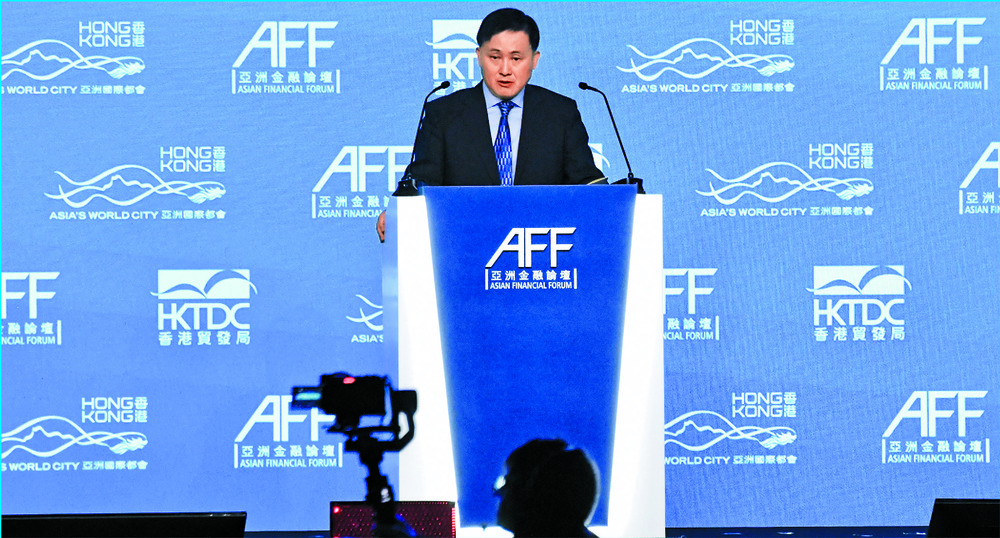

Pan Gongsheng reveals plans to enhance the connectivity of financial markets between the mainland and the SAR.

Cici Cao

China will significantly increase the proportion of its foreign exchange reserves allocated to assets in Hong Kong, said the People’s Bank of China Governor Pan Gongsheng.

Speaking at the Asian Financial Forum, Pan outlined four key priorities to support Hong Kong’s role as an international financial center, including enhancing the connectivity of financial markets between the mainland and the SAR.

He announced plans to increase the proportion of China’s foreign exchange reserves allocated to assets in the city, adding the PBOC will facilitate more high-quality companies in listing and issuing bonds in Hong Kong.

According to the official data released on January 7, China’s total foreign exchange reserves stood at US$3.2 trillion (HK$24.96 trillion), down 1.94 percent or US$63.5 billion in a single month.

Meanwhile, the PBOC will further boost Hong Kong’s status as an offshore yuan business hub, enriching the products and services in its offshore yuan market, such as issuing offshore yuan China treasury bond futures.

Pan also vowed to enhance the city’s functions in global asset and wealth management while ensuring its financial stability and security.

Chief Executive John Lee Ka-chiu said the SAR government plans to boost competitiveness as an international asset and wealth management center, as well as explore new opportunities including building an international gold trading center.

Authorities are set to relax the requirements of the investment entrant scheme in March to attract more top-tier global businesses and talent and to expand joint asset projects with the mainland financial markets, including strengthening Bond Connect trading, Lee said.

Hong Kong’s stability amid global geopolitical changes will provide a secure environment for gold storage and other forms of wealth management, he added, revealing plans to build the gold trading center that will feature world-class storage and support services.

Financial Secretary Paul Chan Mo-po said Hong Kong could offer a comprehensive range of financing options to meet the diverse needs of governments and businesses at various stages of development, from project funding to business expansion.

The city boasts a vibrant private equity and venture capital ecosystem, managing over US$230 billion (HK$1.79 trillion) in assets, he added.

In response to PBOC’s supportive policies, Secretary for Financial Services and the Treasury Christopher Hui Ching-yu said Hong Kong welcomes those measures, which he believes have positive implications for building a broader overseas yuan market.

Hui added that Hong Kong will further communicate with the mainland on the timing of the launch and pattern of the offshore yuan China treasury bond futures mentioned by Pan.

Moreover, China’s special envoy for climate change Liu Zhenmin said Hong Kong can empower Asia’s energy transition through climate financing.

www.thestandard.com.hk