CRUDE OIL OUTLOOK:Crude oil prices seesaw as OPEC+ opts to stay the course on output riseAll eyes on US jobs report ahead as markets consider “sta

CRUDE OIL OUTLOOK:

- Crude oil prices seesaw as OPEC+ opts to stay the course on output rise

- All eyes on US jobs report ahead as markets consider “stagflation” risk

- Tepid rebound looks to $70/bbl figure as the first layer of key resistance

Crude oil prices are attempting a tepid recovery from four-month lows after the OPEC+ group of major producers agreed to proceed with restoring output levels having ended a regime of coordinated production caps. The move aims to add a further 400k barrels/day in January (although members have struggled to meet quota).

A selloff initially followed, suggesting traders were somewhat surprised by the cartel-led consortium, having perhaps expected a pause given prices’ breakneck plunge recently. Momentum quickly fizzled however, with oil recovering all of the ground lost intraday.

That may owe to a change in rhetoric accompanying the decision to stay the course. Officials signaling that an about-face pivot is possible in the near term if their concerns about the impact of the newly-identified Omicron variant of Covid-19 on demand materialize.

US JOBS DATA EYED AS MARKETS WEIGH ‘STAGFLATION’ RISK

From here, the spotlight turns to November’s US jobs report. An increase of 550k in nonfarm payrolls is expected, which would mark relatively steady growth after October’s 531k rise. The unemployment rate is seen ticking lower from 4.6 to 4.5 percent.

US economic news-flow has tended to outperform relative to baseline forecasts recently, hinting that analysts’ growth models are overly pessimistic. Leading PMI survey data warns that the pace of job creation has slowed substantially however as labor shortages derail filling a sea of vacancies.

A soggy payrolls rise coupled with another pickup in wage inflation reflecting these dynamics may warn of mounting “stagflationary” forces on the horizon. Omicron’s spread threatens to compound such risks if it results in another broad wave of restrictions fracturing supply chains and stifling economic activity.

Worries about the policy uncertainty inherent to such a scenario – where rising prices demand tightening but weak growth begs for accommodation – may broadly sour risk appetite. This could pull crude oil lower alongside other sentiment-sensitive assets.

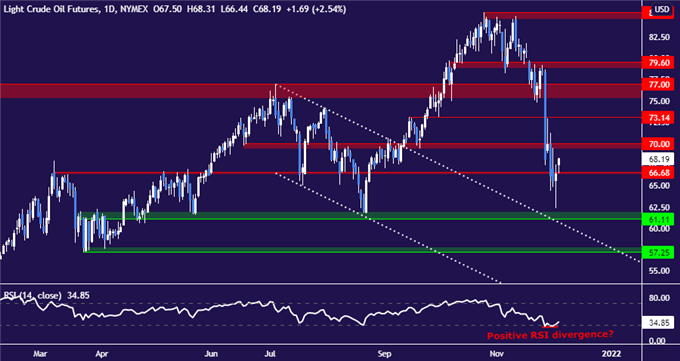

CRUDE OIL TECHNICAL ANALYSIS

The WTI contract is cautiously probing above inflection point resistance at 66.68. A break higher confirmed on a daily closing basis sees subsequent upside barriers at the $70/bbl figure and 73.14. Immediate support is anchored at 61.11, with a break below that setting the stage for a test below the $60/bbl handle to challenge the swing low at 57.25.

Crude oil price chart created using TradingView

CRUDE OIL TRADING RESOURCES

— Written by Ilya Spivak, Head Strategist, APAC for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com