CRUDE OIL & GOLD TALKING POINTS:Crude oil costs rose alongside shares on Friday amid a broad-based restoration in market-wide

CRUDE OIL & GOLD TALKING POINTS:

Crude oil costs rose alongside shares on Friday amid a broad-based restoration in market-wide threat urge for food. The cheery backdrop proved damaging for gold costs regardless of its damaging affect on the US Greenback – whose losses sometimes assist elevate the metallic – as yields rose, sapping the enchantment of non-interest-bearing belongings.

Asia-Pacific markets picked up on the optimistic lead at first of the brand new buying and selling week and extra of the identical seems to be seemingly forward. Bellwether S&P 500 futures are pointing convincingly larger earlier than the opening bell on Wall Avenue. A sparse information docket presents seemingly few roadblocks to continuation.

On steadiness, that bodes nicely for the cycle-sensitive WTI contract. Observe-through could also be restricted nonetheless merchants look forward with unease on the upcoming OPEC+ assembly. Gold costs are again on offense, capitalizing on its anti-fiat credentials because the Dollar stays pressured whereas yields regular close to Friday’s shut.

Advisable by Ilya Spivak

Get Your Free Oil Forecast

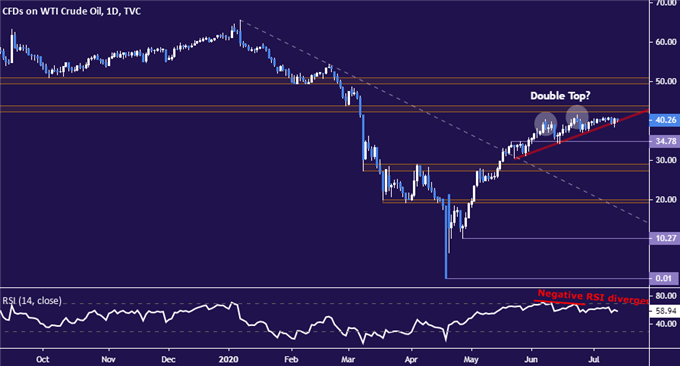

CRUDE OIL TECHNICAL ANALYSIS

Crude oil costs managed to hold on at development line help guiding them larger since late Might. Close to-term resistance is within the 42.40-43.88 space, with a every day shut above that prone to open the door for a problem of the 50/bbl determine. Alternatively, breaching help sees the following notable inflection level at 34.78.

Crude oil worth chart created utilizing TradingView

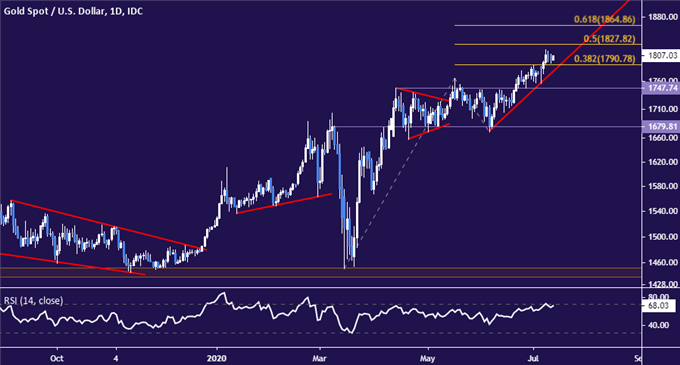

GOLD TECHNICAL ANALYSIS

Gold costs are in consolidation mode after taking out resistance at 1789.78,the 38.2% enlargement. The subsequent upside barrier is marked by the 50%stage at 1827.82, with a break above that eyeing the 61.8% Fib at 1864.86. Neutralizing the near-term upside bias in earnest in all probability requires a every day shut beneath 1747.74.

Gold worth chart created utilizing TradingView

Advisable by Ilya Spivak

Get Your Free Gold Forecast

COMMODITY TRADING RESOURCES

— Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the feedback part beneath or @IlyaSpivak on Twitter