This week’s Baker-Hughes Rig Depend is out and drilling operations have as soon as once more expanded. Energetic U.S. oil rigs have are available

This week’s Baker-Hughes Rig Depend is out and drilling operations have as soon as once more expanded. Energetic U.S. oil rigs have are available at 193, up 4 from final Friday’s depend of 189. Whereas not an amazing achieve, it marks the third straight weekly uptick and means that drilling is on the rise. Is the downturn in North American fracking over? That’s a troublesome query, but it surely seems just like the trade could have lastly bottomed.

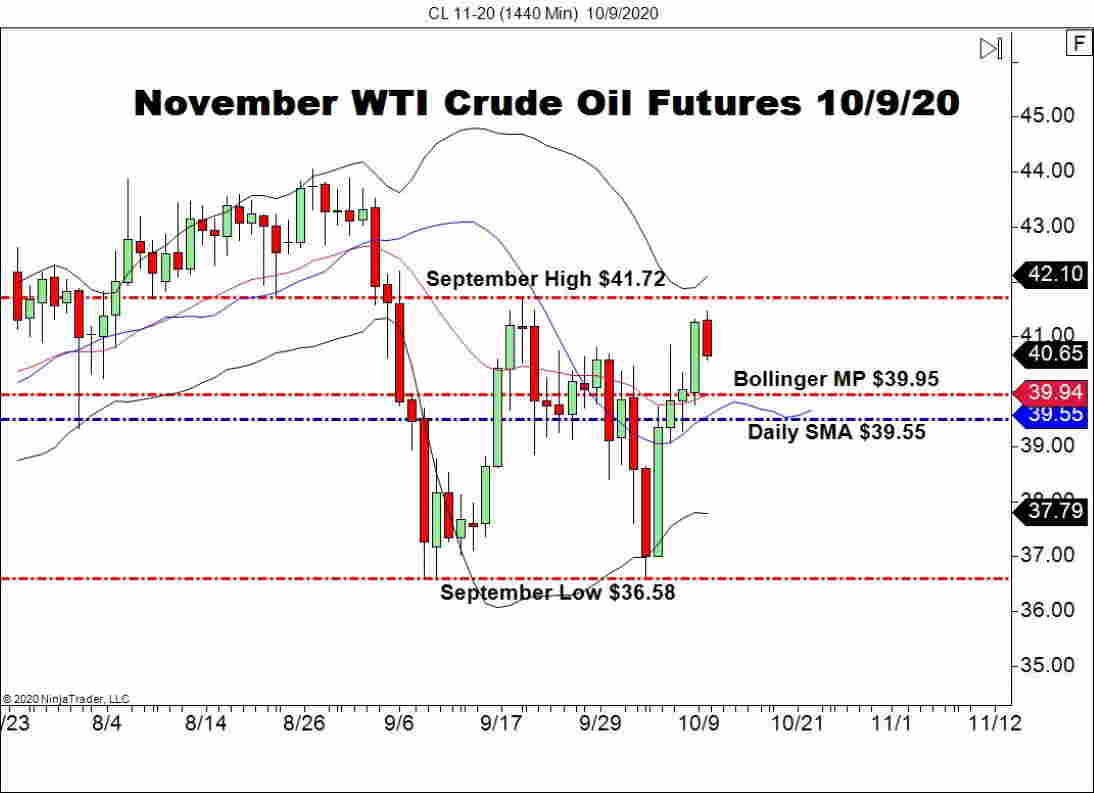

On the WTI entrance, costs are holding agency above the $40.00 deal with. This can be a bullish signal for vitality merchants as fall seasonality is now upon us and the anticipated weak spot on this market has but to develop. Nevertheless, an intermediate-term bearish bias stays warranted for world oil. COVID-19 demand questions and elevated OPEC+ manufacturing are the important thing drivers of the downward stress on the vitality markets. However, potential Biden administration U.S. fracking bans and a slumping USD are poised to ship crude oil costs larger. At this level, the U.S. election is shaping as much as be a important underpinning of the worldwide oil advanced.

At the moment’s rise within the Baker-Hughes Rig Depend is a bit surprising. Nevertheless, there are some American areas the place turning a revenue with crude oil at $40.00 is possible. If producers can safe low-interest financing, then drilling new wells could also be a modestly engaging enterprise.

Baker-Hughes Up, WTI Down

November WTI crude oil futures are within the strategy of giving again Thursday’s features. Nevertheless, costs are nonetheless above day by day topside resistance and are inside vary of September’s Excessive ($41.72).

++10_9_2020.jpg)

Overview: At the moment’s enhance within the Baker-Hughes Rig Depend is constructive for U.S. vitality despite the fact that the figures stay close to all-time lows. Maybe that is the start of a pattern and a long-anticipated restoration in crude oil.

On the WTI entrance, not a lot has modified because the plunge of early September. Costs have traded inside a roughly $5 vary for a few month, in a bullish trend. Finally, this worth motion is bucking seasonal traits and helps a short-term bullish bias. Nonetheless, it’s powerful to disregard the long-term fundamentals and purchase WTI forward of the U.S. election’s outcome turning into official.