Canadian inflation and retail gross sales to drive loonie – Foreign exchange Information Preview Posted on

Canadian inflation and retail gross sales to drive loonie – Foreign exchange Information Preview

Posted on July 21, 2020 at 9:35 am GMTMelina Deltas, XM Funding Analysis Desk

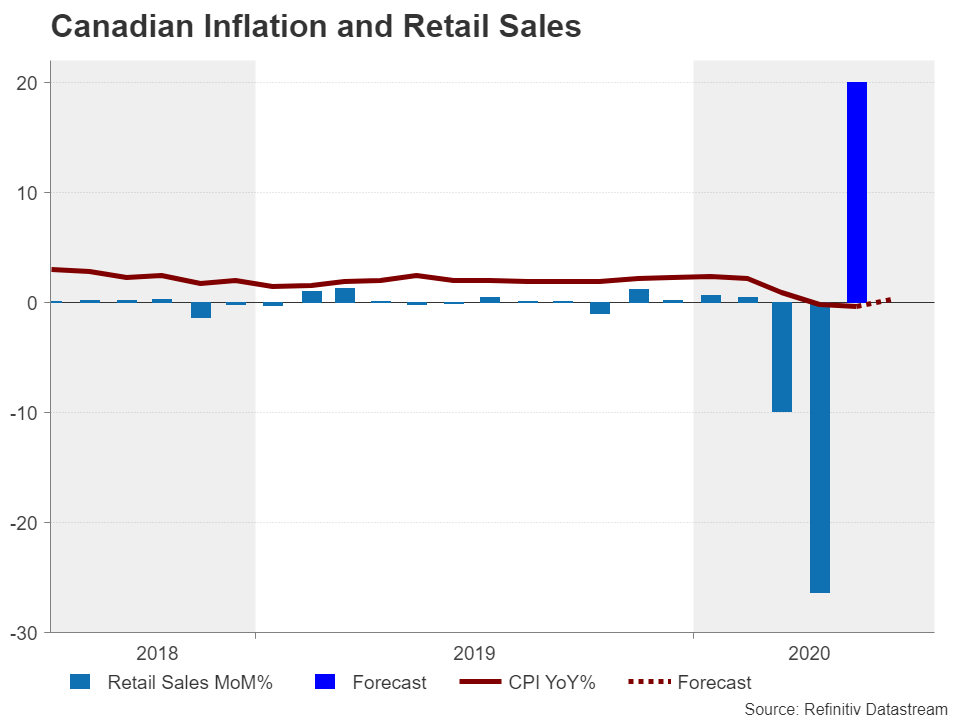

Canada will publish its retail gross sales knowledge for the month of Might at 1230 GMT on Tuesday earlier than releasing inflation figures of June on the similar time on Wednesday. Given its sharp tumble within the previous month, the retail gross sales report could possibly be a extra necessary market mover amongst knowledge releases for the loonie this week, which has simply managed to stabilize from final month’s sell-off.

Why the Financial institution of Canada is avoiding a charge minimize

The Financial institution of Canada (BoC) stored its rates of interest unchanged on the final assembly on June 15 and policymakers famous that charges will stay at 0.25% till the two% inflation goal has been achieved. Very like the remainder of the world, Canada’s economic system has been crippled by the pandemic and the following lockdown, as tens of 1000’s of individuals have been sickened by Covid-19 in components of Canada’s largest cities.

The Committee talked about that the economic system is in a restoration mode amid the easing of coronavirus restrictions, although the outlook remains to be unsure as a result of unpredictable pandemic. Additionally, policymakers referred to their quantitative easing program that may proceed with large-scale asset purchases and forecasted that the actual GDP will seemingly dive by 7.8% in 2020 and broaden once more with development of 5.1% in 2021 and three.7% in 2022.

Retail gross sales to rebound after tumble

Retail gross sales in Canada tumbled by 26.4% m/m in April, which was the biggest downturn on file as a result of Covid-19 pandemic and is predicted to have rebounded to 20% m/m in Might. Core gross sales are predicted to extend by 12% m/m versus a decline of 22% m/m beforehand. The falls had been primarily led by the important drop at motorized vehicle and components sellers, clothes and clothes equipment shops and gasoline stations, as crude oil costs collapsed because of a worldwide oil provide glut and decrease demand.

Inflation to carry under the goal

This week, the headline CPI inflation might not urge any change in rates of interest as soon as once more because the index is forecasted to rebound to 0.2% y/y from -0.4% beforehand, holding properly under the two.0% midpoint goal for an additional month. The core CPI inflation is predicted to inch as much as 0.9% y/y from 0.7% earlier than.

Technical view on loonie

In phrases of market response, merchants are extra about this months’ retail gross sales knowledge. Therefore, for the loonie, if the numbers beat expectations, they may bolster the foreign money, pushing the greenback/loonie pair even decrease.

In any other case, a weaker inflation prints particularly in the core measures, which higher mirror the inflation development, may ease momentum available in the market as buyers wait and see whether or not there might be any additional deterioration in international financial circumstances and subsequently within the Canadian GDP development most likely stemming from the coronavirus.

Taking a look at USDCAD, the value is in a impartial mode during the last six weeks and is pushing efforts to proceed the four-month draw back transfer, bringing help across the 200-day SMA and the 1.3483 barrier. Decrease, the value may retest the 1.3310 area earlier than heading to the 1.3200 psychological mark.

Alternatively, disappointing CPI and retail gross sales numbers may re-challenge close by resistance round 1.3715, above the short-term transferring averages. Past that impediment, the way in which would open in the direction of the 1.3850 stage after which as much as 1.4050.

USDCAD