Here's what it's essential know on Friday, June 19: Markets have stabilized after as coronavirus issues are considerably soft

Here’s what it’s essential know on Friday, June 19:

Markets have stabilized after as coronavirus issues are considerably softer whereas financial uncertainty stays excessive because the greenback is holding onto beneficial properties. The “quadruple witching” occasion is ready to set off excessive volatility because the week attracts to an finish.

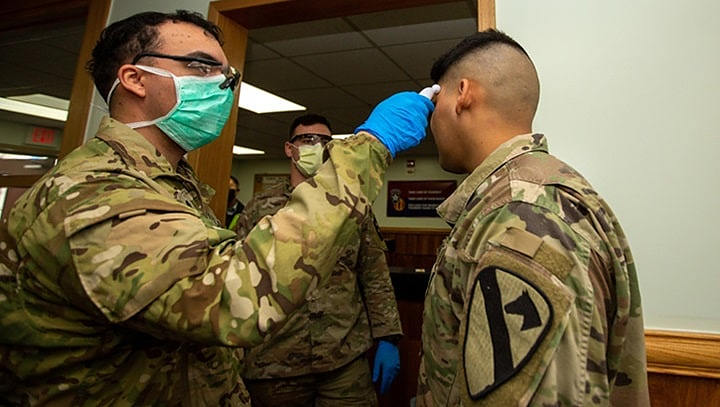

Receding coronavirus issues?: Whereas circumstances and hospitalizations within the US Solar Belt proceed rising, the shortage of latest acceleration is offering some calm. China’s announcement that it has an outbreak in Beijing beneath management can be offering some aid.

On the medical entrance, COVID-19 information have been combined as properly. Dexamethasone, an inexpensive steroid, has proved efficient in decreasing the mortality charge, and efforts for growing a vaccine are in full swing. However, a research in Wuhan solid doubt about growing immunity.

US-Sino relations: President Donald Trump has touted “complete decoupling” from China as an possibility. Nevertheless, different officers within the administration have reiterated that Beijing is fulfilling its commitments in Part One of many commerce deal.

US jobless claims disillusioned by stabilizing round 1.5 million whereas persevering with claims didn’t fall from 20 million. Alongside a miss in housing begins, the shine from sturdy retail gross sales is waning.

Jerome Powell, Chairman of the Federal Reserve, will converse in a digital panel late within the day, and can possible reiterate his warning concerning the restoration. Neel Kashkari, his colleague from the Minnesota Fed, stated the street will possible be bumpy and the restoration “muted.” White Home adviser Larry Kudlow remained optimistic a couple of return to regular by

The main focus towards the top of the week will possible be on expires of 4 various kinds of choices and futures – “quadruple witching” – which are inclined to set off volatility in US shares. It could spill into currencies.

US politics: Forward of Trump’s rally within the weekend, seen by some because the firing shot within the elections marketing campaign, a ballot by Fox Information confirmed the incumbent is trailing rival Joe Biden by 12 factors. Markets are will steadily tune into the elections.

GBP/USD is licking its wounds from the Financial institution of England’s determination on Thursday. The BOE elevated its bond-buying scheme by £100 billion, the underside of the vary, and also will gradual the tempo of purchases. Sterling can be affected by uncertainty about Brexit and comparatively excessive coronavirus figures.

See BOE Fast Evaluation: Three causes to promote sterling as Bailey appears burned out

UK retail gross sales are set to point out a rebound in Could after plunging in April, the primary full month of the lockdown. UK GfK Shopper Confidence bounced from the lows.

EUR/USD is buying and selling simply above 1.12 as European leaders maintain a gathering to debate the EU Fund. Germany and France are pushing to undertake the European Fee’s bold program, whereas the “Frugal 4” group of wealthy international locations rejects mutual funding. Selections will possible be deferred to the following summit in July.

AUD/USD is stabilizing after retail gross sales bounced by 16.3% in line with the preliminary launch for Could. Australian PM Scott Morrison warned that his nation is struggling a cyber assault.

USD/CAD is clinging to 1.36 forward of Canadian retail gross sales figures for April, projected to point out a double-digit drop.

Oil costs have recovered with WTI buying and selling round $39. The black gold is on the rise regardless of a scarcity of progress in a technical OPEC assembly.

Gold costs stay secure just below $1,730. The valuable steel has been repeating a sample of dips, adopted by recoveries, and a return again to the vary.

Cryptocurrencies are buying and selling at considerably decrease floor, with Bitcoin hovering round $9,300.

Extra Coronavirus comeback or financial re-emergence, Which narrative will carry the day?