Key Speaking Factors:DAX 30 clears resistance and heads for all-time excessiveFTSE 100 struggles to interrupt free from 61.8% Fib

Key Speaking Factors:

- DAX 30 clears resistance and heads for all-time excessive

- FTSE 100 struggles to interrupt free from 61.8% Fibonacci

DAX 30 TECHNICAL OUTLOOK

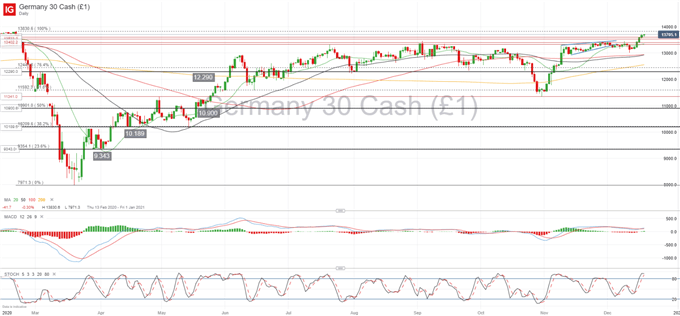

The DAX has managed to interrupt varied horizontal resistance strains in its 3.8% rise since Tuesday, leaving the German inventory index simply shy of its all-time excessive seen final March at 13,830. The problem I’m having with getting totally behind the DAX is that this notion of borrowed future returns, and what this can imply for the index within the new yr. Momentum indicators are signaling robust overbought situations, and fairly frankly, the DAX has been tagging together with US inventory indices ignoring home turbulence relating to the Covid-19 pandemic.

This has arrange a situation the place a doable fiscal stimulus bundle within the US would proceed this Santa rally till the top of the yr, most definitely taking the DAX above its all-time excessive, however vital dangers stay and shouldn’t be ignored, which is why I discover it arduous to think about that we’ll see a break above the 14,000 stage within the short-run.

Failure to interrupt above 13,830 might see the DAX heading decrease firstly of the brand new yr, however for now the 13,000 stage stays as a powerful space of help. It should take greater than only a failure of stimulus talks to show sentiment bearish given how risk-on they at present are, however a break under 12,915, the place the 50-day and 100-day shifting averages converge, is more likely to see improve promoting stress again in the direction of the 12,290 stage.

Inventory Market Vacation Calendar 2020/21

Beneficial by Daniela Sabin Hathorn

Get Your Free Equities Forecast

DAX 30 Every day chart

| Change in | Longs | Shorts | OI |

| Every day | -6% | 0% | -2% |

| Weekly | -40% | 39% | 4% |

FTSE 100 TECHNICAL OUTLOOK

The FTSE 100 has struggled to interrupt free from the 61.8% Fibonacci retracement stage after pushing above 6,490 in the beginning of the month. The current power within the Pound is probably going one of many driving forces behind this underlying weak point within the FTSE, as is the worsening well being scenario within the nation. Technically, the inventory index remains to be displaying weak point in its push increased however the path of least resistance appears to stay tilted to the upside, so additional extension of the rebound for the reason that starting of November could also be anticipated.

Momentum indicators extra on the bullish aspect, because the Stochastic nears the 70 stage, the place overbought stress is beginning to construct. The 20-day shifting common is more likely to provide short-term help at 6,490, adopted by the horizontal help line at 6,255. A retracement again to this stage dangers exposing the FTSE to the coronavirus hole, and the 61.8% Fibonacci would possible be a powerful resistance once more.

Pushing increased, the primary impediment shall be overcoming the ceiling the index has been trapped beneath in current days, positioned across the 6,635 space. Additional promoting stress might come up across the 6,660 stage adopted by the 76.4% Fibonacci at 6,895.

FTSE 100Every day chart

| Change in | Longs | Shorts | OI |

| Every day | -10% | 16% | 1% |

| Weekly | 14% | 4% | 9% |

Study extra concerning the inventory market fundamentals right here or obtain our free buying and selling guides.

— Written by Daniela Sabin Hathorn, Market Analyst

Comply with Daniela on Twitter @HathornSabin