Australian Greenback Basic Forecast: BearishThe RBA’s semi-annual Monetary Stability Evaluation, and issues encompass AstraZeneca

Australian Greenback Basic Forecast: Bearish

- The RBA’s semi-annual Monetary Stability Evaluation, and issues encompass AstraZeneca’s vaccine, could proceed to drive the risk-sensitive AUD decrease within the close to time period.

- Nonetheless, sturdy Chinese language financial information could restrict the foreign money’s potential draw back, with Q1 GDP anticipated to bolster the nation’s robust rebound in output.

Uncover what sort of foreign exchange dealer you’re

Dovish RBA, Vaccine Considerations to Weigh on AUD

The chance-sensitive Australian Greenback could proceed to lose floor towards its haven-associated counterparts within the week forward regardless of the prospect of strong Chinese language first-quarter GDP figures, because the Reserve Financial institution of Australia’s semi-annual Monetary Stability Evaluation reveals rising dangers to the native financial system.

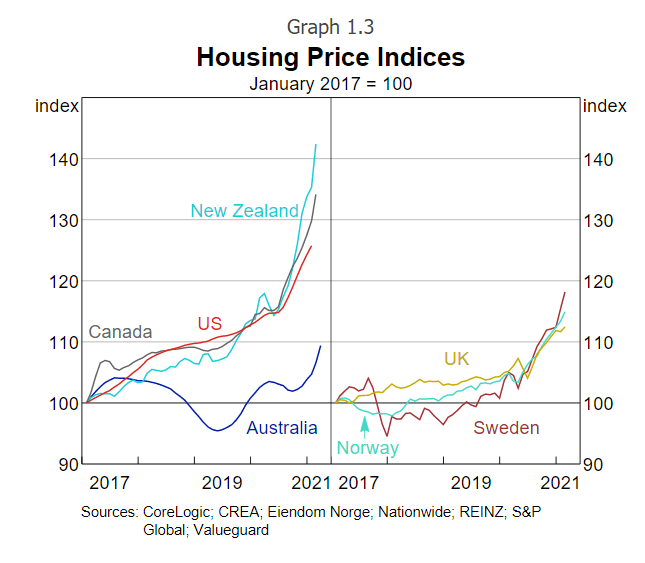

The central financial institution warned that dangerous behaviour from overly-optimistic buyers may drive asset costs above their basic values and trigger debt ranges to construct, exposing these property to a big correction that “would expose lenders to giant losses on the elevated debt, significantly if the standard of that debt had been eroded”.

Nonetheless, the RBA downplayed the latest rise in housing costs as a menace to monetary stability, because it had not been accompanied by a notable construct up in debt. Home costs surged by the biggest quantity since 1988, – on a month-to-month foundation – in March, as report low rates of interest and low cost mortgages continues to gas demand.

This commentary means that the central financial institution will retain its dovish financial coverage stance for the foreseeable future. Certainly, Governor Phillip Lowe has acknowledged that the financial institution could roll over the November 2024 bond from the April 2024 bond for its YCC goal within the coming months, and reiterated that “the financial institution is ready to undertake additional bond purchases if doing so would help with progress in direction of the objectives of full employment and inflation”.

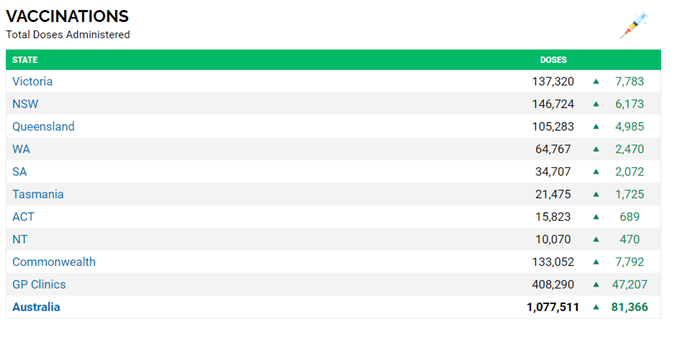

Compounding the draw back strain on the native foreign money is the cumbersome rollout of coronavirus vaccines to the general public, with just one.07 million doses administered as of April 7. That is far wanting the 4 million doses projected to have been delivered by now, and the speed of inoculations is unlikely to select up given the latest warnings concerning AstraZeneca’s shot.

Prime Minister Scott Morrison acknowledged that the AZ vaccine would now not be beneficial for under-50’s as a consequence of attainable hyperlinks to a uncommon blood clotting dysfunction, all however ruling out the likelihood that every one Australians could have acquired their first shot by October.

Supply – covidlive.com.au

Chinese language Q1 GDP In Focus

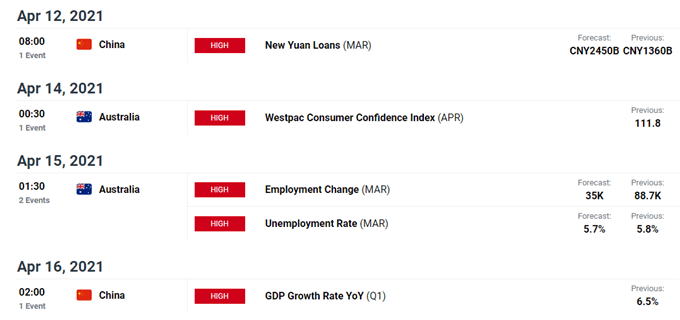

Wanting forward, upcoming jobs numbers for March and sturdy Chinese language financial information could restrict AUD’s potential draw back. The native jobless fee is predicted to fall 0.1% in March to five.8% nevertheless, that is unlikely to have a notable impression on the RBA’s outlook transferring ahead contemplating the JobKeeper program expired on the tail-end of final month. Treasury forecasts the cessation of this program may in the end result in the lack of over 150,000 jobs and see the unemployment fee climb to 7%.

Indicators of financial power out of China could assist to stem the Aussie’s slide decrease, with Australia’s largest buying and selling accomplice’s financial system anticipated to broaden by double digits within the first quarter. Nonetheless, deteriorating fundamentals regionally could proceed to low cost AUD towards its lower-beta counterparts within the close to time period.

DailyFX Financial Calendar

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Advisable by Daniel Moss

Get Your Free AUD Forecast

component contained in the component. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the component as a substitute.

www.dailyfx.com