Written by George Mathew , Sandeep Singh , Edited by Defined Desk | Mumbai, New Delh

, Sandeep Singh

, Edited by Defined Desk | Mumbai, New Delhi |

Up to date: August 8, 2020 7:47:48 pm

In ten months, India has added 25 per cent of the reserves it had until September 20, 2019. (Getty Photos/File)

In ten months, India has added 25 per cent of the reserves it had until September 20, 2019. (Getty Photos/File)

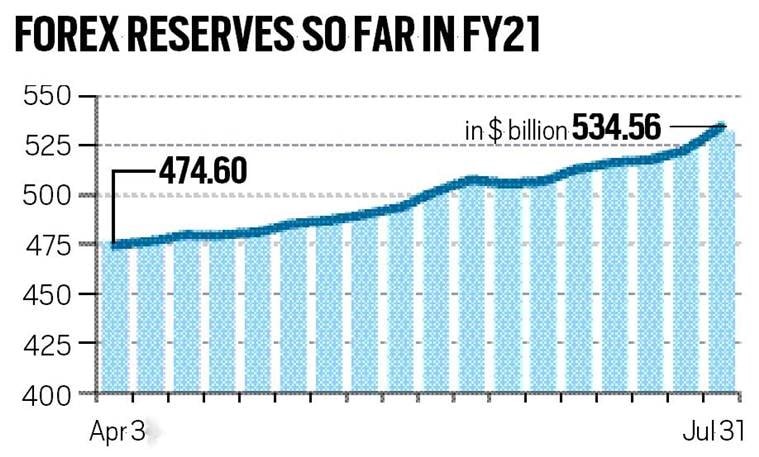

Covid-hit India’s overseas change reserves jumped by a file $11.9 billion within the week ending July 31 to hit a contemporary excessive of $534.5 billion, making it the fifth largest holder of reserves on the earth. Through the 10-month interval between September 27, 2019 and July 31, 2020, the overseas change reserves have swelled by $100 billion.

At a time when the economic system is underneath stress and the expansion is predicted to contract in 2020-21, the rising foreign exchange reserves have come as a breather as it could actually cowl India’s import invoice of a couple of yr.

India’s overseas change reserves: How has the rise been?

The development of rising overseas change reserves began after Finance Minister Nirmala Sitharaman introduced a pointy lower in company tax charges on September 20, 2019. Whereas investor sentiments turned weak after the funds announcement in July to impose larger surcharge, the federal government’s determination to reverse its funds determination regarding larger surcharge impression on FPIs together with a lower within the company tax fee in September performed a big function in turning the traders temper and draw them to put money into the Indian economic system and markets.

Between September 20, 2019 and July 31, 2020, the reserves have grown by $106 billion and, for the reason that starting of April, it has grown by $60 billion. So, in ten months India has added 25 per cent of the reserves it had until September 20, 2019. India is now fifth in international rating behind China ($ 3,298 billion), Japan ($ 1,383 billion), Switzerland ($ 896 billion) and Russia ($ 591 billion).

What has led to this rise in foreign exchange reserves?

The rise has been in a number of phases and has been led by various factors over the past ten months. Consultants say that the rise in overseas change inflows via International portfolio funding (FPI) and International Direct Funding (FDI and has additionally been supported by decline in import invoice over the past 4-5 months on account of dip in crude costs and commerce impression following Covid-19 pandemic.

Foreign exchange reserves to date in FY21

Foreign exchange reserves to date in FY21

Additionally learn | The significance of India’s rising foreign exchange reserves amid Covid financial disaster

A few of the key elements embrace:

FPI inflows: Whereas it began with a pointy rise in FPI inflows following the federal government’s determination in September to chop company tax fee. Between April and December 2019, FPIs pumped in a web $15.1 billion, based on the RBI.

Dip in crude oil costs: India’s oil import invoice declined as the worldwide unfold of coronavirus since February 2020 not solely roiled the inventory markets but additionally led to a crash within the Brent crude oil costs. Whereas crude accounts for nearly 20 per cent of India’s whole import invoice, Brent crude oil costs fell to ranges of $20 per barrel in direction of March finish, it dropped additional and traded between $9 and $20 in April. In January 2020, Brent crude was buying and selling between $60 and $70 per barrel.

Import financial savings: Lockdown throughout nations in response to Covid-19 pandemic impacted international commerce and has resulted in a pointy dip in import expenditure — electronics, gold and in addition crude oil costs amongst others.

FDI inflows: Between September 2019 and March 2020 overseas direct investments stood at $23.88 billion and in April and Could it amounted to $5.9 billion. Market specialists say that lots of FDI has additionally are available June and July too, particularly the Rs 1 lakh crore plus funding by international tech giants in Jio Platforms. Thus FDI influx has been a big contributor to the rise in overseas change reserves.

Dip in gold imports: Gold which was a giant import element for India witnessed a pointy decline within the quarter ended June 2020 following the excessive costs and the lockdown induced by the Covid-19 pandemic. In accordance with the World Gold Council (WGC), gold imports plummeted by 95 per cent to 11.6 tonnes within the quarter as in comparison with 247.Four tonnes in the identical interval a yr in the past as a consequence of logistical points and poor demand. The worth of gold transacted through the June quarter fell to Rs 26,600 crore, down by 57 per cent as in comparison with Rs 62,420 crore a yr in the past, WGC mentioned.

📣 Categorical Defined is now on Telegram. Click on right here to hitch our channel (@ieexplained) and keep up to date with the most recent

What does the rising foreign exchange reserves imply?

The rising foreign exchange reserves give lots of consolation to the federal government and the Reserve Financial institution of India in managing India’s exterior and inside monetary points at a time when the financial development is about to contract by 5.Eight per cent in 2020-21. It’s a giant cushion within the occasion of any disaster on the financial entrance and sufficient to cowl the import invoice of the nation for a yr. The rising reserves have additionally helped the rupee to strengthen in opposition to the greenback. The overseas change reserves to GDP ratio is round 15 per cent. Reserves will present a stage of confidence to markets {that a} nation can meet its exterior obligations, display the backing of home forex by exterior belongings, help the federal government in assembly its overseas change wants and exterior debt obligations and preserve a reserve for nationwide disasters or emergencies. “Ample foreign exchange reserves ought to present room for the RBI to chop charges and assist restoration. We estimate that the RBI can promote $50 bn to defend the rupee in case of a speculative assault. Of observe, RBI motion to assist development ought to entice FPI fairness flows,” says a Financial institution of America report.

What does the RBI do with the foreign exchange reserves?

The Reserve Financial institution capabilities because the custodian and supervisor of foreign exchange reserves, and operates throughout the general coverage framework agreed upon with the federal government. The RBI allocates the {dollars} for particular functions. For instance, underneath the Liberalised Remittances Scheme, people are allowed to remit as much as $250,000 yearly. The RBI makes use of its foreign exchange kitty for the orderly motion of the rupee. It sells the greenback when the rupee weakens and buys the greenback when the rupee strengthens. Of late, the RBI has been shopping for {dollars} from the market to shore up the foreign exchange reserves. When the RBI mops up {dollars}, it releases an equal quantity within the rupees. This extra liquidity is sterilised via situation of bonds and securities and LAF operations to stop an increase in inflation.

Are foreign exchange reserves giving returns to India?

Solely gold reserves have given massive returns to India. Whereas the RBI has not disclosed the precise returns from foreign exchange reserves, specialists estimate India is more likely to get solely negligible returns as rates of interest within the US and Eurozone are round one per cent. Quite the opposite, India could possibly be going through a price to maintain the reserves overseas. Out of the whole overseas forex belongings, as a lot as 59.7 per cent was invested in securities overseas, 33.37 per cent was deposited with different central banks of different nations and the BIS and the steadiness 7.06 per cent comprised deposits with business banks abroad as of March 2020. Additional, as at end-March, 2020, the RBI held 653.01 tonnes of gold, with 360.71 tonnes being held abroad in secure custody with the Financial institution of England and the Financial institution for Worldwide Settlements, whereas the remaining gold is held domestically. With gold costs taking pictures up round 40 per cent to over Rs 55,000 per 10 grams this yr, the worth of gold holdings has shot up.

Additionally in Defined | Kerala Air India Categorical aircraft crash: Why the tabletop runway is a problem

📣 The Indian Categorical is now on Telegram. Click on right here to hitch our channel (@indianexpress) and keep up to date with the most recent headlines

For all the most recent Defined Information, obtain Indian Categorical App.

© The Indian Categorical (P) Ltd