Major Central Bank AnalysisBank of England likely to pave the way towards a rate cut this summer as inflation and the labour market show signs of cont

Major Central Bank Analysis

- Bank of England likely to pave the way towards a rate cut this summer as inflation and the labour market show signs of continued easing

- Markets anticipate another cut from the Swiss National Bank

- RBA to stand pat, await further progress in inflation as economic growth slumps

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

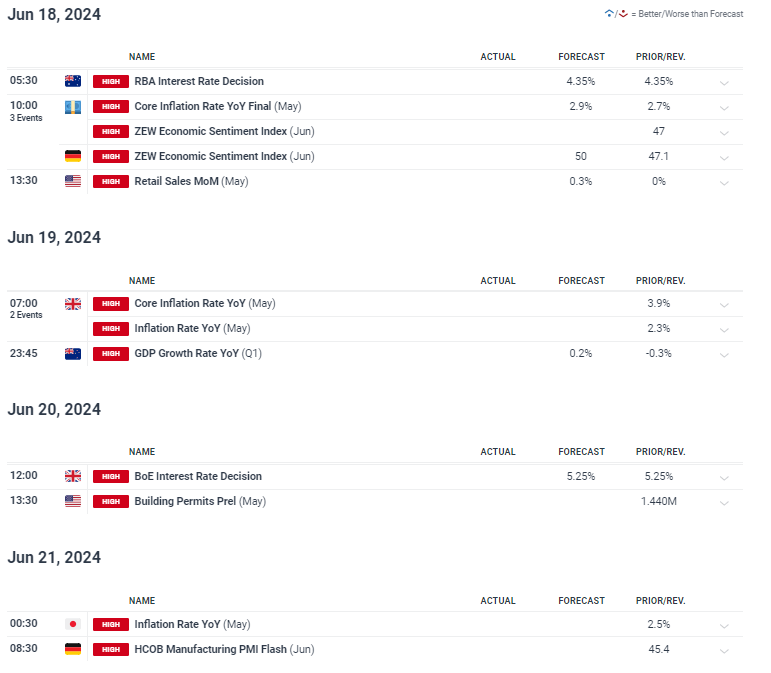

With US CPI and the FOMC economic projections in the rear view mirror, markets will be looking ahead to more central bank activity when the Australian, Swiss and UK central banks meet this week to decide monetary policy. In addition, UK and Japanese inflation prints will be scrutinized for differing reasons. Japanese officials are hoping for evidence of greater ‘demand pull’ inflation while Britain is hoping to see price pressures improve (decline) after the April figures disappointed.

Customize and filter live economic data via our DailyFX economic calendar

Learn how to prepare for high impact economic data or events with this easy to implement approach:

Recommended by Richard Snow

Trading Forex News: The Strategy

Bank of England Likely to Pave the Way Towards a Rate Cut in the Summer

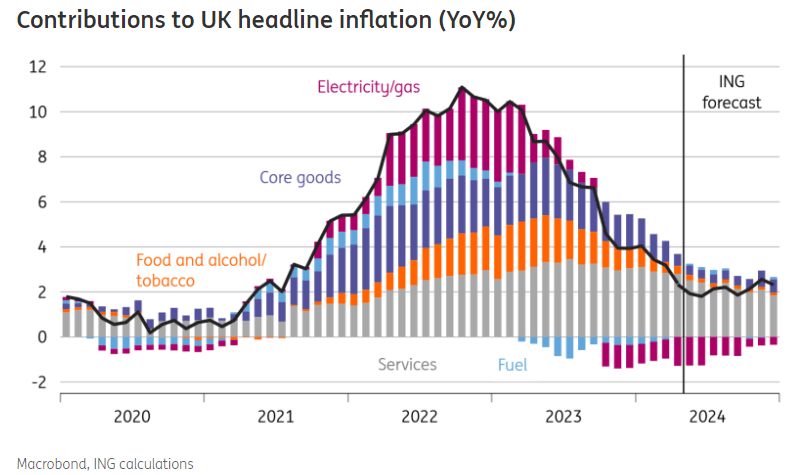

The Bank of England (BoE) is likely to keep rates unchanged when they meet next week but their messaging will be eagerly anticipated as conditions for a rate cut appear on the horizon. In April, inflation dropped encouragingly but was unable to match lofty expectations. The most recent jobs report also highlighted some nervousness in the labour market with more a flurry of claimants (for unemployment benefits) being registered in May (50k+).

UK growth remains anaemic, with the economy stagnating in April with a print of 0% growth for the month. One sticking point for the BoE is inflation and more importantly services inflation which remains an issue. Average earnings has also proven to be sticky, failing to drop in the three month period ending in April when compared to the prior three months but this is less of a concern according to the BoE and their analysis. A move lower in services inflation would be a step in the right direction.

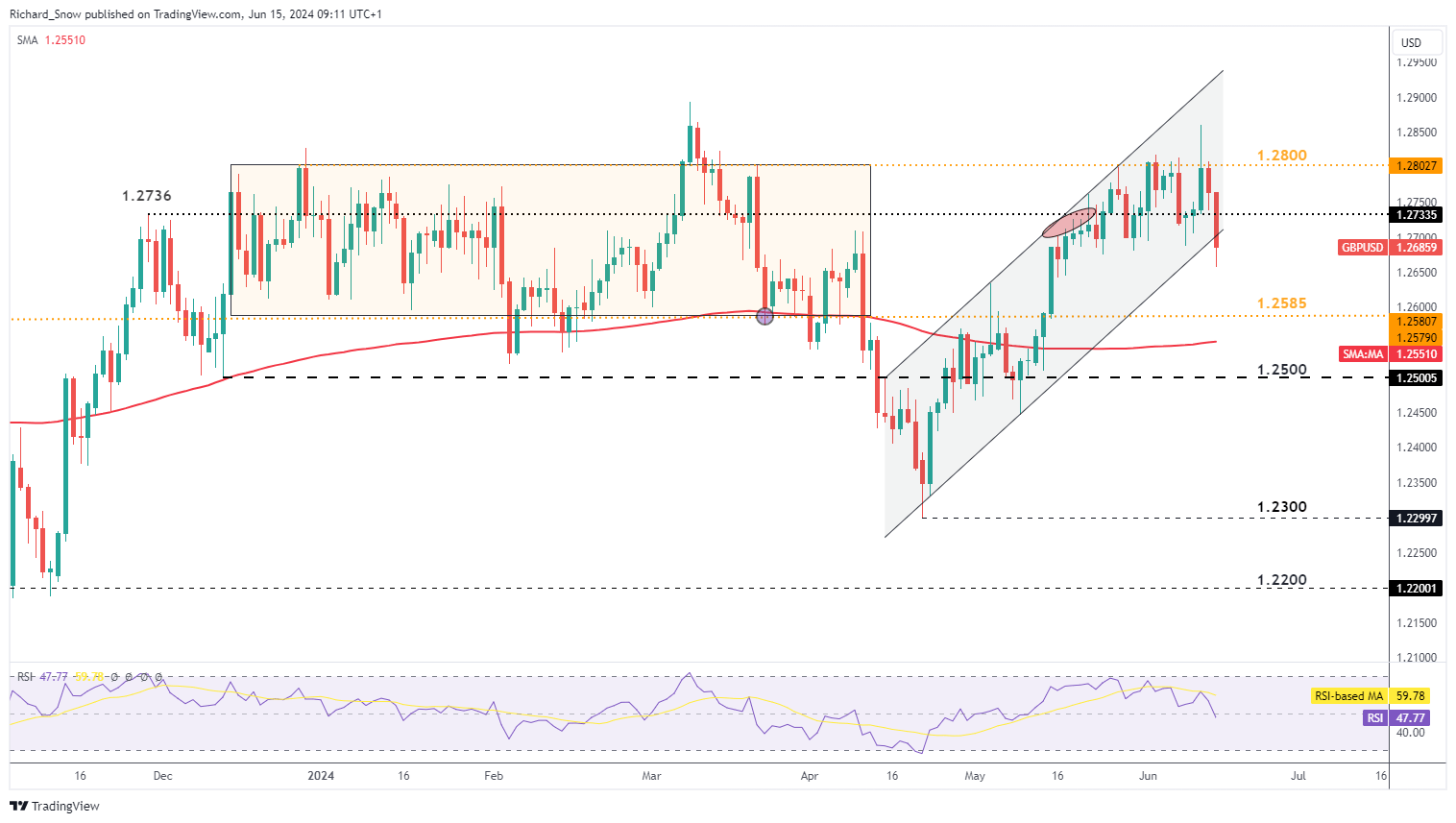

Cable had a volatile week, driven almost entirely by top tier US data (US CPI, FOMC forecasts). The welcomed inflation data on Wednesday and subsequent rise in the pair was pulled back a few hours later with more hawkish revisions to the inflation outlook. Since then FX markets have prioritized the hawkish projections over the encouraging inflation data – the reverse of what has been seen in the US stock market as major indices achieved new all time highs. Continued progress in inflation and a more dovish BoE could extend the current move lower, towards 1.2585 and possibly even the 200 SMA.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

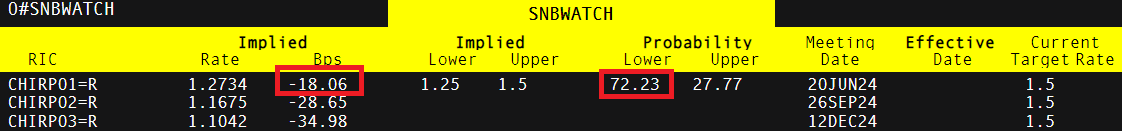

Markets Anticipate another 25 Basis Point Cut from the SNB

After surprising markets in March with 25 basis point cut, the Swiss National Bank (SNB) will meet again in the coming week and potentially lower the policy rate once again. Switzerland has managed to bring headline inflation down to just 1% in March, since then it’s been 1.4% but remains very low compared to other developed nations. Markets factor in a 72% chance of a rate cut in the coming week.

Market-Implied Rate Probabilities

Source: Refinitiv, prepared by Richard Snow

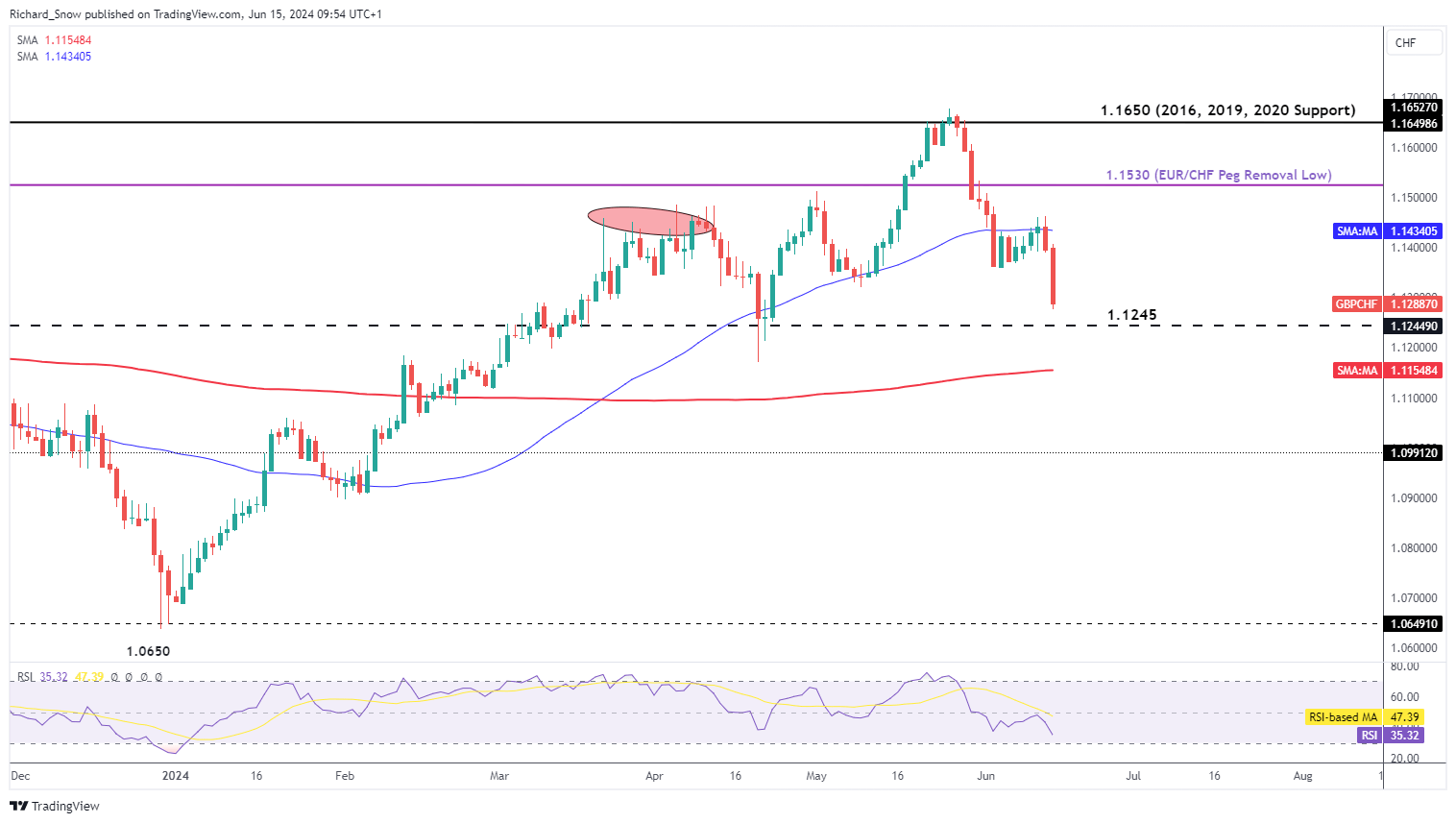

A major risk to the market view appeared when the SNB Chairman mentioned that the greatest risk to the inflation outlook is a weak Swiss Franc. His comments immediately saw the currency strengthen. GBP/CHF approaches 1.1245 with the potential to test the 200 SMA. The blue 50 SMA appears as dynamic resistance.

GBP/CHF Daily Chart

Source: TradingView, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls

Recommended by Richard Snow

Traits of Successful Traders

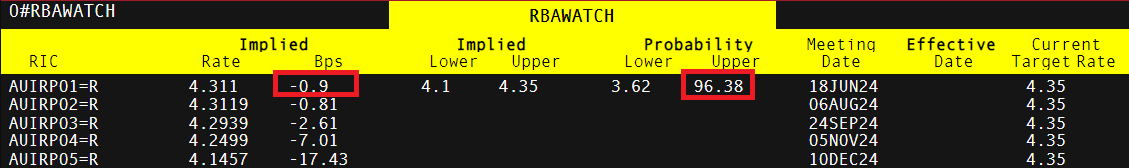

The RBA to Hold but the Economy is Feeling the Pressure of Restrictive Policy

The RBA has had its struggles with resurgent inflation, forcing it to hike after seemingly having paused in 2023. Therefore, officials want to be sure that inflation is on the right track before loosening monetary conditions. As such, there is a 96% chance that rates remain on hold according to rates markets with the potential for just one rate hike later this year in December but even that is not nailed on.

Source: Refinitiv, prepared by Richard Snow

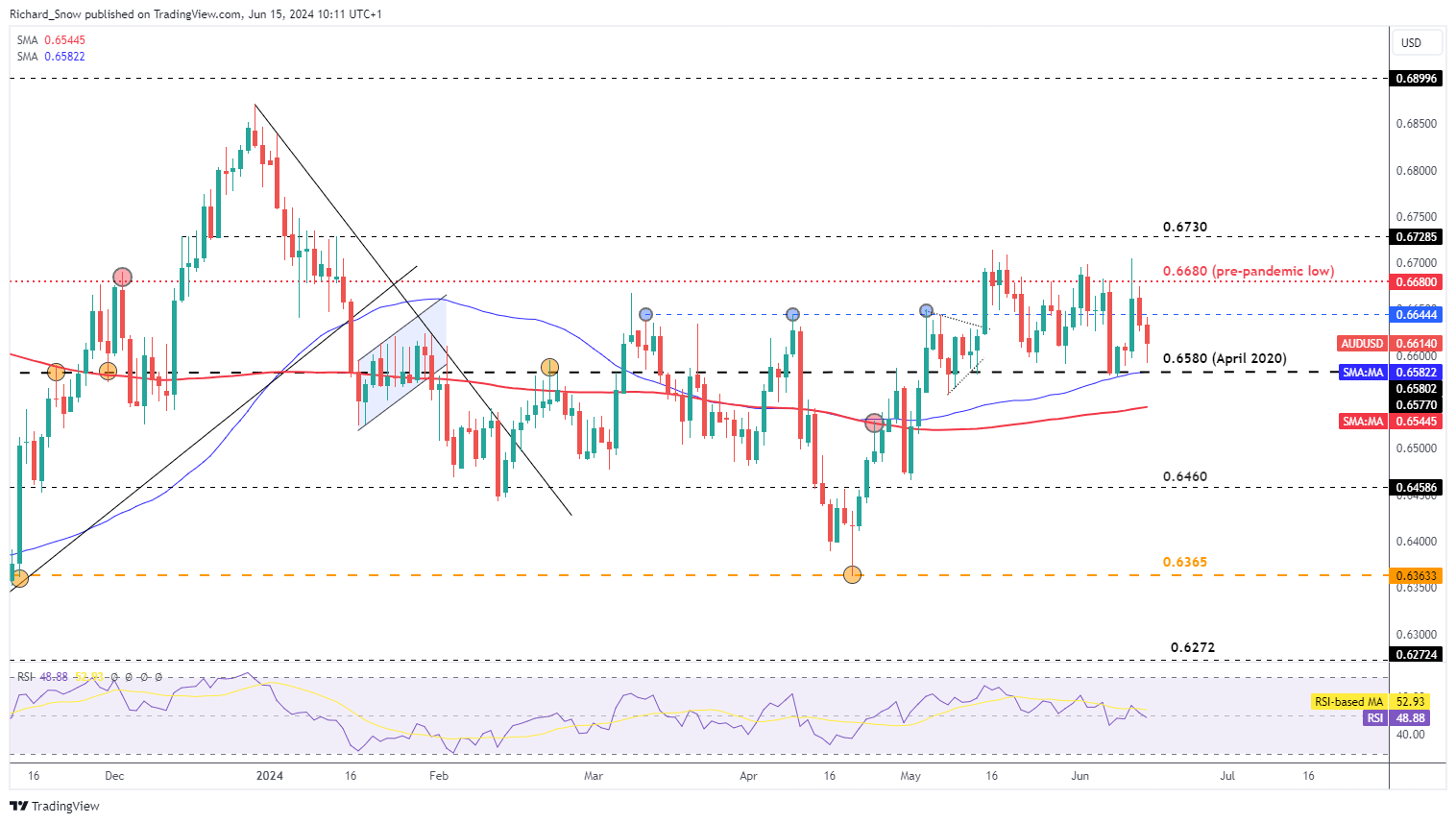

The Aussie dollar lost ground in the week gone by. AUD/USD has mainly oscillated between 0.6680 and 0.6580 with prices testing the lower bound this week before lifting off it. Australian GDP is due next week as well, with estimates for Q1 suggesting a stagnant start to the year with 0% quarter-on-quarter growth. AUD/USD could continue to drift lower next week due to recent upward momentum in the US dollar and a complicated growth outlook for Australia.

AUD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com