DAX 30, German 10-12 months Bunds, Angela Merkel, European Central Financial institution – Speaking Factors:Higher-than-expected

DAX 30, German 10-12 months Bunds, Angela Merkel, European Central Financial institution – Speaking Factors:

- Higher-than-expected Chinese language information buoyed risk-associated belongings all through Asia-Pacific commerce.

- Wait-and-see ECB might weigh on Germany’s benchmark DAX 30 index amid a ‘second wave’ of Covid-19 infections.

- German 10-year Bunds eyeing a push to contemporary month-to-month highs. Is a resurgence of danger aversion within the offing?

Asia-Pacific Recap

S&P 500 futures climbed larger throughout the Asia-Pacific session alongside the trade-sensitive Australian Greenback, as Chinese language retail gross sales and industrial manufacturing figures confirmed the native economic system’s restoration had accelerated in August.

The haven-associated Japanese Yen and US Greenback misplaced floor in opposition to their main counterparts whereas gold surged again above the $1960/ouncesmark.

Silver jumped as a lot as 1.4% as yields on US 10-year Treasuries nudged marginally decrease.

Trying forward, Euro-zone and German financial sentiment for September headlines the financial docket, as focus turns in direction of tomorrow’s Federal Reserve rate of interest resolution.

Market response chart created utilizing TradingView

Begins in:

Reside now:

Sep 16

( 16:09 GMT )

Be a part of Day 2 of the DailyFX Summit discussing indices

DailyFX Training Summit: Commerce Your Market – Day 2, Indices

Wait-and-See ECB Dragging on DAX 30 Index

As famous in earlier experiences, Germany’s benchmark DAX 30 index is prone to reversing decrease after the European Central Financial institution opted to preserve the established order at its September assembly, as a ‘second wave’ of Covid-19 infections threaten to upend the nation’s nascent financial restoration.

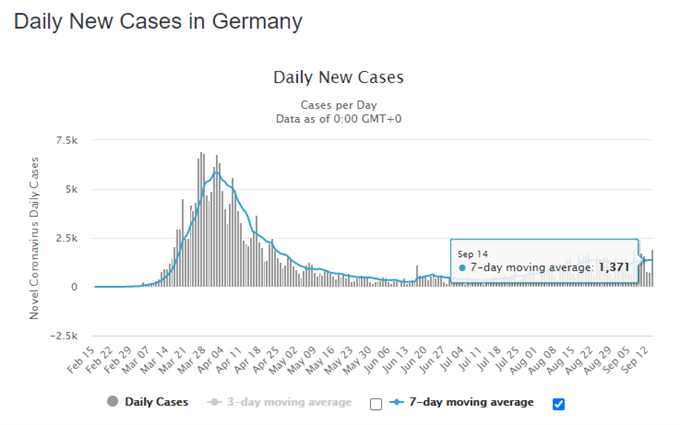

After all, the latest climb in coronavirus case numbers is a far cry from these seen throughout March-April and are but to drive the native authorities to reimpose economically devastating restrictions.

Nonetheless, German Chancellor Angela Merkel moved to introduce a minimal advantageous for failing to stick to masks protocols and prolonged a ban on all main public occasions till subsequent yr, stating that “we must stay with this virus for a very long time to return”.

Supply – Worldometer

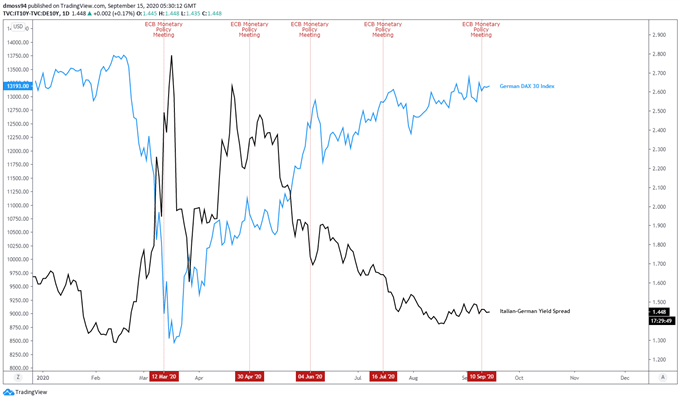

Clearly its not simply Merkel who is anxious by latest well being developments because the yield unfold between Italian authorities bonds and German Bunds has noticeably widened since setting the post-crisis low in mid-August.

In truth, the widening of the risk-gauging yield unfold appears to have coincided with not solely the benchmark DAX 30 index’s struggles to interrupt to contemporary post-crisis highs, but additionally the marked enhance in Covid-19 infections.

With that in thoughts, native Covid-19 developments could dictate the near-term outlook for regional danger belongings within the absence of extra financial stimulus from an ECB that believes that “so long as the baseline situation stays intact, there is no such thing as a purpose to regulate the financial coverage stance”.

Italian-German yield unfold every day chart created utilizing TradingView

German 10-12 months Bunds Each day Chart – March Downtrend Beneath Strain

Europe’s ‘protected haven’ asset, German 10-year Bunds, seem like gearing up for a push to contemporary month-to-month highs after discovering assist on the psychologically pivotal 104 stage and clambering again over the 21- (104.65) and 50-day (104.81) shifting averages.

Though the March downtrend continues to cap upside potential, the trail of least resistance appears skewed to the upside because the RSI and MACD indicators nudge above their respective impartial midpoints and into bullish territory.

Having stated that, with value but to beat confluent resistance on the month-to-month excessive (105.18) and March downtrend, a short-term pullback may very well be within the offing.

A every day shut beneath the trend-defining 50-DMA (104.81) would most likely generate a push again to confluent assist on the 38.2% Fibonacci (104.28) and 200-DMA, with a break decrease doubtlessly bringing the 61.8% Fibonacci (103.23) into play.

Conversely, a every day shut above the month-to-month excessive (105.18) might carve a path for value to check the April excessive (106.00) and would most likely coincide with a interval of sustained danger aversion and doubtlessly set off a marked discounting of Germany’s benchmark DAX 30 index.

German Bunds every day chart created utilizing TradingView

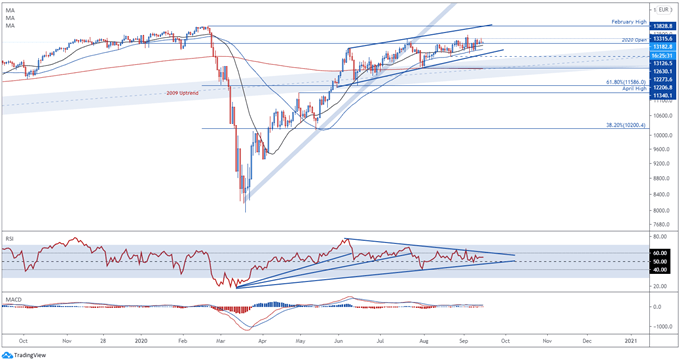

DAX 30 Index Each day Chart – February Excessive Simply Out of Attain

Though value stays constructively perched above the yearly open and continues to trace throughout the confines of an Ascending Channel, Germany’s DAX 30 index could reverse decrease within the coming days if key psychological assist on the 13000 stage fails to suppress promoting stress.

The DAX 30’s push in direction of the February excessive seems to be operating out of steam because the RSI hovers simply above its impartial midpoint and the MACD indicator continues to flatline.

With that in thoughts, a every day shut beneath the 21-day shifting common would most likely ignite a short-term pullback to confluent assist on the September low (12746) and Ascending Channel assist, with a break decrease carving a path for value to check the sentiment-defining 200-DMA.

Then again, a every day shut above the month-to-month excessive (13464.2) could sign the resumption of the main uptrend and will see value surge again in direction of key resistance on the document excessive set in February (13828.8).

DAX 30 Index every day chart created utilizing TradingView

| Change in | Longs | Shorts | OI |

| Each day | 52% | -5% | 13% |

| Weekly | 52% | -18% | 1% |

— Written by Daniel Moss, Analyst for DailyFX

Comply with me on Twitter @DanielGMoss

Really helpful by Daniel Moss

Constructing Confidence in Buying and selling