The Australian greenback versus the New Zealand greenback forex pair retraced from 1.0826 in a very noticeable

The Australian greenback versus the New Zealand greenback forex pair retraced from 1.0826 in a very noticeable method. Are the bulls making ready an vital motion, or are the bears the ones doing that?

Lengthy-term perspective

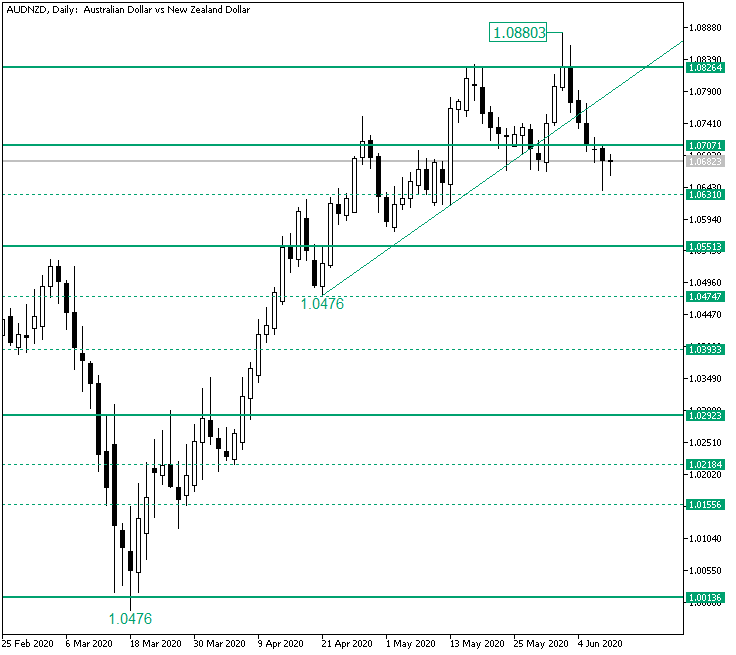

The upwards pointing tendency that began after the 1.0013 degree received confirmed as help prolonged all of the solution to the 1.0880 excessive.

The latter a part of this growth took the type of an ascending development, which is supported by the trendline ranging from the low of 1.0476.

Nevertheless, the starting of June introduced in regards to the invalidation of the ascending trendline and additionally the piercing of the main 1.0707 degree.

This unfolding, which seems excellent from the bearish perspective, will be counterbalanced by the undeniable fact that the market printed a hammer candlestick sample on June 9, as this sample normally signifies that the bulls are about to closely be a part of the market.

However the undeniable fact that the hammer materialized beneath the related 1.0707 degree, and additionally printed a decrease low, makes the state of affairs much less enticing for the patrons.

So, if the bulls do handle to deliver the value again above 1.0707 and shut a candle above it, then they could have a likelihood to make issues proper. In the first step, they need to be capable of drive the value to their prime goal, 1.0826. For the second one, they need to accomplish carrying on with the rally in order that the value will get above the 1.0826 degree and confirms it as help, which might permit for additional extensions in direction of 1.0983.

Though this might occur, if the bullish motion halts at 1.0826, then a head and shoulders chart sample could also be in place, which might shift the goal to 1.0551.

Brief-term perspective

The descending motion that began at 1.0880 prolonged till the 1.0681 middleman degree. Right here, the value superior beneath the degree solely to retrace in a comparatively brief time, persevering with to oscillate across the 1.0681 degree.

However as what adopted was not a sturdy rally, which may have been fueled by the rejection, and as a substitute allowed a consolidation, factors out to the undeniable fact that this isn’t a state of affairs in which the bulls are taking on, however one in which they’re defending.

So, if the 1.0694 excessive is taken out, then the bulls may head for 1.0741 and 1.0778 in a while. On the different hand, if 1.0681 will get confirmed as resistance, then the bears would goal the 1.0621 middleman degree.

Ranges to preserve an eye on:

D1: 1.0707 1.0826 1.0983 1.0551

H4: 1.0681 1.0741 1.0778 1.0621 and the peak of 1.0694

If you’ve any questions, feedback, or opinions relating to the Technical Evaluation, be happy to put up them utilizing the commentary type beneath.