Crude Oil Value Forecast Speaking Factors:Oil costs loved an aggressively bullish run within the wake of the US Presidential Elec

Crude Oil Value Forecast Speaking Factors:

- Oil costs loved an aggressively bullish run within the wake of the US Presidential Election.

- CL futures jumped by greater than 100% from the November low to the March excessive.

- After setting a contemporary two-year-high on March 8th, costs have began pulling again. Extra lately, that pullback has taken on extra aggression, highlighting the potential for reversal potential from a robust topside transfer.

- The evaluation contained in article depends on value motion and chart formations. To study extra about value motion or chart patterns, try our DailyFX Schooling part.

Plenty of danger belongings put in sturdy main strikes beginning across the US Presidential Election final November. Whereas a lot of the eye has been on crypto or Gamestop or NFTs for this latest phenomenon, oil costs have put in a fairly sturdy pattern of their very own. Crude oil futures set a low on the day of the election round $33.64. Earlier this month and only a bit greater than 4 months after that low, Crude Oil futures hit a contemporary two-year-high at 67.98, a full 102% away from that low set final 12 months.

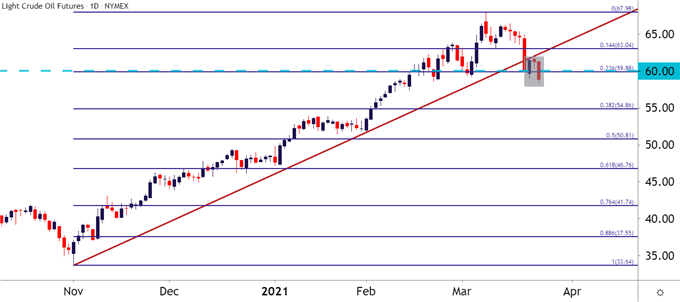

That transfer put in an preliminary pullback of 14.4%, at which level a little bit of help confirmed up. However patrons had been unable to re-test the highs and since then help has continued to slip decrease. Final Thursday was notably notable, within the wake of the FOMC fee resolution, when Crude Oil costs pushed under a bullish trendline that had been in-place since that November low.

Now, after the Friday bounce led right into a spinning high yesterday, with one other bearish push this morning – there’s the potential for a night star sample on the Every day chart. Night star formations will typically be approached with the goal of bearish reversals, and given the place that spinning high confirmed up yesterday, the door would seem like opening for a deeper push in Crude Oil costs.

To study extra concerning the Night Star Formation and why it’s approached for bearish reversal potential, try DailyFX Schooling

Crude Oil Every day Value Chart (CL1)

Chart ready by James Stanley; CL1 on Tradingview

Crude Oil Testing Beneath Key Assist

Maybe extra vital than the potential formation checked out above is the realm on the chart the place all of that is going down.

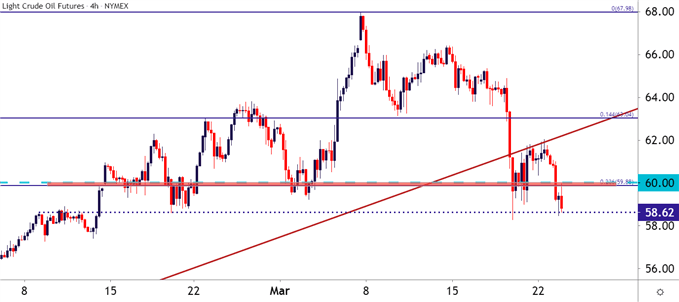

Crude oil costs are testing under a key spot of confluent help operating from $59.88-60.00. The previous of these costs is the 23.6% Fibonacci retracement of the November-March main transfer, whereas the latter of these costs is a serious psychological degree.

Advisable by James Stanley

Understanding the Core Fundamentals of Oil Buying and selling

On a shorter-term foundation, we will see the place this confluent zone has lately begin to present as short-term resistance; and near-term help is coming in round a bunch of swing-highs from early-February. This chart presents short-term breakdown potential because the longer-term bullish pattern additional pulls again.

To study extra about Fibonacci or psychological ranges, be part of us in DailyFX Schooling

Crude Oil 4-Hour Value Chart (CL1)

Chart ready by James Stanley; CL1 on Tradingview

Crude Oil Costs Longer-Time period

Taking a step again as a way to put the short-term setup into context, and there could possibly be much more motive for a deeper pullback or a potential reversal.

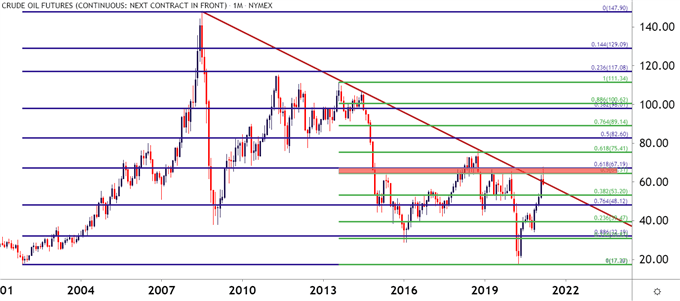

Please be aware, the under chart and associated evaluation is predicated off of the CL2 value feed, as a way to work across the sub-zero transfer that confirmed up final April. The fast value leap seen from the November low bumped into the 61.8% Fibonacci retracement of the 2001-2008 main transfer at $67.19. Close by is the 50% marker of the shorter-term main transfer spanning from the 2013 excessive all the way down to the 2020 low. That plots at 64.31 and together with the above degree, creates a confluent Fibonacci zone of resistance that had some pull on the matter again in 2019.

Given the opportunity of pullback within the longer-term pattern and the potential for reversal of the shorter-term pattern, the door would seem open to deeper breakdown potential in crude oil costs.

Crude Oil Month-to-month Value Chart (CL2)

Chart ready by James Stanley; CL2 on Tradingview

— Written by James Stanley, Strategist for DailyFX.com

Contact and comply with James on Twitter: @JStanleyFX

factor contained in the

factor. That is in all probability not what you meant to do!nn Load your utility’s JavaScript bundle contained in the factor as a substitute.www.dailyfx.com