Crude Oil, WTI, Iran, JCPOA, Backwardation, Technical Forecast - Talking PointsCrude and Brent oil prices fell overnight as US-Iran nuclear talks res

Crude Oil, WTI, Iran, JCPOA, Backwardation, Technical Forecast – Talking Points

- Crude and Brent oil prices fell overnight as US-Iran nuclear talks resumed

- A backwardated market structure providing major tailwind for oil bulls

- Prices are riding trendline support but a break lower may drag WTI lower

Crude and Brent oil prices fell overnight, pulling back from the highest levels traded in seven years. The pullback is likely attributable to talks between the United States and Iran over the Joint Comprehensive Plan of Action (JCPOA) headed by President Obama in 2015 but then subsequently abandoned by President Trump back in 2018, which could lead to the return of more than one million barrels per day to the market if successful.

The stakes are high and previous rounds of discussions have fallen short of securing a deal, which leaves oil prices in a precarious situation. American negotiators are optimistic, however, and the drop in prices at the onset of the renewed negotiations perhaps reflects that. In a show of good faith, leading up to the talks, the United States signaled it would grant waivers for Chinese, Russian, and European companies to sidestep sanctions that prevented civilian nuclear business with Iran. In the days and weeks ahead, as negotiations play out, positive headlines indicating progress may very well drag oil prices lower yet.

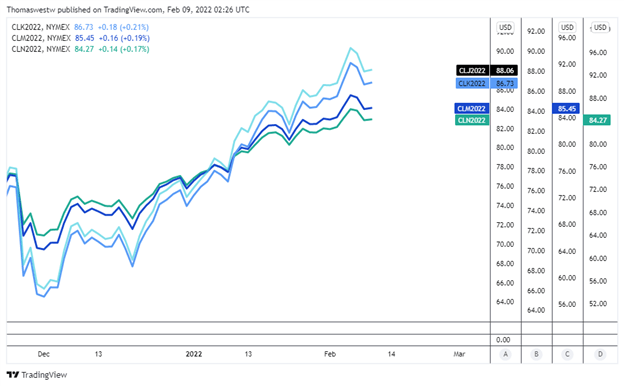

However, even if talks succeed, it would take months for Iranian oil to start flowing into the global energy markets. In the meantime, prices look primed to resume rising when looking at the market structure in WTI, with severe backwardation between futures contracts, which encourages prompt storage releases. That could see inventories drain at an increased rate in the coming weeks and months while pushing prices higher. Traders will turn their focus to tonight’s EIA oil inventory report, expected to cross the wires at +1.2 million barrels, according to a Bloomberg survey. A larger-than-expected build may pull prices lower.

Crude Oil Futures (April, May, June and July Contract Prices)

Chart created with TradingView

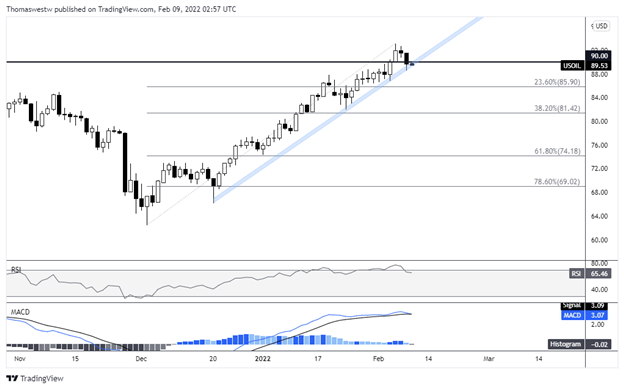

Crude Oil Technical Forecast

Crude oil price are trading back under the psychologicallly imposing 90 level as prices tread lower in early APAC trade, extending the overnight drop. A break below trendline support from the late December swing low may induce additional weakness, with the 23.6% Fibonacci retracement eyed as possible support. Alternatively, prices may quickly return above the 90 handle if trendline support holds.

WTI Crude Oil Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com