The Dow Jones, S&P 500 and Nasdaq Composite roared to life this previous week as a blowout jobs report defied even the least-

The Dow Jones, S&P 500 and Nasdaq Composite roared to life this previous week as a blowout jobs report defied even the least-dismal projection from economists. Over 2.5 million non-farm payroll positions have been added versus -7.5m anticipated. The US unemployment fee even declined to 13.3% from 14.7% prior. Analysts have been in search of a rise to 19.0%.

Advisable by James Stanley

Don’t give into despair, make a sport plan

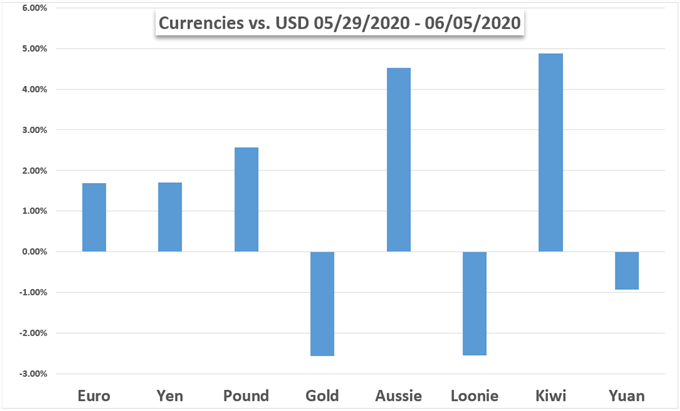

This meant a dreadful week for the haven-linked US Greenback because it plunged to its common most cost-effective value since early March. The sentiment-linked Australian and New Zealand {Dollars} exploded greater, testing peaks set firstly of this yr. Longer-term Treasury yields rose, reflecting rising confidence which weighed towards anti-fiat gold costs.

For now fears of a second wave of the coronavirus and escalating US-China tensions have taken a again seat. All eyes subsequent week flip to the Federal Reserve financial coverage announcement as nations world wide proceed slowly lifting lockdown measures. The central financial institution’s most important coverage settings are anticipated to be left unchanged with merchants eyeing financial assessments.

Crude oil costs have the weekend OPEC+ assembly to catch assist from because the commodity-producing cartel might lengthen report output curbs. Brexit talks additionally proceed for the destiny of the transition interval. Merchants may additionally search for indicators of rising confidence on the finish of the week when the world’s largest financial system releases preliminary sentiment knowledge for June.

Advisable by James Stanley

Are retail merchants leaning into momentum or preventing it?

Uncover your buying and selling character to assist discover optimum types of analyzing monetary markets

Basic Forecasts:

Euro Forecast: Outlook for EUR/USD Nonetheless Bullish, Extra Stimulus Deliberate

The European Fee’s proposed €750 billion restoration package deal for the EU financial system shall be on the agenda this coming week, probably holding EUR/USD on an upward path.

Crude Oil Costs Eye OPEC+ Assembly as US and China Demand Rises

Crude oil costs await the OPEC+ assembly the place report output cuts could possibly be extended as demand for power from the US and China continues recovering. What could possibly be the draw back dangers?

USD/MXN Outlook: Revenue-Taking, FOMC and Extra Actual-Time Financial Knowledge

The Mexican Peso performs one other stellar week towards the Greenback however profit-taking could curb additional losses

Gold Value Outlook: Gold Slammed Decrease on Report US Jobs Creation

Gold has fallen sharply after the most recent US Non-Farm Payroll report confirmed 2.5 million jobs created in Could , smashing expectations of an eight million loss.

AUD/USD Rallies to Yearly Open Forward of FOMC Fee Resolution

The Australian Greenback has soared again to the yearly open highs, seemingly dismissing the upcoming onset of Australia’s first recession in 29 years

Nasdaq 100, DAX 30 & FTSE 100 Forecasts: Will the Restoration Proceed?

The Nasdaq reached contemporary heights on Friday regardless of an ever extra difficult basic panorama as President Trump floated the thought of auto tariffs on the EU. How may this influence the week forward?

Technical Forecasts:

US Greenback Restoration May Undermine Good points in AUD/USD & EUR/USD

The Buck could reclaim some misplaced floor versus the Australian Greenback and Euro within the week forward after an aggressive promoting bout despatched the USD index to an 11-week low.

Gold Forecast: 2012 Excessive Nonetheless on Radar as Value Holds Could Vary

The value of gold could proceed to exhibit a bullish conduct in June because the pullback from the yearly excessive ($1765) reverses forward of the Could low ($1670).

Yen Value Outlook: USD/JPY Explodes, AUD/JPY Extends V-Restoration

JPY value motion weakens additional because the Japanese Yen continues to crumble towards its US Greenback and Australian Greenback friends. Can spot USD/JPY and AUD/JPY preserve climbing or is the rally overdone?

Crude Oil Outlook: Huge Hole & Resistance Ranges in View

Oil continues to restoration, and should have some extra room to go, however merchants will need to regulate a few necessary technical thresholds.

S&P 500, Nasdaq 100, FTSE 100 Technical Outlook For Subsequent Week

S&P 500 bulls in command, Nasdaq 100 produces “V” formed restoration, whereas FTSE 100 extends restoration

Sterling Value Outlook: Pound Surges into Essential Fibonacci Resistance

Sterling rallied greater than 11% vs US Greenback for the reason that March low with value now testing key confluent resistance. Listed below are the degrees that matter on the technical charts.

Euro Technical Forecast: EUR/USD, EUR/JPY, EUR/GBP, EUR/CHF

The danger rally continued in a giant approach this week and Euro bulls have remained in-charge towards the US Greenback and Japanese Yen.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD