The crypto market, which includes well-known digital assets like Bitcoin and Ethereum, is severely down as about $1 billion got liquidated in the past

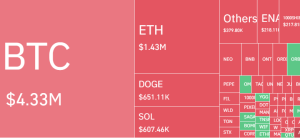

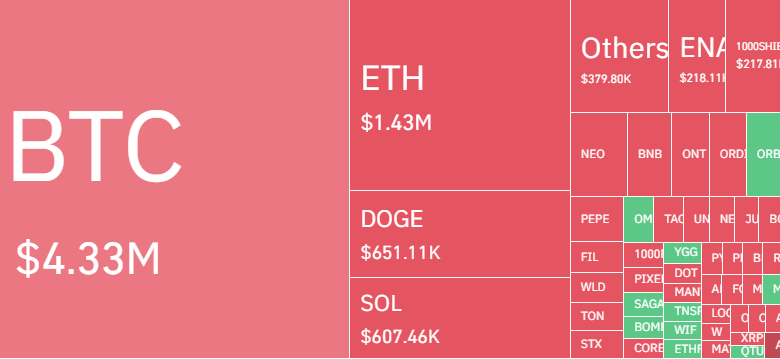

The crypto market, which includes well-known digital assets like Bitcoin and Ethereum, is severely down as about $1 billion got liquidated in the past 24 hours 298,239 traders were liquidated, for a total liquidation value of $935.43 million.

The OKX ETH-USD-SWAP liquidation order, valued at $7.19 million, was the highest single liquidation order. Most of those holdings were long bets taken aback by the abrupt drop and were wagered on rising prices. Crypto derivative contracts known as “longs” enable investors to wager on the increase in the value of an asset. A trader has lost the wager and the position gets closed involuntarily if a long is liquidated.

As risk aversion in traditional markets due to escalating geopolitical uncertainties extended to digital assets on Friday, the appetite for cryptocurrency assets moderately declined.

Bitcoin’s Price action

Bitcoin (BTC) fell sharply throughout the afternoon during U.S. trading, breaking below $66,000 after having just hours before tested the $71,000 mark. As of the time of writing, bitcoin had fallen more than 5% in the previous day but had since recovered to $66,700.

Most recent price action before the publication shows that the price of a Bitcoin is a little less than $67,000. That is a decrease of more than 2.5% in a single day and a reasonable decline from its all-time high price of $73,737 in March.

The price of Bitcoin (BTC) has been rangebound for a few weeks now, staying within that range. This could result in significant liquidation on both sides before the establishment of a direction. Although there is still hope for Bitcoin in the long run, market fluctuations may cause it to decline before the next halving.

Ethereum’s price, meanwhile, has dropped more than 5% in a day; it is currently trading at $3,215.

The fifth-largest cryptocurrency, Solana, has plummeted by about 12%, while Dogwifhat, which has been trending higher this week, has lost at least 5% of its value.

As traders flocked to safe-haven assets, gold—long seen as a haven asset—soared above $2,400 to a new all-time high before reducing its gains, while oil saw a 1% increase. Meanwhile, Treasury bonds and the U.S. dollar index (DXY) gained.

This abrupt change in the market is in stark contrast to the recent upswing, which was partially driven by interest in the upcoming Bitcoin halving event—a significant modification to the cryptocurrency’s code intended to reduce its supply.

Even with the current cryptocurrency liquidations, Bitcoin is still much higher for the year—it has increased by almost 60%.

www.fxleaders.com

COMMENTS