DAX 30 & CAC 40 Worth Outlooks:DAX 30 & CAC 40 Forecasts for the Week ForwardWorth motion has been aggressive to start ou

DAX 30 & CAC 40 Worth Outlooks:

DAX 30 & CAC 40 Forecasts for the Week Forward

Worth motion has been aggressive to start out the week in a wide range of markets, starting from gold and silver to EUR/USD. Whereas volatility and break outs have been plentiful, worth motion throughout the European indices, significantly the DAX 30 and CAC 40, has been wholly unimpressive. That mentioned, the disappointing efficiency from the markets in query has helped delineate clear technical boundaries that will affect worth as soon as volatility picks up.

DAX 30 Technical Outlook

Within the case of the DAX 30, worth has proven a reluctance to interrupt above the June excessive close to 12,930. In consequence, we will wager this stage is an space of attainable resistance and the closest to the present buying and selling worth. Subsequent resistance could also be discovered alongside the ascending trendline from March, which presently resides barely above the projected barrier at 12,930. That mentioned, each ranges must be surpassed earlier than the DAX 30 can take goal on the July peak at 13,310. A profitable transfer above this stage can be an encouraging improvement for a continuation increased.

DAX 30 Worth Chart: 4 – Hour Time Body (February 2020 – July 2020)

Conversely, close by assist is quite sparse. Other than the assorted July swing highs that will present affect on an intraday foundation, the index appears to lack notable assist till the Fibonacci stage at 12,448.Due to this fact, the topside seems the extra perilous of the 2 paths however stays a chance in opposition to the broader backdrop that has seen worth climb from the March lows.

| Change in | Longs | Shorts | OI |

| Day by day | -5% | 6% | 1% |

| Weekly | 40% | -14% | 4% |

Both method, a break above outlined resistance can be required earlier than a bigger bullish break may be established. Fortunately for the in pursuit of volatility, the week forward possesses main occasion danger within the type of a FOMC assembly and company earnings from the Nasdaq’s most influential members. Collectively, the bulletins may critically shake up the Nasdaq – the present pacesetter throughout fairness markets – and due to this fact the DAX. Within the meantime, observe @PeterHanksFX on Twitter for updates and evaluation.

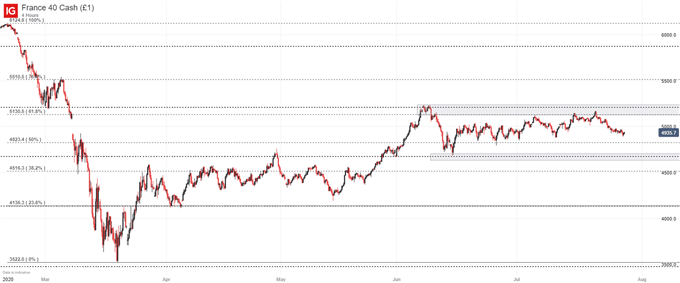

CAC 40 Technical Outlook

The CAC 40 can even await data from the upcoming occasions because it trades sideways inside a clearly outlined vary. Given the gap from the present worth to the outlined technical limitations, persistent volatility could also be required for a critical escape in both route. With that in thoughts, the attainable resistance from 5,130 to five,240 and potential assist round 4,823 and 4,670, has made the French fairness index ripe for vary buying and selling alternatives.

The three Step Vary Buying and selling Technique

CAC 40 Worth Chart: 4 – Hour Time Body (February 2020 – July 2020)

Advisable by Peter Hanks

Get Your Free Equities Forecast

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and observe Peter on Twitter @PeterHanksFX