Crude Oil, Copper, Vaccination Milestones, Texas Winter Storm, Commodities Briefing - Speaking Factors:Crude oil rallied with sha

Crude Oil, Copper, Vaccination Milestones, Texas Winter Storm, Commodities Briefing – Speaking Factors:

- Crude oil rallied with shares, Texas winter storm created provide woes

- Copper aiming for 2012 peak on excessive demand as US Greenback weakens

- China reportedly mulling uncommon earth export curbs to US protection sector

- WTI, copper uptrends stay, however distance to key trendlines a danger

Advisable by Daniel Dubrovsky

What are the highest buying and selling alternatives this 12 months?

Progress-linked crude oil costs and copper futures aimed larger over the previous 24 hours as market temper remained optimistic. That is as equities have been closed for buying and selling in China and in the US amid the Lunar New Yr and Presidents’ Day holidays respectively. In Europe, the Euro Stoxx 50 and FTSE 100 climbed as equities monitoring futures on Wall Road adopted.

Broadly talking, weak spot within the anti-risk US Greenback actually helped propel each crude oil and copper costs upward. Vaccine rollout milestones within the US and UK probably contributed to ongoing bets of financial restoration from the coronavirus pandemic. You may see this dynamic being priced in longer-dated Treasury yields. The 10-year price soared at market open.

Additional bolstering crude oil costs has been the acute chilly climate within the state of Texas. This has resulted in near-term provide considerations as energy outages put tens of millions at midnight. In the meantime, a pickup in demand for the purple metallic is pressuring tight inventories. China, the most important shopper and producer of copper, noticed stockpiles for the metallic shrink to the bottom for this time of 12 months in over a decade, in accordance with Bloomberg.

In direction of the tip of Tuesday’s APAC session, reviews crossed the wires that China is mulling uncommon earth exports to U.S. protection contractors, in accordance with the Monetary Occasions. Consideration now turns to the US’ response. Market temper did bitter, with volatility probably amplified given decrease ranges of liquidity. Each crude oil and copper pulled again barely.

Nonetheless, futures monitoring Wall Road stay within the inexperienced earlier than European hours. A ‘risk-on’ tone could proceed benefiting WTI and copper costs because the US Greenback is pressured. Eurozone GDP information and German sentiment are on faucet. Fed converse from members Esther George and Robert Kaplan are additionally due. They’re anticipated to speak in regards to the economic system and outlook. Take a look at the DailyFX Financial Calendar for extra key occasions.

Advisable by Daniel Dubrovsky

What does it take to commerce round information?

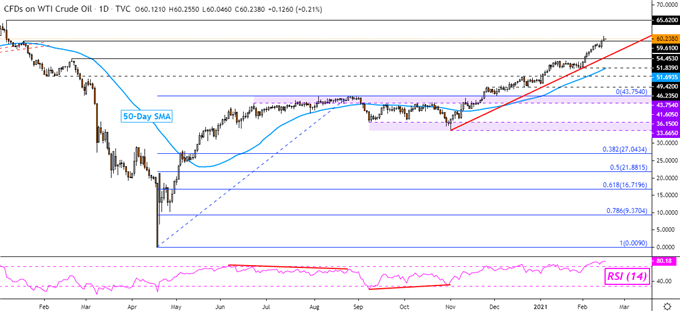

Crude Oil Technical Evaluation

WTI crude oil costs have confirmed a break above the January 2020 excessive, exposing the height from final 12 months at 65.62. Momentum appears to be favoring the present development as RSI follows costs to the upside. Nonetheless, sustaining the main focus to the upside has been rising assist from November – see chart beneath. This does go away WTI with some room to fall within the short-run earlier than dealing with the trendline.

WTI Crude Oil Each day Chart

Chart Created Utilizing TradingView

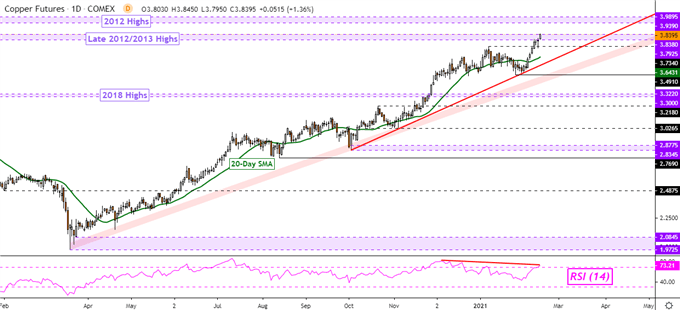

Copper Technical Evaluation

Copper futures prolonged beneficial properties, climbing in the direction of peaks seen in 2012. Nonetheless, getting there entails pushing via late-2012/2013 highs. This makes for a key zone of resistance between 3.7925 and three.8380. In the meantime, damaging RSI divergence does warn that upside momentum is fading. This may at instances precede a flip decrease. Very similar to WTI, there may be some room to fall earlier than the purple metallic faces key rising assist – see chart beneath.

Copper Futures Each day Chart

Chart Created Utilizing TradingView

–— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter