Financial institution of Canada Assembly Overview:The December Financial institution of Canada charge resolution will conclude o

Financial institution of Canada Assembly Overview:

- The December Financial institution of Canada charge resolution will conclude on Wednesday, December 9 at 15:00 GMT. No change in the primary rate of interest is anticipated.

- USD/CAD charges have not too long ago fallen to recent month-to-month lows after a disappointing November US jobs report and a greater than anticipated November Canadian jobs report.

- Retail dealer positioning suggests a bullish bias to USD/CAD charges.

12/09 WEDNESDAY | 15:00 GMT | CAD Financial institution of Canada Fee Choice (DEC)

The December Financial institution of Canada charge resolution will conclude on Wednesday, December 9 at 15:00 GMT. The BOC has been sustaining its emergency low rate of interest regime for the reason that begin of the coronavirus pandemic, and amid constructing financial momentum, it seems unlikely that policymakers shall be appearing once more anytime quickly.

Recall the commentary by BOC Governor Tiff Macklem in current weeks, that “if you’re a family contemplating making a significant buy, in case you’re a enterprise contemplating investing, you might be assured that rates of interest shall be low for a very long time.” To this finish, the BOC doesn’t seem to vary its tone to face in the way in which of additional Canadian Greenback power.

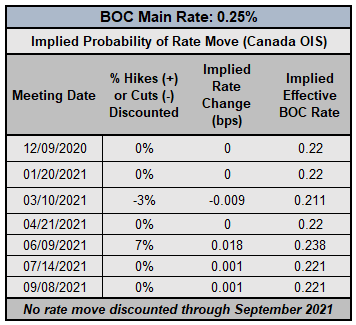

Financial institution of Canada Curiosity Fee Expectations (DECEMBER 7, 2020) (Desk 1)

Accordingly, rate of interest expectations have evaporated because of the clear ahead steering supplied by BOC Governor Macklem. 4 months in the past, in mid-August, there was a 17% probability of a 25-bps charge lower by December 2020. Now, there’s a 0% probability for December 2020, an expectation that carries by way of September 2021.

Pair to Watch: USD/CAD

Advisable by Christopher Vecchio, CFA

Buying and selling Foreign exchange Information: The Technique

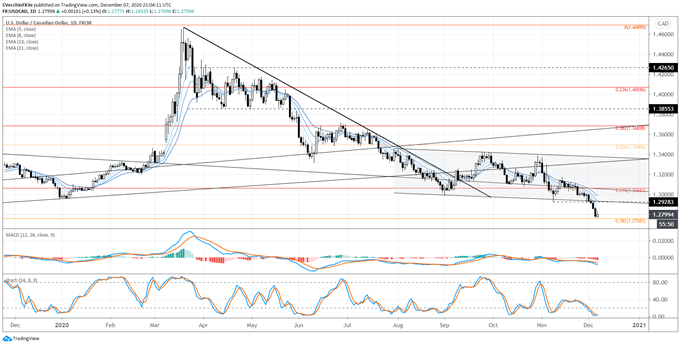

USD/CAD RATE TECHNICAL ANALYSIS: DAILY CHART (DECEMBER 2019 TO DECEMBER 2020) (CHART 1)

In our final replace it was famous that, “Now that the recent yearly lows have emerged, USD/CAD charges could also be biased to proceed decrease in direction of a longer-term Fibonacci retracement: the 38.2% retracement from the 2012 low to 2016 excessive at 1.2758.”Because the prior replace, USD/CAD charges fell as little as 1.2770 earlier than rallying firstly of this week.

USD/CAD charges proceed to commerce under their each day 5, 8-, 13-, and 21-EMA envelope, which is in bearish sequential order. Each day MACD is trending under its sign line (and gaining tempo), whereas Gradual Stochastics are holding firmly in oversold territory. The trail of least resistance is decrease for USD/CAD charges, at the least till the each day EMA envelope is damaged (USD/CAD charges shut above the each day 21-EMA). A near-term bounce increased gained’t negate the numerous technical injury executed in current weeks.

Advisable by Christopher Vecchio, CFA

Foreign exchange for Inexperienced persons

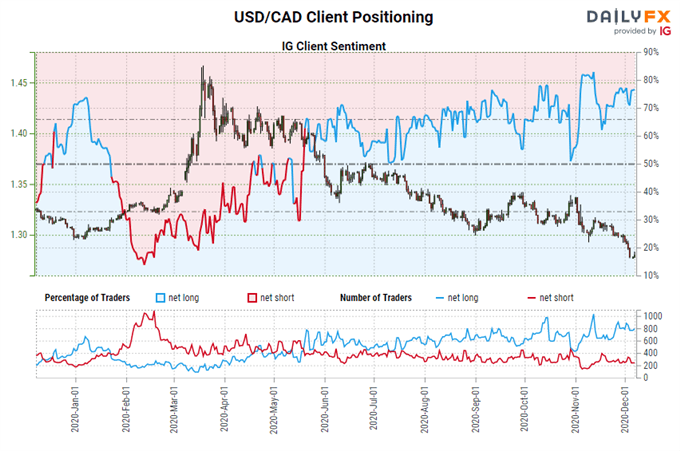

IG CLIENT SENTIMENT INDEX: USD/CADRATE FORECAST (DECEMBER 7, 2020) (CHART 2)

USD/CAD: Retail dealer information exhibits 73.92% of merchants are net-long with the ratio of merchants lengthy to brief at 2.83 to 1. The variety of merchants net-long is 13.28% increased than yesterday and three.20% increased from final week, whereas the variety of merchants net-short is 28.99% increased than yesterday and three.37% increased from final week.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests USD/CAD costs might proceed to fall.

But merchants are much less net-long than yesterday and in contrast with final week. Current modifications in sentiment warn that the present USD/CAD value development might quickly reverse increased regardless of the actual fact merchants stay net-long.

Learn extra: FX Week Forward: November Mexican Inflation & USD/MXN Fee Forecast

— Written by Christopher Vecchio, CFA, Senior Forex Strategist