The United States greenback versus the Japanese yen foreign money pair appears to have been taken over by the

The United States greenback versus the Japanese yen foreign money pair appears to have been taken over by the bears. Do the bulls nonetheless maintain any probabilities?

Lengthy-term perspective

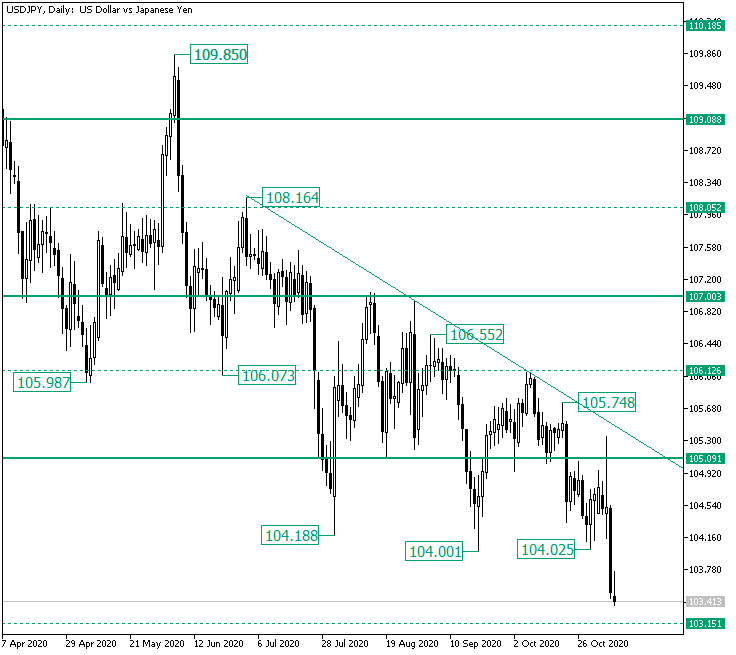

The excessive of 109.85 spawned a depreciation that, moreover rendering the piercing of 109.08 as a false one, managed to pierce the subsequent agency assist, the psychological degree of 107.00.

The piercing was restricted by the 106.12 middleman degree, which — after printing the 106.07 low — despatched the value again above 107.00, crafting the excessive of 108.16.

Nevertheless, the 108.16 excessive was the restrict of the appreciation, as what adopted was a satisfied depreciation that prolonged till the low of 104.18, beneath the necessary degree of 105.09.

Even when the bulls recovered, they weren’t in a position to get above the double resistance etched by the descending trendline and the 107.00 degree. This produced the decrease low of 104.00, which allowed an appreciation to one more double resistance, this time outlined by the 106.12 middleman degree, alongside the identical descending trendline.

The historical past repeated itself, as the value was not in a position to maintain the beneficial properties gained after the rise from the 104.02 low. Thus, the validation of 105.09 as resistance allowed the bears to acquire floor, getting the value nearer to the 103.15 middleman degree.

If the bulls can convey the value above the 104.02 low, then they’ve one other shot for the double resistance outlined by the descending trendline and 105.09. In the event that they pull it off, then 106.12 is their subsequent goal.

Nevertheless, if 104.02 isn’t challenged, then 103.15 is only a matter of time.

Brief-term perspective

The descending development that began from the 106.10 excessive, after the 106.02 degree was validated as resistance, prolonged — as proven by the third decrease low — till the 104.02 low.

From there, a new correction emerged, one which validated the higher line of the channel and the 105.27 middleman degree. This led to a new impulsive swing.

The new swing pierced the degree of 104.44 and printed a new decrease low, with respect to 104.02. However except for that, it additionally pierced the decrease line of the channel.

In this context, one attainable state of affairs is for a short-lived consolidation sample — corresponding to a pennant or a flag — to take form, focusing on the 103.09 middleman degree.

On the different hand, if the value returns contained in the channel, then 104.44 may very well be not solely a bullish goal but additionally a motive for the bulls to try to lengthen till 105.27.

Ranges to preserve an eye on:

D1: 105.09 106.12 103.15 and the low of 104.02

H4: 103.09 104.44 105.27

If you’ve gotten any questions, feedback, or opinions relating to the US Greenback, be at liberty to submit them utilizing the commentary type under.