Early September has been good for the Dollar, a minimum of comparatively talking. Because the FED launched “QE Limitless” to fight COVID-19 fallout, the USD has been on a gradual decline. Upon Jerome Powell’s revision of the two% inflation mandate on the Jackson Gap Symposium, the injury intensified. Now, with the FOMC as a consequence of meet in eight days, america greenback is displaying indicators of life versus the majors.

At this level, no motion is anticipated from the FED at subsequent Wednesday’s assembly. Nonetheless, it seems that traders are gearing up for a extra hawkish tone. Though QE Limitless stays in place and inflation is now in vogue, the markets seem like bracing for a possible shock. For the primary time in months, we’re seeing equities weak spot paired with USD power ― do the markets know one thing we don’t?

At the moment, just about everyone seems to be in wait-and-see mode. And, don’t anticipate this angle to vary anytime quickly. With the U.S. election below 60 days out, political uncertainty will proceed to drive shares, commodities, and the Dollar.

The Dollar Holds Agency Vs The Swissy

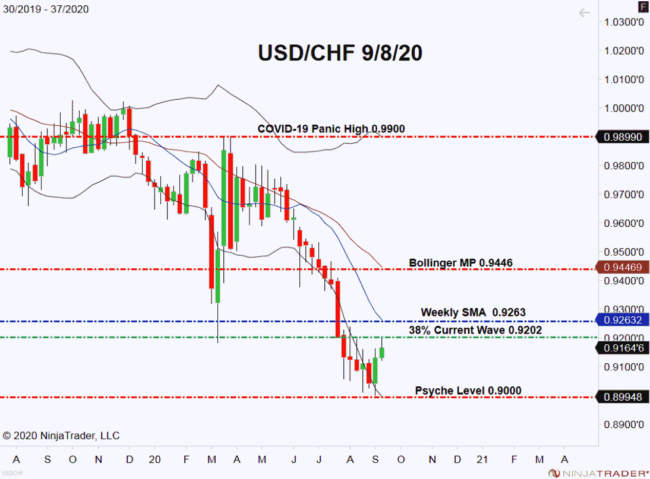

In a Dwell Market Replace from Monday, I issued a promote advice for the USD/CHF. The commerce turned out to be a breakaway winner, cashing in for 25 pips revenue.

Overview: In the interim, all eyes are on the 38% Present Wave Retracement (0.9202) within the USD/CHF. So long as charges stay beneath this degree, an intermediate-term bearish bias is warranted.

Whereas the foreign exchange motion has been considerably sluggish right this moment, enterprise is bound to select up within the coming 24 hours. China’s CPI, the Financial institution of Canada Curiosity Price Choice, and API crude oil shares numbers are due out. As we roll by way of the holiday-shortened buying and selling week, remember to preserve an eye fixed out for volatility surrounding these releases.