Konstantin Kaiser•Thursday, April 24, 2025•3 min read Add an article to your Reading ListRegister now to be able to add articles to y

Quick overview

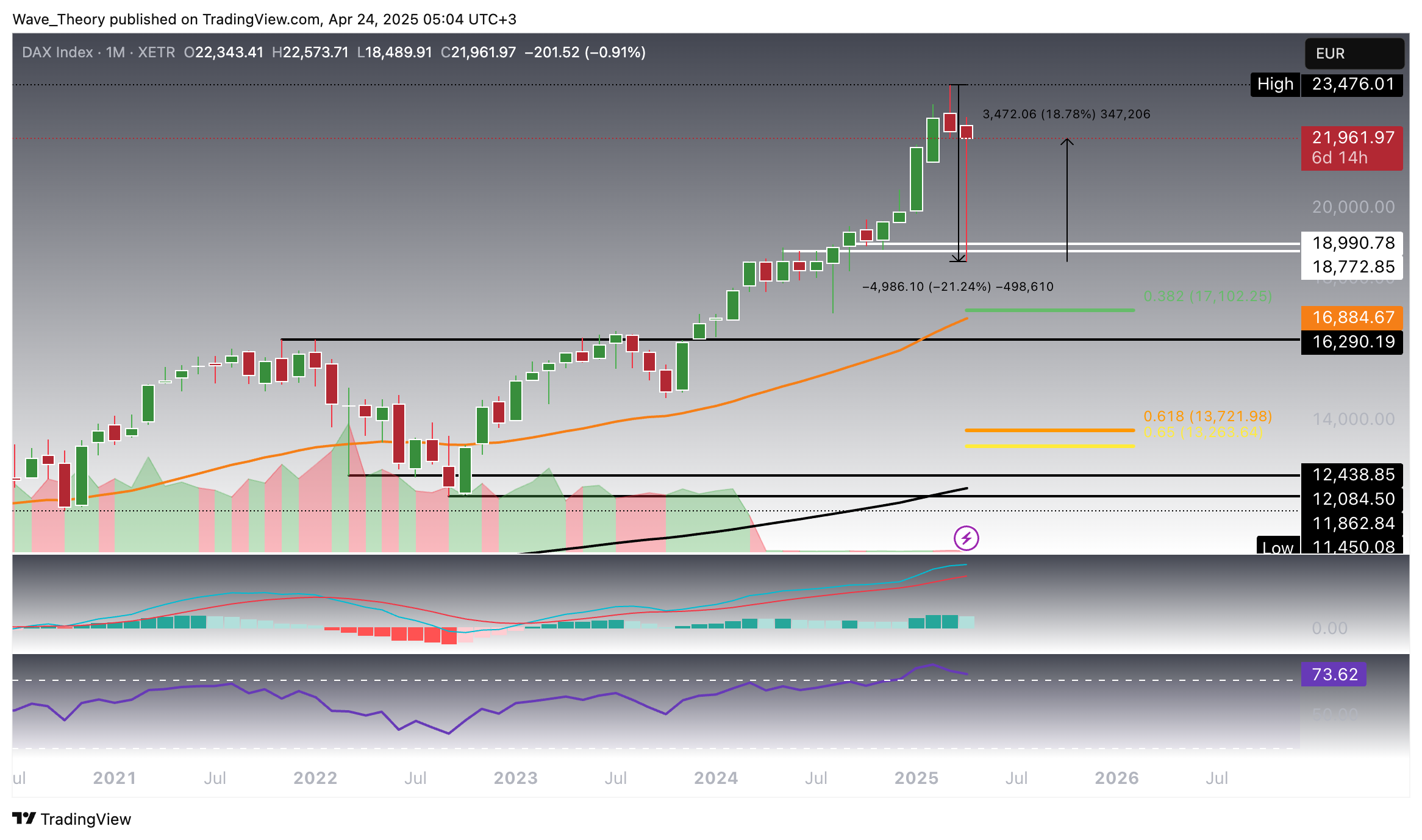

- The DAX index has rebounded strongly from a correction low of 18,490, breaking key resistance levels.

- Currently, it is testing the Golden Ratio resistance at 21,727, which could signal the end of the correction phase.

- Momentum indicators remain bullish, with MACD and EMAs aligned upward, while support is found at the confluence of the Golden Ratio and the 50-day EMA near 21,712.

- A confirmed breakout could lead to a retest of the all-time high at 23,476, with potential for further gains.

The German DAX index recently tested a key support zone after a sharp decline of over 21.2%. From that level, the index has staged a strong rebound, recovering approximately 19% of the prior drawdown — signaling a potential shift in momentum.

DAX Posts Three Consecutive Bullish Weeks — Golden Ratio Break Could Mark End of Correction

The DAX index has delivered a decisively bullish performance over the past three weeks, surging through key resistance levels and signaling a potential shift in trend. After breaking above the 50-week EMA at 20,092, DAX is now testing the Golden Ratio resistance at 21,727 — and appears poised to close the week above it.

A weekly close above the 0.618 Fibonacci level would strongly suggest that the correction phase is complete, setting the stage for a possible retest of the all-time high at 23,476, or even a potential breakout beyond it.

Momentum indicators support this bullish outlook in the medium term: the MACD histogram has begun to tick higher this week, while the EMAs remain in a bullish crossover, reinforcing a positive trend bias.

However, risks remain. The MACD lines are still bearishly crossed, highlighting lingering hesitation beneath the surface, and the RSI continues to move in neutral territory, offering no clear directional signal at present.

DAX Daily Chart Turns Bullish as Key Resistance Breaks

The DAX daily chart is exhibiting strong bullish momentum, with price action pushing decisively through the Golden Ratio resistance, suggesting a continuation of the upward trajectory. This breakout is supported by a confluence of bullish indicators: the MACD lines have crossed bullishly, the MACD histogram is trending higher, and the EMAs remain in a bullish alignment, confirming short- to mid-term upside bias.

While the RSI remains in neutral territory and does not yet provide a directional signal, the overall structure favors further gains. Should a pullback occur, strong support now lies at the confluence of the Golden Ratio and the 50-day EMA, near 21,712 — a level likely to attract renewed buying interest.

Death Cross Forms on DAX 4H Chart — But Bulls May Soon Regain Control

On the 4-hour chart, the DAX has formed a death cross, with the short-term EMA crossing below the long-term EMA, signaling a bearish short-term trend confirmation. However, the ongoing upward price action is rapidly closing the gap between the moving averages, and a golden crossover could soon invalidate the bearish signal if momentum persists.

Supporting this potential shift, the MACD lines remain bullishly crossed, and the MACD histogram continues to tick higher, reflecting increasing bullish momentum. Meanwhile, the RSI holds steady in neutral territory, showing no immediate signs of exhaustion or divergence.

If bulls maintain control, a golden cross on this timeframe could add further conviction to the broader bullish outlook.

Related Articles

www.fxleaders.com