It’s been a tough morning on Wall Avenue as stimulus hopes are rapidly fading. Simply over the midway level of the U.S. session, the DJIA DOW (-83

It’s been a tough morning on Wall Avenue as stimulus hopes are rapidly fading. Simply over the midway level of the U.S. session, the DJIA DOW (-833), S&P 500 SPX (-84), and NASDAQ (-266) are all deep into the crimson. With the U.S. Presidential election looming in seven days, buyers are going danger off to open the buying and selling week.

For the time being, the weekend COVID-19 information cycle hasn’t been form to equities market bulls. International an infection charges are surging and lots of are calling for contemporary lockdowns and a halt to regional economies. As well as, polling knowledge is tightening up, with oddsmakers calling Election 2020 a literal toss-up. There’s little question about it, “unprecedented uncertainty” is driving risk-off sentiment towards equities.

On the financial information entrance, U.S. New Dwelling Gross sales (Sept.) fell by 3.5% month-over-month. Though this isn’t uncommon for the North American fall season, it’s a steep decline from August’s figures.

All in all, the buyers on Wall Avenue are working for the hills; capitulation is the early week theme as shares and safe-havens are off, with the USD rising.

A Difficult Morning On Wall Avenue

At press time, the S&P 500 is down upwards of two.5%. It is a vital bearish transfer, one of many largest since June.

++Week+27_2019+-+Week+43_2020.jpg)

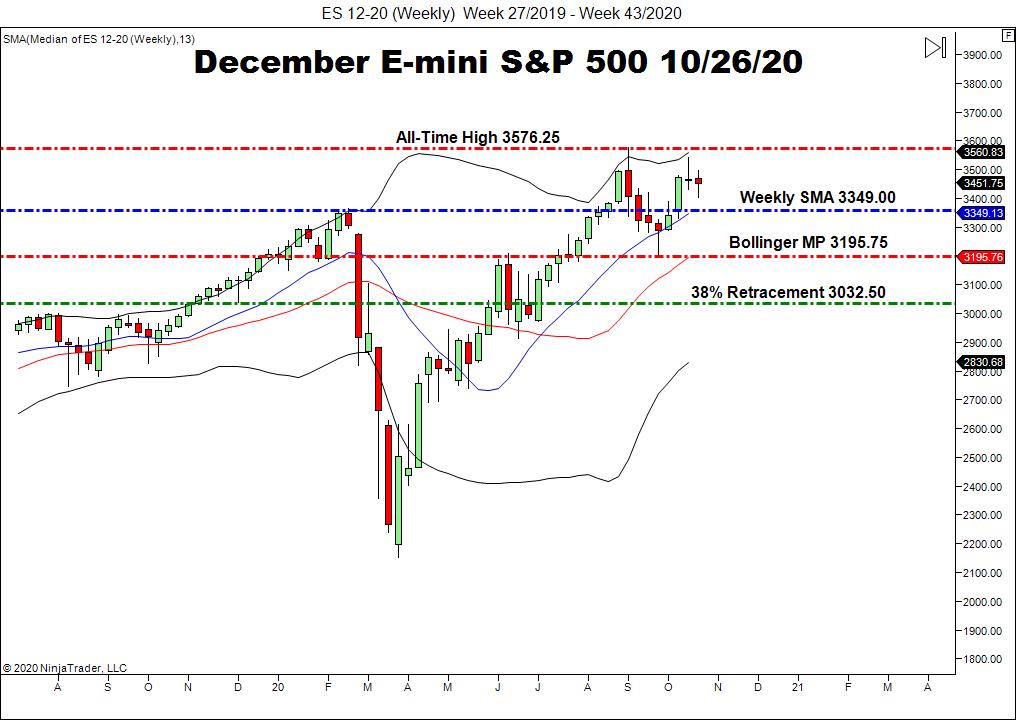

The chart above is a have a look at December E-mini S&P 500 futures as of final Friday’s shut. Costs stay in intermediate-term bullish territory however that’s altering quick. Listed here are the important thing ranges to look at for the rest of the week:

- Resistance(1): All-Time, 3576.25

- Assist(1): Weekly SMA, 3349.00

Overview: As we speak’s shut goes to be an enormous one on Wall Avenue. With sentiment persistently fading, political and COVID-19 uncertainties are dominating the markets. If we see a deep, crimson settle, shares might be positioned to increase losses as midweek commerce rolls on.