Roy Levine•Sunday, May 25, 202

Quick overview

- Chainlink (LINK) has faced strong resistance at $16.95, confirming a bearish outlook as anticipated in previous forecasts.

- The token has retreated to test immediate support at $15.00, with a potential breakdown opening the door to further declines.

- Current market sentiment is negatively impacted by global tariff tensions, increasing the likelihood of a drop to $12.81 if support at $15.00 fails.

- Without a sustained close above $16.95, the path of least resistance for Chainlink remains downward.

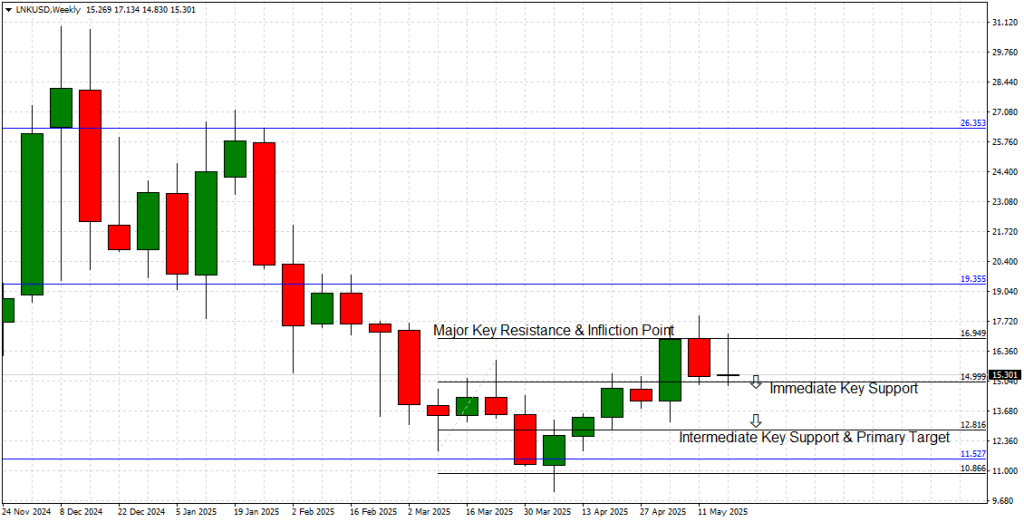

Chainlink (LINK) has followed our previous forecast scenario to the letter. In our May 11, 2025 forecast, we flagged the $16.95 Major Resistance and Infliction Point as a crucial ceiling for LINK’s bullish momentum.

As anticipated, the token advanced directly into this key barrier, but the move was short-lived. Price action immediately stalled and reversed, confirming the strength of the resistance and setting up a textbook downside reversal.

Since then, Chainlink has retreated to test the Immediate Key Support at $15.00 — another target we highlighted in our last report. With market sentiment deteriorating further amid escalating global tariff war tensions, our bearish conviction is growing stronger. A clean breakdown beneath $15.00 would likely open the door for an extended corrective move toward the next major support at $12.81.

Breakout Levels and Technical Outlook

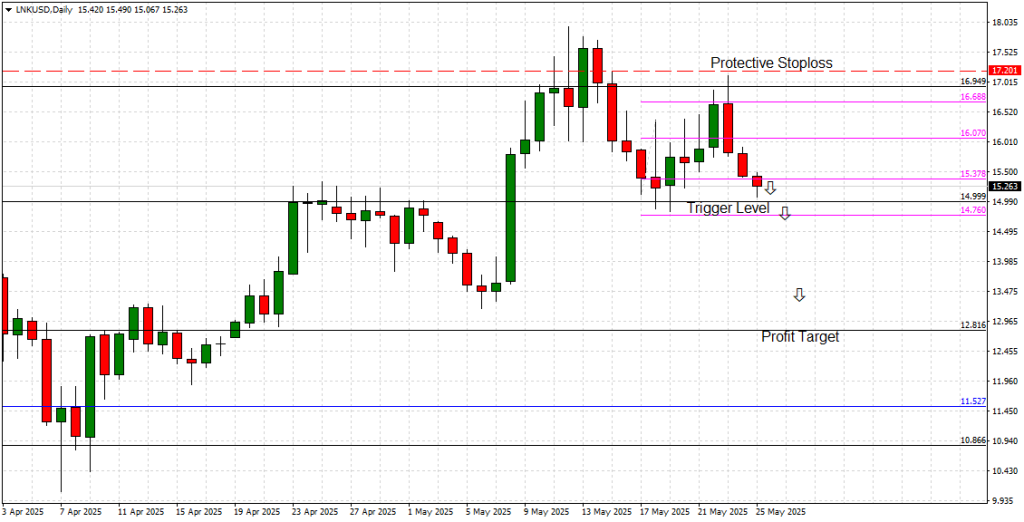

The Weekly and Daily charts (see attached) illustrate the rejection at $16.95 clearly. LINK’s price action formed rejection wicks and failed to close above this key level, confirming the area as a formidable barrier. After retracing to $15.00, the market is now consolidating — teetering on the edge of a potential breakdown.

Key Levels to Watch:

-

Major Key Resistance & Infliction Point: $16.95

-

Immediate Key Support: $15.00

-

Trigger Level: $14.76

-

Profit Target / Intermediate Key Support: $12.81

-

Protective Stoploss: $17.20

A decisive daily or weekly close below $15.00 would confirm bearish continuation, with the next key downside objective at $12.81. Below that, further pressure could eventually expose support at $11.52.

Unless bulls can reclaim $16.95 and produce a sustained close above that resistance, the path of least resistance remains firmly to the downside.

Price Action and Momentum Analysis

Chainlink’s momentum has shifted decisively bearish following the failed breakout. The Daily chart reveals a consistent pattern of lower highs since the rejection at $16.95, while RSI readings continue to trend lower, reflecting declining buying pressure.

The most recent candles on both the Daily and Weekly charts exhibit bearish characteristics — including long upper wicks, small-bodied candles, and failed attempts to reclaim lost ground. These signals suggest growing seller control, with a breakdown below $15.00 increasingly likely in the near term.

A confirmed close beneath the Trigger Level at $14.76 would likely accelerate bearish momentum, opening the way for a swift drop to $12.81.

Technology and Ecosystem Update

From a technology perspective, there have been no major protocol upgrades or project developments announced since our last report. Chainlink continues to maintain its position as the market’s leading decentralized oracle network, with ongoing integrations into DeFi platforms and traditional enterprise blockchain solutions.

While long-term fundamentals remain intact, short-term price action is overwhelmingly influenced by macroeconomic pressures, including the escalating tariff war tensions impacting risk assets globally. The current climate favors defensive positioning, with speculative tokens like Chainlink particularly exposed to capital outflows.

Conclusion: Bearish Outlook Strengthens

In summary, Chainlink’s rejection at $16.95 confirms our May 11 forecast scenario. The market has since retraced to $15.00, and ongoing geopolitical uncertainty continues to weigh on sentiment. A clean breakdown below $15.00 would validate our downside projections, targeting $12.81 as the next significant support.

Unless bulls can reclaim $16.95 — a move that appears increasingly unlikely given the current macro backdrop — the bias remains firmly to the downside.

Related Articles

www.fxleaders.com