US Greenback, Singapore Greenback, New Taiwan Greenback, Philippine Peso, Indian Rupee, ASEAN, Basic Evaluation – Speaking Factor

US Greenback, Singapore Greenback, New Taiwan Greenback, Philippine Peso, Indian Rupee, ASEAN, Basic Evaluation – Speaking Factors

- US Greenback held floor as greater Treasury charges offset threat urge for food strain

- Fiscal stimulus delay, Fed might cool Buck versus SGD, TWD, PHP, INR

- APAC, ASEAN information: Taiwanese and Philippine GDP, Chinese language industrial income

Advisable by Daniel Dubrovsky

Get Your Free USD Forecast

US Greenback ASEAN Weekly Recap

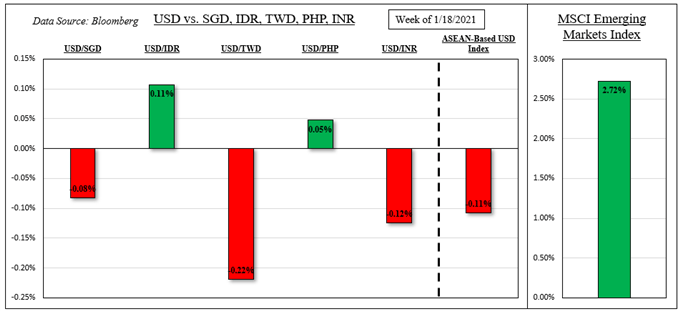

Final week, the haven-linked US Greenback cautiously weakened towards its ASEAN counterparts, such because the Singapore Greenback and New Taiwan Greenback. It additionally noticed some weak point towards the Indian Rupee, however losses had been modest. All issues thought-about, it may have been worse for the anti-risk Buck contemplating one other strong week for Rising Market indices because the EEM hit document highs – see chart under.

Notable standouts had been the Indonesian Rupiah and Philippine Peso. USD/IDR gained because the Financial institution of Indonesia left benchmark lending charges unchanged, signaling the intent to maintain borrowing prices low till there are indicators that inflation is rising. Policymakers additionally reiterated their stance on sustaining stability within the alternate fee. USD/PHP was little modified as 3-month implied volatility plunged to the bottom in over 20 years.

US Greenback, Rising Markets Index – Final Week’s Efficiency

*ASEAN-Based mostly US Greenback Index averages USD/SGD, USD/IDR, USD/TWD and USD/PHP

Exterior Occasion Danger – US Fiscal Bets, Treasury Yields, Earnings Season, Federal Reserve

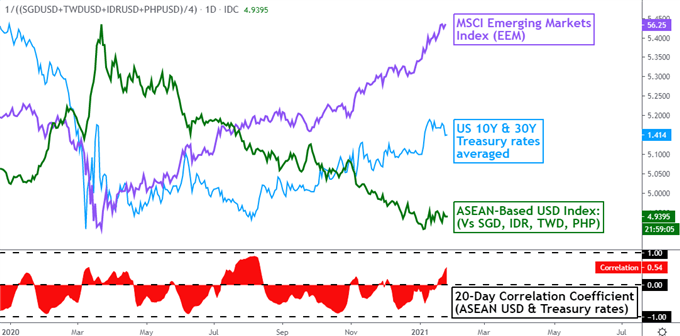

ASEAN and Rising Market currencies will be fairly delicate to basic threat urge for food, particularly towards the US Greenback in right this moment’s low-interest-rate atmosphere. What could also be maintaining the USD from falling extra aggressively is the story of Treasury yields ever since Democrats took management of each chambers within the legislative department. That elevated prospects of extra aggressive fiscal stimulus.

Consequently, longer-dated authorities bond yields rallied, providing the US Greenback some enchantment. In actual fact, Treasury yields even outpaced authorities bond charges from ASEAN nations earlier this month. So whereas market temper has broadly remained upbeat, the Buck has notably slowed its descent as of late. My ASEAN-based USD index is now extra intently following Treasury yields – see subsequent chart under.

Advisable by Daniel Dubrovsky

What are the highest buying and selling alternatives in 2021?

May this modification over the rest of the week? Prospects that one other Covid reduction fiscal bundle might not arrive earlier than the center of March sank Treasury yields to start out off the week. Equities additionally recovered after this announcement, maybe having fun with what has been a somewhat rosy fourth-quarter earnings season. Nonetheless, all eyes are on key tech stories from Apple, Microsoft and Fb. Extra of the identical might maintain traders upbeat.

Hold a detailed eye on the FOMC financial coverage announcement. Whereas lending charges are anticipated to stay unchanged on Wednesday, markets will seemingly deal with commentary concerning the US$120 billion in month-to-month asset purchases. Final week, the central financial institution’s steadiness sheet climbed to its highest but, round US$7.42 trillion. With tapering seemingly being some methods off, the Buck might stay below strain.

Advisable by Daniel Dubrovsky

How are you going to overcome frequent pitfalls in FX buying and selling?

ASEAN, South Asia Occasion Danger – Taiwanese and Philippine GDP, Chinese language Industrial Earnings, Singaporean Unemployment

Specializing in the ASEAN financial docket, Taiwanese fourth-quarter superior GDP estimates are due on Friday. Upbeat native industrial manufacturing for December helped increase TWD to start out off the week as output grew 9.9% y/y versus 6.0% anticipated. A rosy GDP print might observe, additional pressuring USD/TWD decrease. The Philippine Peso will probably be eyeing GDP information as properly.

On Thursday, Philippine development is predicted to shrink -8.2% y/y in This fall. That will mark a fourth consecutive contraction, with 2020 annual GDP anticipated to drop -9.5% y/y. The latter can be one of many worst readings amongst its ASEAN counterparts. Whereas USD/PHP stays a lot decrease than final yr, declines have notably slowed. That is because the benchmark PSEi index stays properly under its peak from early 2018.

Final week, better-than-expected Chinese language fourth-quarter GDP helped push the EEM to new highs amid strong output from the world’s second-largest economic system. On Wednesday, China will report December industrial income which can observe an analogous rosy path. For ASEAN members, China is a key buying and selling companion and upbeat financial information might proceed reverberating outwards. USD/SGD is eyeing Singaporean unemployment information.

Take a look at the DailyFX Financial Calendar for ASEAN and world information updates!

On January 26th, the 20-day rolling correlation coefficient between my ASEAN-based US Greenback index and a mean of 10-year and 30-year Treasury yields elevated to +0.54 from +0.17 one week in the past. Values nearer to +1 point out an more and more constructive relationship, although it is very important acknowledge that correlation doesn’t indicate causation.

ASEAN-Based mostly USD Index Versus MSCI Rising Markets Index and Treasuries – Each day Chart

Chart Created Utilizing TradingView

*ASEAN-Based mostly US Greenback Index averages USD/SGD, USD/IDR, USD/TWD and USD/PHP

— Written by Daniel Dubrovsky, Forex Analyst for DailyFX.com

To contact Daniel, use the feedback part under or @ddubrovskyFX on Twitter