Dow Jones, Nasdaq 100, S&P 500 October Worth Outlook: Dow Jones, Nasdaq 100, S&P 500 Forecast for the Month ForwardAn exp

Dow Jones, Nasdaq 100, S&P 500 October Worth Outlook:

Dow Jones, Nasdaq 100, S&P 500 Forecast for the Month Forward

An expectedly risky September noticed the Dow Jones, Nasdaq 100 and S&P 500 fall from their August ranges as volatility surged and election uncertainty grew. That mentioned, September is traditionally a bearish month for fairness markets and plenty of buyers had been issuing warning because the summer time doldrums drew to an in depth. Both means, value motion within the closing week of the month, and certainly of the third quarter, was encouraging, however does that recommend shares will proceed larger in October?

Inventory Market Seasonality

Supply: Bloomberg, compiled by John Kicklighter

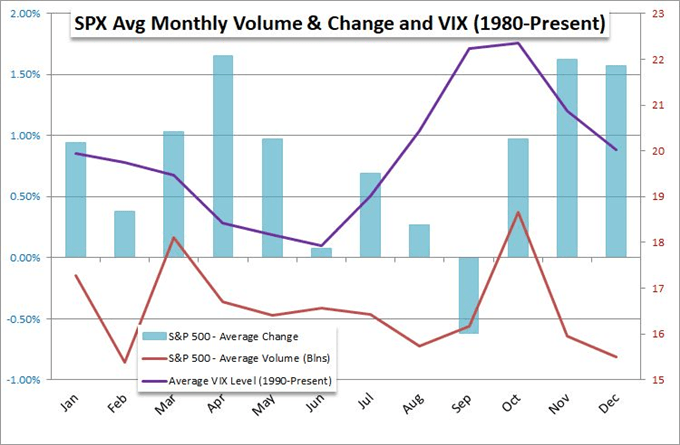

Whereas it’s troublesome to say with any certainty, historical past suggests October is likely one of the higher performing months of the 12 months on common with the S&P 500 returning roughly 1% within the month over the past thirty years. That mentioned, a historic evaluate of the volatility index (VIX) reveals October has additionally been probably the most risky month with a mean VIX degree of 22.5 since 1990. Nonetheless, previous efficiency is hardly indicative of future outcomes and every calendar 12 months can have substantial outliers that buck the pattern.

Advisable by Peter Hanks

Traits of Profitable Merchants

That being mentioned, the components for a risky October are definitely current. On the bullish facet, analysts are hoping for a coronavirus vaccine that may expedite a return to normalcy whereas others cling to the prospect of additional stimulus packages. Conversely, many buyers have develop into pessimistic concerning the post-covid financial system – maybe rightfully in order corporations announce huge layoffs.

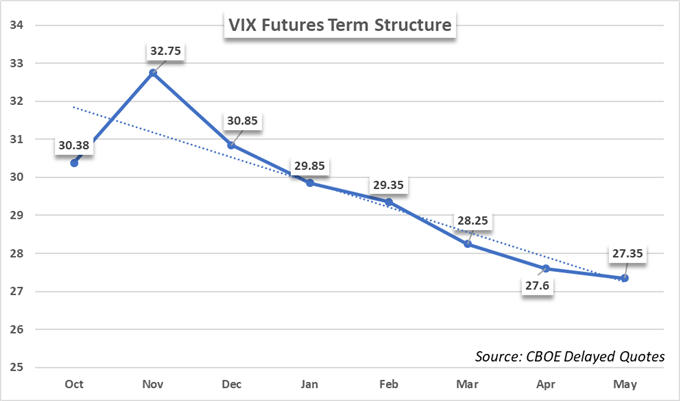

Additional nonetheless, buyers are already positioning for election associated volatility, evidenced by VIX futures. Evidently, the story of the fairness market is way from a fairytale and a seasonal rise in volatility will work to exacerbate value swings in both course. Nonetheless, a dedication from the Fed to keep up low rates of interest ought to present a tailwind for fairness valuations within the longer-term.

Advisable by Peter Hanks

Get Your Free Equities Forecast

Whereas the longer-term outlook unfolds, I consider the election will develop into an more and more dominant theme to observe within the fourth quarter and additional volatility appears doubtless. Within the meantime, observe @PeterHanksFX on Twitter for updates and evaluation.

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and observe Peter on Twitter @PeterHanksFX