The Australian greenback versus the US greenback foreign money pair appears to have some hassle heading in dir

The Australian greenback versus the US greenback foreign money pair appears to have some hassle heading in direction of the north. Is that this a signal of a bearish comeback?

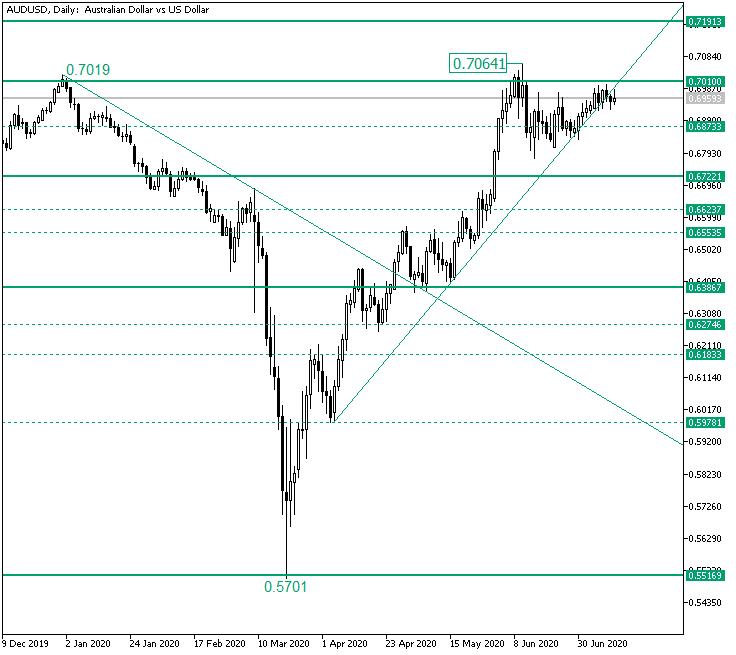

Lengthy-term perspective

The appreciation that began from the 0.7501 low, after the stage of 0.5516 was validated as help, managed to move the necessary resistance space outlined by the stage of 0.6386 and the descending trendline. This aided the extension of the appreciation till the 0.7041 excessive.

Nonetheless, even when the ascending trendline supported the value for as lengthy as doable, the appreciation appears to be out of energy, as the rally makes an attempt have been both turned in their tracks or decelerated.

As a consequence, the ascending trendline was pierced. Noteworthy is to point out that this occurred after the value was, but once more, turned away from the 0.7010 agency stage.

In this case, the bears might be entitled to imagine that it’s their flip to drive the market. So, in the event that they ship the value to the 0.6873 middleman stage, then they might have gained the first battle.

However for an precise pattern change to happen, they need to validate 0.6873 as resistance. If this occurs, then the 0.6722 stage is their subsequent cease. This may be an space from the place the bulls might begin a comeback.

If 0.6722 does cede, then the bears can put the 0.6386 stage as their most important vacation spot, at least for the time being. On the flip facet, if the bulls do handle to conquer and validate 0.7010 as help, then the 0.7191 stage would function their goal.

Brief-term perspective

The value oscillates restricted by the resistance of 0.7002 and the ascending trendline that begins from the 0.6776 low.

If the bulls handle to maintain on to the 0.6949 middleman stage and affirm it as help, then they may tackle the subsequent stage of their plan, validating 0.7002 as help, respectively.

However even when 0.6949 is, but once more, handed, as lengthy as the low of 0.6923 shouldn’t be taken out, the bulls nonetheless have a likelihood. Nonetheless if the low is taken out, then the value might attain the double help space outlined by the 0.6889 stage and the ascending trendline. From right here, the bulls can problem as soon as extra the 0.7002 stage. But when this space fails, then the 0.6816 middleman stage is uncovered.

Ranges to hold an eye on:

D1: 0.6873 0.6722 0.6386 0.7191

H4: 0.6949 0.7002 0.6889 0.6816 and the low of 0.6923

If you will have any questions, feedback, or opinions concerning the US Greenback, be at liberty to submit them utilizing the commentary type beneath.