The previous 24-hours have been difficult for cryptocurrency bulls, as values throughout the board have plunged. For business chief Bitcoin (BTC), the injury has been nothing in need of catastrophic. Costs are down greater than $2250 and falling. The large 12.5% session loss is without doubt one of the largest single-day downturns in BTC historical past.

Thanksgiving is often a quiet interval on the markets. U.S inventory exchanges are closed and CME futures function an early halt to commerce. Whereas the foreign exchange is technically open, the overwhelming majority of liquidity suppliers are out of the workplace on vacation. Nonetheless, the world’s crypto exchanges are totally open for enterprise. Right this moment’s crash in BTC is a stark reminder of how rapidly issues can change within the cryptosphere.

So, what’s the purpose for the epic crash in Bitcoin? The reply to that query is anybody’s guess. Nonetheless, a tweet from Coinbase CEO Brian Armstrong concerning potential U.S. Treasury regulation definitely threw fuel on the hearth:

“Final week we heard rumors that the U.S. Treasury and Secretary Mnuchin have been planning to hurry out some new regulation concerning self-hosted crypto wallets earlier than the top of his time period. I’m involved that this is able to have unintended uncomfortable side effects, and needed to share these considerations.”

Whereas this tweet is just a part of the image, regulation isn’t good for cryptos. Studies are coming in that institutional merchants liquidated large portions of BTC prior to now 18 hours. One has to surprise if Armstrong’s tweet is a clue that the U.S. Treasury is getting ready to crack down on Bitcoin and cryptos within the coming weeks. In the end, we’ll see.

Bitcoin (BTC) Fails At $20,000, Now In A Freefall

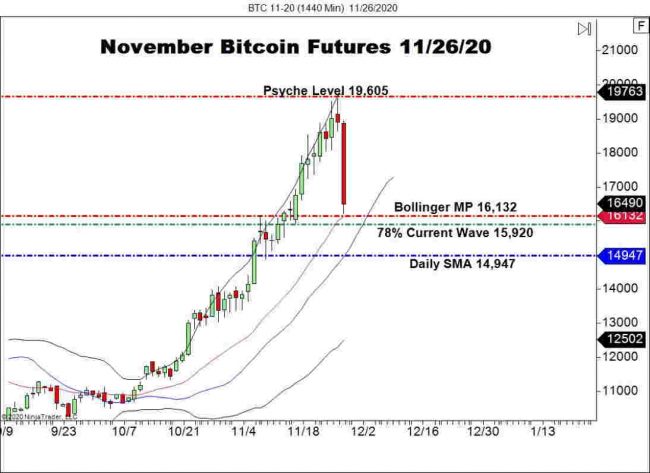

The chart beneath for November Bitcoin futures illustrates the extent of in the present day’s injury. Look out beneath ― $15,000 is the following quantity up for scrutiny.

Listed below are the degrees price awaiting the rest of the day:

- Assist(1): Bollinger MP, 16,132

- Assist(2): 78% Present Wave, 15,920

- Assist(3): Each day SMA, 14,947

Backside Line: The intraday downtrend is steep for Bitcoin and any shopping for ought to be achieved with excessive warning. That being stated, I’ll be trying to purchase BTC on the money markets from $14,979. With an preliminary cease loss at $13,479, this commerce produces $1500 (10%) on a rebound from the Each day SMA.