HANG SENG, ASX 200, S&P 500 INDEX OUTLOOK:Havens have been on bid as rising coronavirus instances threatened one other lockdo

HANG SENG, ASX 200, S&P 500 INDEX OUTLOOK:

- Havens have been on bid as rising coronavirus instances threatened one other lockdown wave

- US fairness indices closed broadly decrease as markets reassessed the vaccine’s influence

- Cling Seng Index (HSI), ASX 200 index might face a near-term pullback amid souring sentiment

Rising Covid-19 Circumstances, S&P 500, Asia-Pacific at Open:

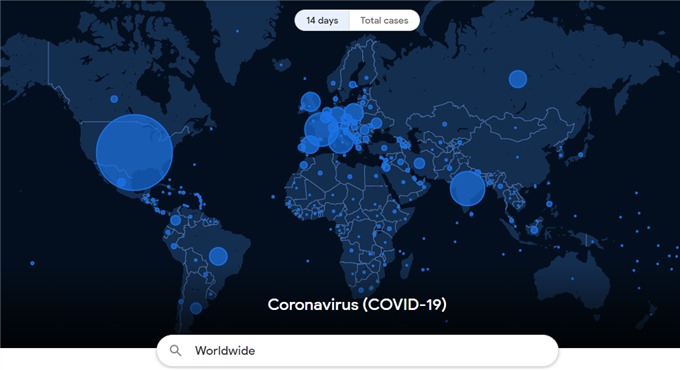

US fairness indices ended broadly decrease on Thursday, dragged by cyclically-linked vitality and materials sectors. A “danger off” sentiment is prevailing at Asia-Pacific open, as international Covid-19 infections proceed climbing at an alarming charge, posing a danger for extra lockdown measures across the globe. Around the globe, new coronavirus instances surpassed 7.Three million over the previous 14 days, reaching a report excessive. In the meantime, vaccine optimism appeared to have cooled as buyers re-focused on near-term headwinds. The Dow Jones, S&P 500 and Nasdaq index closed at -1.08%, -1.00% and -0.65% respectively.

The US 10-year Treasury yield fell 80 bps to 0.881%, flagging souring danger urge for food as capital fled into the safe-havens. Within the foreign exchange market, the risk-sensitive New Zealand Greenback was among the many worst-performing G10 currencies, reflecting fragile market sentiment. Crude oil and gold costs retreated.

Asia-Pacific shares look set to open broadly decrease, with Japan’s Nikkei 225, Australia’s ASX 200, Singapore’s Straits Occasions Index (STI) and Hong Kong’s Cling Seng Index (HSI) futures all pointing to retreat from latest highs. Revenue taking may very well be the principle theme on Friday as vaccine enthusiasm pale whereas pandemic danger is again within the heart of the stage.

International New Covid-19 Circumstances Surpassed 7 Million in The Final 14 Days

On the macro entrance, Hong Kong, Russia and the EU will publish their Q3 GDP readings later immediately. A number of Fed and BoE officers will ship speeches, which will probably be eyed for additional stimulus hints because the pandemic swept the US and most elements of the EU. The College of Michigan Client Sentiment can be among the many high occasions. Discover out extra on the DailyFX financial calendar.

Advisable by Margaret Yang, CFA

Why do rates of interest matter for currencies?

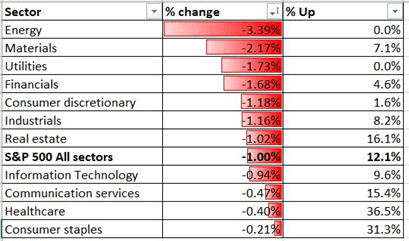

Sector-wise, all eleven S&P 500 sectors closed within the purple, with 87.9% of the index’s constituents ending decrease on Thursday. Vitality (-3.39%), supplies (-2.17%) and utilities (-1.73%) have been among the many hardest hit, whereas defensive shopper staples (-0.21%) healthcare (-0.40%) registered smaller losses.

S&P 500 Sector Efficiency 12-11-2020

Supply: Bloomberg, DailyFX

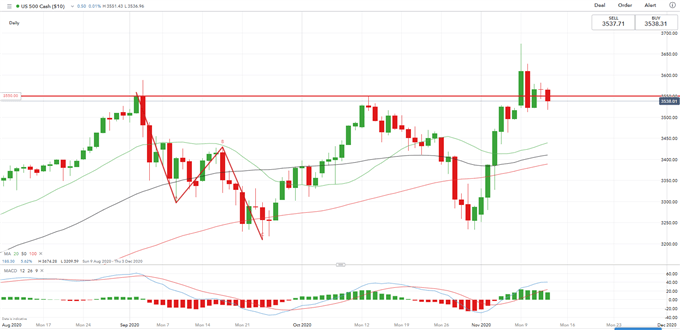

S&P 500 Index Technical Evaluation:

Technically, the S&P 500 index retreated to check a key help degree at 3,550, which was as soon as a key resistance. Help ranges, as soon as damaged, change into rapid help ranges. Revenue taking actions might kick in after a powerful rally final week. The MACD indicator appeared to have flattened, reflecting weakening upward momentum. Holding above 3,550 might pave means for additional upsides, whereas breaking beneath might result in a deeper pullback. A right away resistance degree will be discovered at round 3,610.

Advisable by Margaret Yang, CFA

What’s the highway forward for equities this quarter?

S&P 500 Index – Day by day Chart

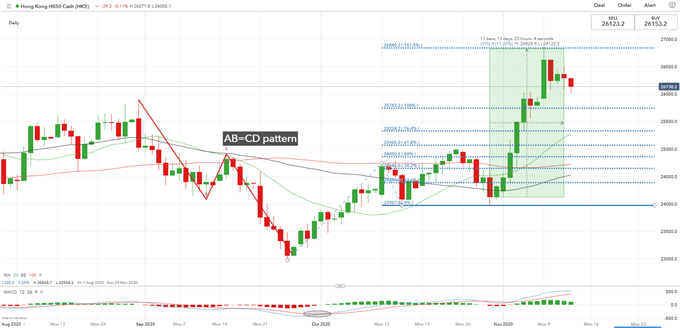

Cling Seng Index Technical Evaluation:

The Cling Seng Index (HSI) has probably entered a consolidative part after rising greater than 11% in early November. A right away resistance degree will be discovered at 26,840 – which is the 161.8% Fibonacci extension degree. A right away help degree will be discovered at round 25,740 – the 100% Fibonacci extension. Close to-term momentum seems to biased in direction of the draw back, whereas the general pattern stays bullish-biased.

Cling Seng Index – Day by day Chart

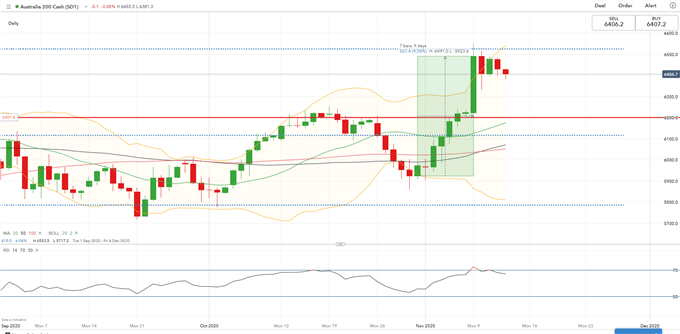

ASX 200 Index Technical Evaluation:

Technically, the ASX 200 seems to have entered a consolidative part after registering a formidable 9.5% month-to-date achieve. The index retreated after hitting a key resistance degree at 6,525, which is the 76.4% Fibonacci retracement. The general pattern stays bullish-biased, however some quick time period pullback is feasible because the RSI indicator has reached overbought territory following a powerful rally over the previous two weeks. A key help degree will be discovered at round 6,200 – earlier key resistance.

ASX 200 Index – Day by day Chart

Advisable by Margaret Yang, CFA

Enhance your buying and selling with IG Consumer Sentiment Information

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part beneath or @margaretyjy on Twitter