Cardano value has returned to 2018 excessive. Some skeptics argue that r/WallStreetBets fanatics have overhyped the token. Full decentralization

- Cardano value has returned to 2018 excessive.

- Some skeptics argue that r/WallStreetBets fanatics have overhyped the token.

- Full decentralization will higher place Cardano to problem main rivals.

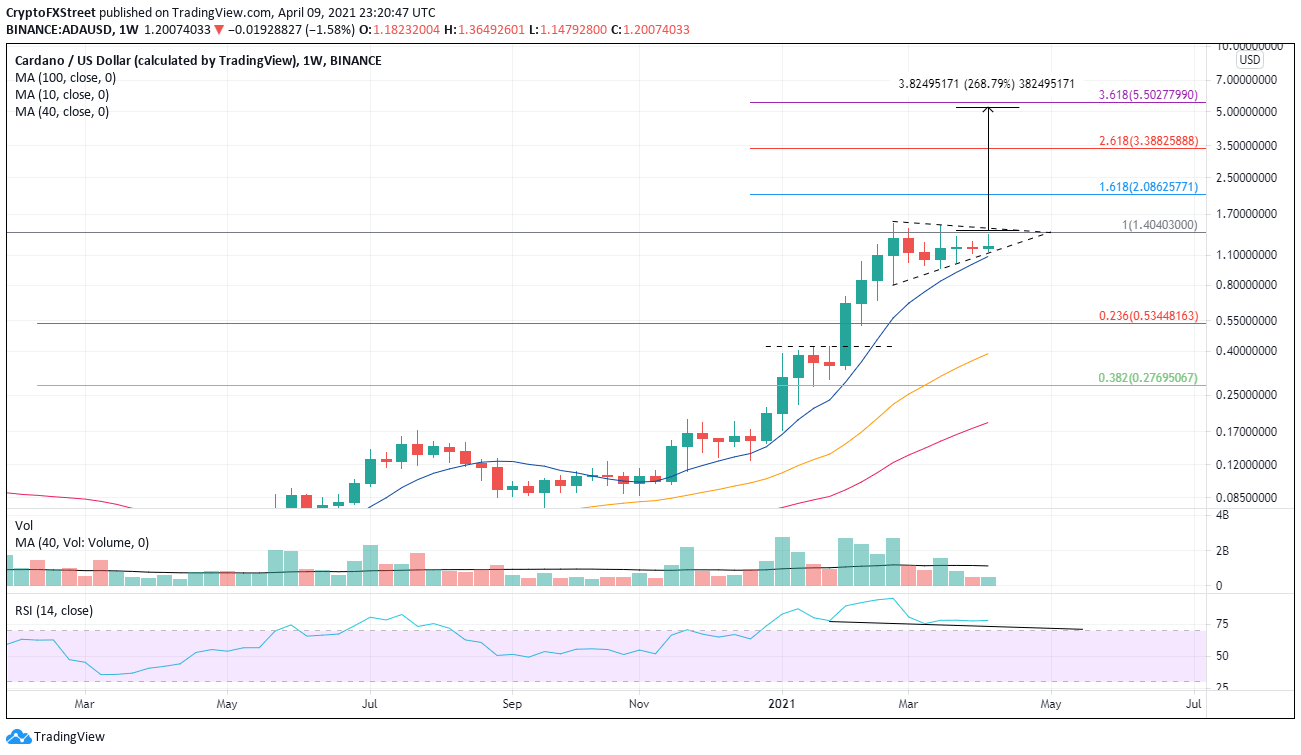

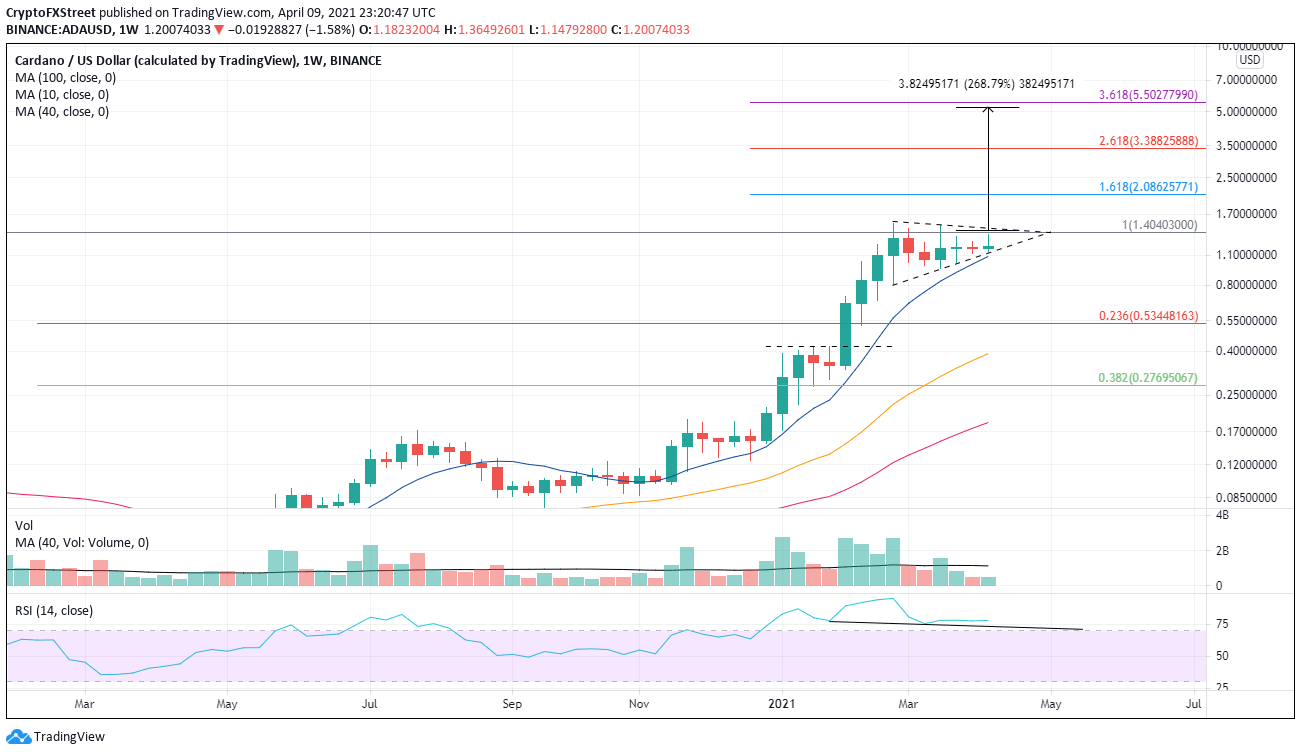

Cardano value has constructed a pennant continuation sample slightly below 2018 excessive. Based mostly on the tightness of the value motion within the final three weeks, there’s a excessive likelihood for a decision to the upside within the subsequent few days.

Cardano value wants clean rolling out of sensible contracts

The ADA advance over the past yr represents a outstanding restoration for the cryptocurrency after plunging nearly 99% from 2018 excessive to the 2020 low. Enabling the rally has been a bullish information function for the Cardano ecosystem. The founder, Charles Hoskinson, has revealed that it’ll focus its efforts on the NFT market and that his workforce has negotiated with many top-10 NFT marketplaces about porting them to Cardano.

Hoskinson additionally introduced on the Blockchain Africa Convention that Cardano was close to “offers and initiatives” by public-private partnerships with a number of nations in Africa, intending to draw hundreds of thousands of customers to the ecosystem.

Shifting ahead, the important thing will probably be whether or not the Cardano sensible contracts replace will facilitate blockchain builders to create crowdfunding, auctions, and now well-known, collectibles enterprise functions.

The pennant sample measured transfer is 270%, and it targets $5.25 within the medium-term, slightly below the 361.8% Fibonacci extension of the February-March decline at $5.50. If the sample evolves right into a symmetrical triangle, the measured transfer goal is $2.03, near the 161.8% extension at $2.08, representing a 38% acquire from the triangle’s breakout.

ADA/USD weekly chart

A weekly shut under the triangle’s decrease development line at $1.12 and the 10-week easy transferring common (SMA) at $1.09 opens the likelihood for a big decline. Clear help is located on the 23.6% retracement of the 2020-2021 advance at $0.53.

Get the 5 most predictable forex pairs