Boost YoY revenue of 29.2%, net loss of RM48 mil, Boost Life users up 11% Given the challenging externalities, landed first quarter on steady

- Boost YoY revenue of 29.2%, net loss of RM48 mil, Boost Life users up 11%

- Given the challenging externalities, landed first quarter on steady footing

Axiata Group Bhd presented improved operational performance for the first quarter ended 31 March 2022 (1Q22) driven by the resilience of its operating companies (OpCos) and sustained demand for data and digitalisation across the region.

On an underlying basis, revenue excluding device (ex-device) and Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) increased by 7.8% and 7.4%, mainly contributed by all OpCos except Ncell (Ncell Axiata Limited).

EBITDA margin stood at 44.8%, whilst EBIT expanded by 44.5%. Underlying PATAMI (Growth numbers for OpCos are based on results in local currency in respective operating markets) soared by 70.7% carried by higher EBITDA contribution across all OpCos except Ncell and the absence of accelerated depreciation of 3G assets in 2022, whilst being offset by higher tax.

On a reported basis, the company posted steady growth in revenue and EBITDA which were up by 6.7% and 7.7% year-on-year (YoY) on the back of contributions from all OpCos except Ncell, despite bracing against external impacts such as headwinds in Sri Lanka and macroeconomic uncertainties stemming from the slowing of major economies. Profit After Tax (PAT) and Profit After Tax and Minority Interest (PATAMI) however plunged significantly due to unrealised foreign exchange (forex) losses primarily at the Dialog (Dialog Axiata PLC) and Axiata levels, as well as higher tax contributions due to the one-off Cukai Makmur (One-off Prosperity Tax for 2022 assessment year).

During the quarter, Axiata achieved cost excellence through capital expenditure (Capex) and operational expenditure (Opex) savings of RM163 million and RM78 million, adding up to RM241 million in total savings. The Group’s balance sheet held steady with Gross debt/EBITDA within target limit at 2.49x, net debt/EBITDA at 1.99x and cash balance of RM5.8 billion. Capital structure was well-managed amidst the challenging macroeconomic backdrop, where 45% of loans were in local currency, 60% on fixed rate and 65% with more than two years maturity.

Digital telcos performance

[Note: Growth numbers for OpCos are based on results in local currency in respective operating markets.]

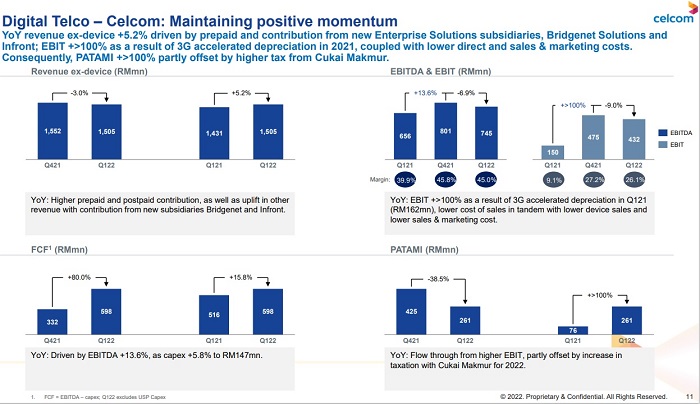

Celcom Axiata Bhd sustained its positive momentum as revenue ex-device climbed 5.2% YoY driven by its prepaid business and contribution from new Enterprise Solution subsidiaries – Bridgenet Solutions and Infront Malaysia. EBIT surged more than 100% as a result of the accelerated 3G depreciation in 2021, coupled with lower sales and marketing costs. Consequently, PATAMI grew more than 100%, whilst being partly offset by higher tax from the one-off Cukai Makmur.

The proposed Celcom-Digi merger is expected to be completed within the second half of 2022

Driven by increased operational expenditure (opex) spend, PT XL Axiata Tbk’s revenue ex-device increased 7.9% supported by higher data revenue (+10%), whilst EBITDA rose slightly by 1.8% as a result of higher sales and marketing cost due to footprint expansion, while EBIT slipped 12.3% in line with network investments. PATAMI dropped 56.6% impacted by higher net finance cost and one-off gain in 1Q21.

Robi Axiata Limited’s performance in 1Q22 was moderated by aggressive competition, and revenue ex-device grew 2.0% YoY on the back of higher data revenue (+14.0%), in tandem with higher data subscribers and usage. EBITDA rose 4.9% due to lower direct and staff costs, while EBIT dipped marginally by 0.4% impacted by higher amortisation from the new spectrum. PATAMI expanded 16.1% benefiting from lower taxation.

Sri Lanka’s economic and political crisis that resulted in the depreciation of its currency against the US Dollar since mid-March 2022 has significantly impacted most onshore businesses. At Dialog, despite the 16.6% increase in revenue ex-device YoY attributed to strong growth across all segments of mobile, fixed broadband and TV, PATAMI flipped to a loss of LKR15.8 billion, impacted by non-cash forex loss arising from USD-denominated debt. Excluding forex loss, underlying PATAMI was at LKR4.3 billion.

Ncell’s revenue ex-device dropped 7.8% due to lower voice revenue from the impact of reduced interconnect rate, the lockdown, and a decline in International Long Distance. EBIT reduced by 20% due to the revenue decline coupled with higher network cost, while PATAMI decline of 9.7% moderated relative to EBIT, due to lower taxation.

Smart Axiata Company Limited maintained its steady performance across all metrics, recording an increase of 6.3% in revenue ex-device YoY on the back of growth in data contribution (+11.4%) in line with higher subscribers and usage. EBIT growth was muted at 2.5% on account of higher direct cost and D&A (Depreciation and Amortization), while PATAMI expanded 33.0% due to investment impairment of financial services business in 1Q21.

Digital Businesses Performance

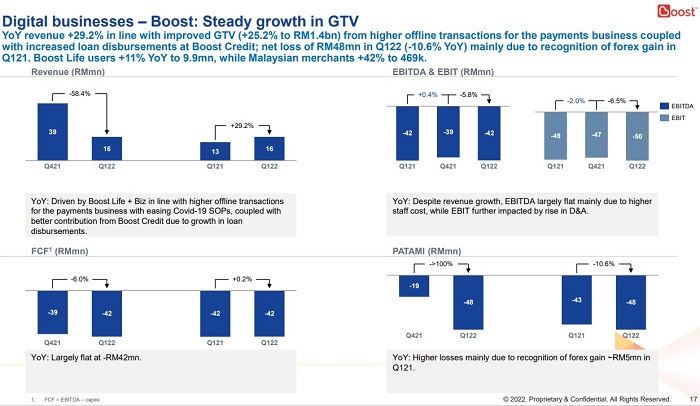

Boost Holdings Sdn Bhd’s revenue grew by 29.2% YoY in line with improved gross transaction value from higher offline transactions for the payments business coupled with increased loan disbursements at Boost Credit. It recorded a net loss of RM48 million in 1Q22, down 10.6% YoY mainly due to recognition of forex gain in Q121. Boost Life users and Malaysian merchants expanded 11% to 9.9 million and 42% to 469,000 respectively.

Axiata Digital & Analytics Sdn Bhd’s (ADA) revenue doubled to RM189 million YoY driven by improved contribution from its customer engagement business and new contribution from its eCommerce enablement business stemming from the acquisition of Awake Asia in June 2021. PATAMI decreased by 55.6% to RM6 million due to higher opex, taxation and forex loss.

Infrastructure

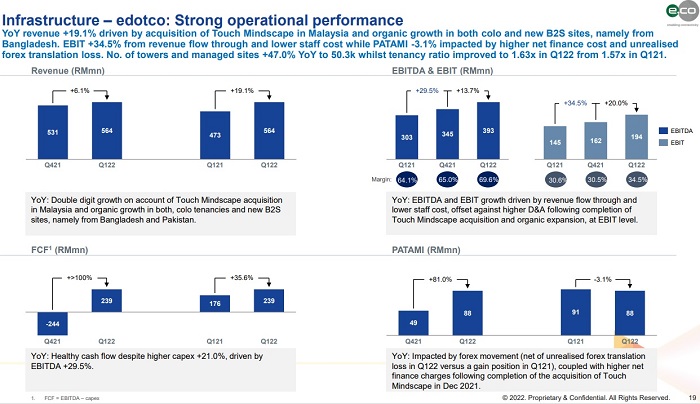

Delivering strong operational performance in 1Q22, edotco Group Sdn Bhd’s revenue grew 19.1% YoY, driven by the organic expansion of higher co-location tenancies and new Build-To-Suit sites, namely from Bangladesh, and inorganically following the completion of the acquisition of Touch Mindscape in Malaysia. EBIT expanded 34.5% from revenue flow through and lower staff cost, while PATAMI slipped 3.1%, impacted by higher net finance cost and unrealised forex translation loss. Towers and managed sites expanded 47.0% YoY to 50,251 while the tenancy ratio improved to 1.63x in 1Q22 from 1.57x in 1Q21.

Board and CEO perspective of results

Offering a board perspective of the results, Shahril Ridza Ridzuan, Chairman of Axiata said, “The Board is encouraged to note the continued resilience and steady operating performance across the Group for the first quarter, especially driven by initiatives for internal efficiencies under the Axiata 5.0 Vision. Significant deals have been closed or are in the midst of being completed in line with the plans to future-proof Axiata’s businesses as well as to serve new growth areas in home and enterprise digitalisation.”

“As part of its rigorous governance standards and in order to keep serving our communities effectively, Axiata regularly assesses business, operational and financial risks. In view of significant headwinds, Board attention will be trained on steadying the Group through current and future uncertainties affecting Dialog’s business in Sri Lanka as well as the negative effects of supply chain shocks and global inflation,” he said.

Izzaddin Idris (pic), who was still President & Group Chief Executive Officer of Axiata when these results were released last week said, “On balance, given the challenging externalities, we landed the first quarter of 2022 on a steady footing.”

[Ed: Axiata announced last week, a few days after the quarterly call, that Izzaddin would leave the organization on Tues, 31 May.]

Backed by strong performance from Axiata’s OpCos which also benefited from the absence of the accelerated depreciation of 3G assets, we delivered stable revenue and EBITDA growth. Correspondingly, underlying PATAMI jumped by 70.7% as a result of higher EBITDA contribution across all OpCos except Ncell.”

“We are cautiously optimistic in our outlook for the rest of 2022 whilst externalities may persist in the medium-term. In addition to exercising prudence in our existing businesses through cost and operational efficiencies, we are doubling down to extract value from our deals. These involve the expansion of edotco’s tower business in the Philippines, Boost’s digital bank licence from Bank Negara Malaysia and in Indonesia, the Hipernet Indodata and proposed Link Net acquisitions,” he said.

“With a well-managed capital structure and strong balance sheet – where gross debt/EBITDA is at 2.49x and cash balance stands at RM5.8 billion, coupled with our continuing internal operational excellence initiatives, we will face the uncertainties ahead from a position of strength.”

Axiata Net-Zero Carbon Roadmap

Committed to achieve net-zero emissions no later than 2050, with a near term 2030 target to reduce operational carbon emissions by 45% from the 2020 baseline; its three-objective strategy for climate action include carbon emissions reduction, avoidance, and removal.

www.digitalnewsasia.com