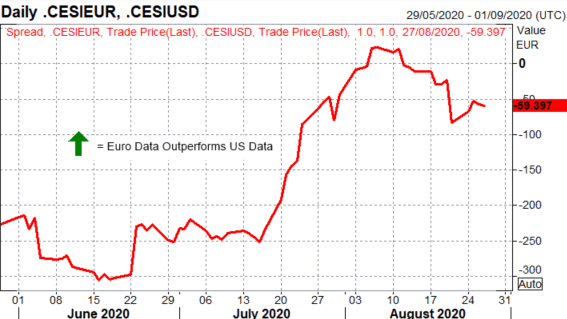

Euro Tailwinds Have Eased

The overriding narrative for the Euro has largely been on development expectations transferring in favour of Europe relative to the US. Nevertheless, in gentle of the strides made in current months, a big chunk of this view is within the worth amid the sizeable mark up from 1.10 to 1.19. That stated, the narrative has additionally been challenged as of late, following the August PMI surveys, through which the Eurozone noticed a notable pullback (French Manufacturing again in contraction).

European Knowledge Has Stopped Outperform US Knowledge

Supply: Refinitiv

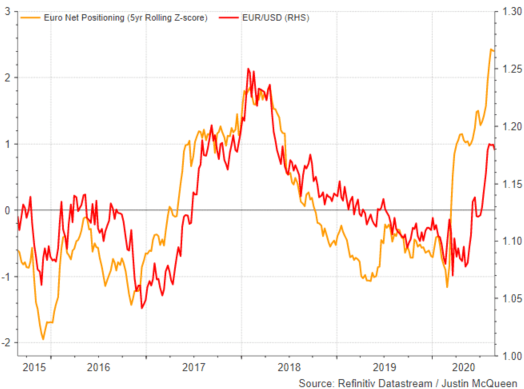

Stretched Euro Positioning Reduces the Attraction within the Brief Time period

It has been effectively documented that speculative positioning may be very stretched within the Euro with outright contracts at a file excessive, whereas on an open-interest adjusted foundation we’re at 2yr highs (non-commercials 28% lengthy). In flip, this reduces the risk-reward enchantment for a continuation increased within the quick run and thus see scope for pullbacks in the direction of 1.1700, through which a break opens the door to 1.1600.

Euro Bulls In a Crowded Commerce

Subsequent Week’s Agenda

Trying to subsequent week, a lot of the main target for the Euro will on from stateside with Fed audio system out in full power (specifically Clarida & Brainard) who’re prone to shed additional gentle on the Federal Reserve’s coverage shift. On the financial schedule, US ISM Manufacturing and NFPs are prone to take precedent over German inflation figures, that are doubtless weighed by current VAT cuts.

Advisable by Justin McQueen

Obtain our Q3 EUR Forecast

EUR/USD Value Chart: Day by day Time Body

Supply: DailyFX

When trying on the Euro over the previous month it’s as we had been with the forex sustaining a 1.17-1.19 vary. Whereas above 1.19 there may be the potential tactical bias for a pullback to 1.17, the long term pattern stays on the upside, which may come sooner than anticipated on a break above 1.1965.

.jpg)