Chart created with TradingViewCrude Oil Elementary Forecast: BearishCrude oil costs are prone to breaking decrease on the again o

Chart created with TradingView

Crude Oil Elementary Forecast: Bearish

- Crude oil costs are prone to breaking decrease on the again of the IEA’s downbeat outlook on international demand.

- Nevertheless, shrinking American crude stockpiles could restrict the potential draw back for oil costs within the near-term.

Really useful by Daniel Moss

Get Your Free Oil Forecast

The outlook for crude oil costs stays fragile, in accordance with the Worldwide Power Company, on condition that “the trajectory for Covid-19 infections is strongly upwards in lots of international locations and governments are tightening restrictions on the actions of their residents”.

In its Oil Market Report for October, the Paris-based intergovernmental group revised down its demand estimates for the third quarter of 2020 and said that though a draw of four million barrels per day in inventories could possibly be seen within the fourth quarter, this important discount “is occurring from report excessive ranges”.

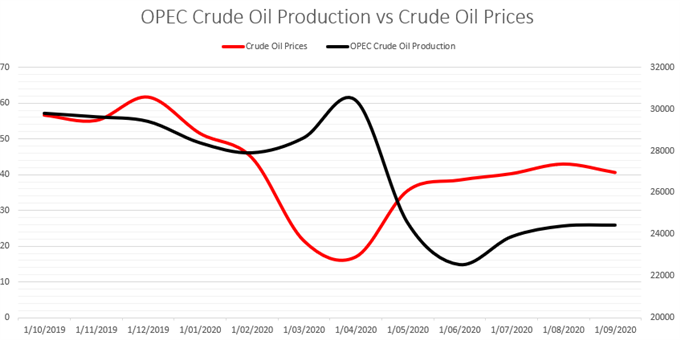

Furthermore, “with the 1.9 mb/d improve within the OPEC+ manufacturing ceiling presently deliberate for January 1, there’s solely restricted headroom for the market to soak up additional provide within the subsequent few months”.

Information Supply – Bloomberg

This will likely concern crude oil consumers in gentle of the resumption of oil manufacturing in Libya, with the nation presently exempt from the cuts OPEC and its allies imposed in April this yr and anticipated to supply as much as 500,000 barrels a day.

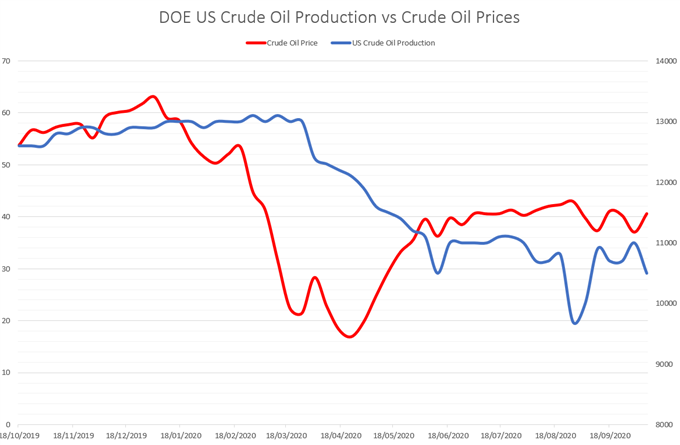

Nevertheless, shrinking American crude stockpiles look like counterbalancing issues of an impending provide glut, after the Power Data Administration (EIA) reported that US inventories had shrank by a larger-than-expected 3.82 million barrels within the week ending October 9th.

That being mentioned, tightening restrictions in a number of European nations could intensify promoting strain within the near-term, because the Worldwide Financial Fund reviews that “extra stringent lockdowns are related to decrease consumption, funding, industrial manufacturing, retail gross sales, buying managers’ indices for the manufacturing and repair sectors, and better unemployment charges”.

Information Supply – Bloomberg

The French authorities has introduced a curfew on residents of 9 of the nation’s largest cities whereas British Prime Minister Boris Johnson introduced that restrictions will tighten in London beginning this coming weekend.

Subsequently, deteriorating international well being outcomes could proceed to hamper the efficiency of crude oil forward of OPEC’s Joint Ministerial Monitoring Committee (JMMC) assembly on October 19.

— Written by Daniel Moss, Analyst for DailyFX

Comply with me on Twitter @DanielGMoss

Really useful by Daniel Moss

Get Your Free Oil Forecast