CRUDE OIL & GOLD TALKING POINTS:Crude oil costs could also be supported in risk-on commerce, vary resistance holdingGold cost

CRUDE OIL & GOLD TALKING POINTS:

- Crude oil costs could also be supported in risk-on commerce, vary resistance holding

- Gold costs testing acquainted help, Greenback and yields supply conflicting cues

- Covid-19 upswell, US fiscal stimulus deadlock stay the highest themes in focus

Crude oil costs fell alongside shares as threat urge for food soured throughout world monetary markets. The MSCI World Inventory Index – a proxy for the efficiency of world equities and a leader for market-wide sentiment – snapped an eight-day profitable streak. Gold costs edged increased because the downbeat temper weighed on bond yields, boosting the attraction of non-interest-bearing alternate options.

Traders turned defensive as Covid-19 instances surged the world over whilst US stimulus negotiations stalled. One other wave of the virus has introduced on renewed lockdowns that threaten to delay financial restoration. In the meantime, the White Home has ceded its function in fiscal assist talks to the Senate, the place the Republican majority is pushing for a far skinner $500 billion effort than the Home Democrats’ $2.2 billion proposal.

Optimism within the wake of stories earlier this week that Pfizer has developed a Covid-19 vaccine with an efficacy charge of near 90 % appears to have light. This is smart: the therapy is prone to be devilishly troublesome to ship at scale in any type of near-term method, if solely as a result of it have to be saved at -70 levels Celsius. The pinpoint precision wanted for the two-injection course of complicates issues additional.

CRUDE OIL MAY FIND SUPPORT IN RISK-ON SENTIMENT AS GOLD STRUGGLES

Wanting forward, a comparatively quiet financial calendar within the last hours of the buying and selling week might maintain sentiment traits on the forefront. Bellwether S&P 500 futures pointing convincingly increased, flagging a risk-on tilt. Which will assist underpin crude oil costs for now. Gold may wrestle for route as yields are pulled upward even because the anti-risk US Greenback falls, providing conflicting cues to the perennially anti-fiat steel.

Advisable by Ilya Spivak

Get Your Free Oil Forecast

CRUDE OIL TECHNICAL ANALYSIS

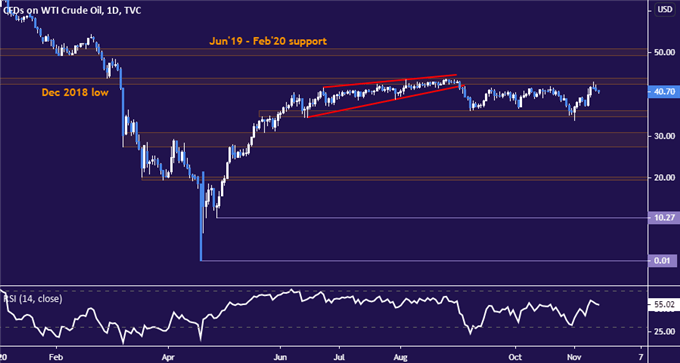

Crude oil costs have stalled at vary resistance within the 42.40-43.88 zone but once more, with a Taking pictures Star candlestick pointing to indecision and warning {that a} pullback could also be forward. Help is within the 34.64-36.15 space, with a every day shut beneath that exposing the 27.40-30.73 area. Alternatively, a push above resistance appears prone to goal the $50/bbl determine subsequent.

Crude oil worth chart created utilizing TradingView

GOLD TECHNICAL ANALYSIS

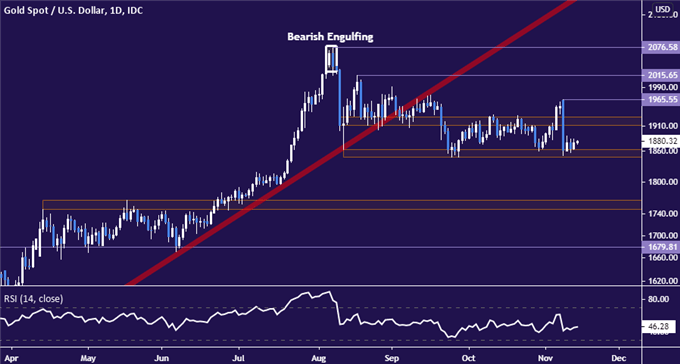

Gold costs are as soon as once more idling at help within the 1848.66-63.27 space. A break beneath that confirmed on a every day closing foundation appears to be like like it might set the stage for a slide beneath the $1800/ozfigure. Resistance begins within the 1911.44-28.82 inflection zone and is following by the swing prime at 1965.55.

Gold worth chart created utilizing TradingView

Advisable by Ilya Spivak

Get Your Free Gold Forecast

COMMODITY TRADING RESOURCES

— Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the feedback part beneath or @IlyaSpivak on Twitter