Over the previous 24-hours, the information cycle has been crammed with key occasions. Among the many most cited is the current spike in U.S. COVI

Over the previous 24-hours, the information cycle has been crammed with key occasions. Among the many most cited is the current spike in U.S. COVID-19 deaths. Over the previous two weeks, the U.S. has averaged greater than 1,000 deaths per day, with Wednesday/Thursday bringing a tally of practically 1500. At this level, instances are on the uptick because the Trump administration falls beneath intense media scrutiny.

On the political entrance, presumptive Democratic nominee Joe Biden has named Kamala Harris as his VP alternative. Harris because the VP choice got here as a shock to many pundits as she is from the far left of the American political spectrum. In different phrases, a lot of Harris’s financial views lean socialist, much like ex-Democratic candidate Bernie Sanders. To this point, the markets haven’t put a lot inventory within the potential affect of VP Harris on the financial system ought to Joe Biden win the White Home.

As soon as once more it’s Thursday and meaning U.S. employment is beneath the microscope. The headline of right now’s experiences was the lower in unemployment claims. Preliminary Jobless Claims (August 7) fell to 963,000, properly beneath projections of 1.12 million. At this level, it seems like we might have seen the worst of the unemployment numbers.

Sadly for the USD, a spike in COVID-19 is prone to result in an extension of FED QE. Thus far right now, the buck is taking it on the chin versus the majors.

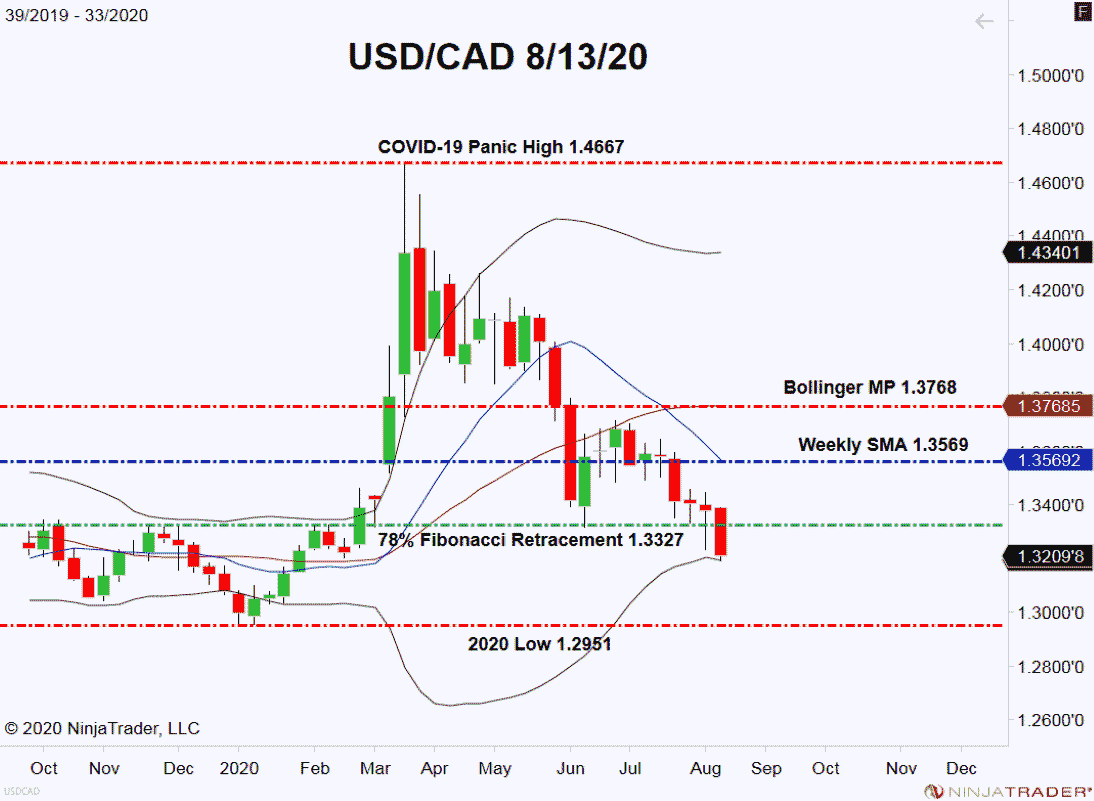

COVID-19 Spikes, USD/CAD Falls

In a Reside Market Replace from earlier this month, I outlined the significance of the 78% Fibonacci help degree within the USD/CAD. This degree is lengthy gone ― subsequent up could also be 2020’s low at 1.2951.

+2020_33+(10_52_45+AM).png)

Overview: In the interim, it’s short-or-nothing for the USD/CAD. Charges are in a relative freefall as COVID-19-inspired dovish coverage is driving values towards 1.3000. If we see WTI crude oil acquire some late-summer swagger above $45.00, this pair is prone to make a legit run at 2020’s low.