ECB assembly minutes might be uneventful for the euro – Foreign exchange Information Preview Posted on Mig

ECB assembly minutes might be uneventful for the euro – Foreign exchange Information Preview

Posted on Might 13, 2021 at 2:55 pm GMTChristina Parthenidou, XM Funding Analysis Desk

The European Central Financial institution will launch the minutes from April’s assembly on Friday at 11:30 GMT offering an in depth clarification about its determination to carry its coverage secure final month. The report just isn’t anticipated to tug something new out of the hat, however buyers might nonetheless undergo the textual content to detect any indicators that policymakers are keen to begin financial tightening dialogues.

PEPP purchases enhance not sufficient to cease yield rally

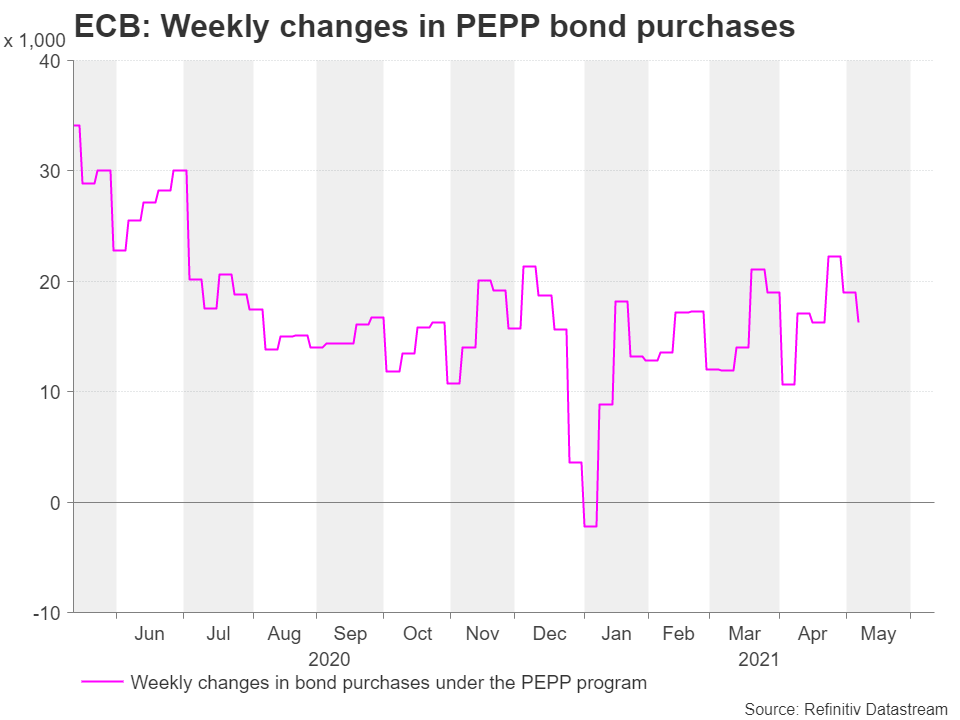

Throughout April’s coverage assembly, the ECB left its deposit facility fee regular at a document low of -0.5% and its asset purchases unchanged as anticipated. Following the March initiative, the central financial institution additionally reiterated that bond purchases beneath the Pandemic Emergency Buy Program (PEPP) “will proceed to be carried out at a considerably larger tempo than throughout the first quarter” however throughout the envelope of 1.85 trillion euros till no less than March 2022 “and, in any case, till the Governing Council judges that the coronavirus disaster section is over” with the intention to tackle the rise in bond yields and maintain borrowing prices low.

Certainly, weekly PEPP purchases have been larger than these within the first three months of the yr, however the addition seems barely a major one and has completed little to regulate the rally in bond yields to date. The German 10-year bund yield, though in unfavourable space, continued to pattern up, hitting a recent three-year excessive of -0.119% on Wednesday after the US core Client Value Index (CPI) boosted international inflation fears.

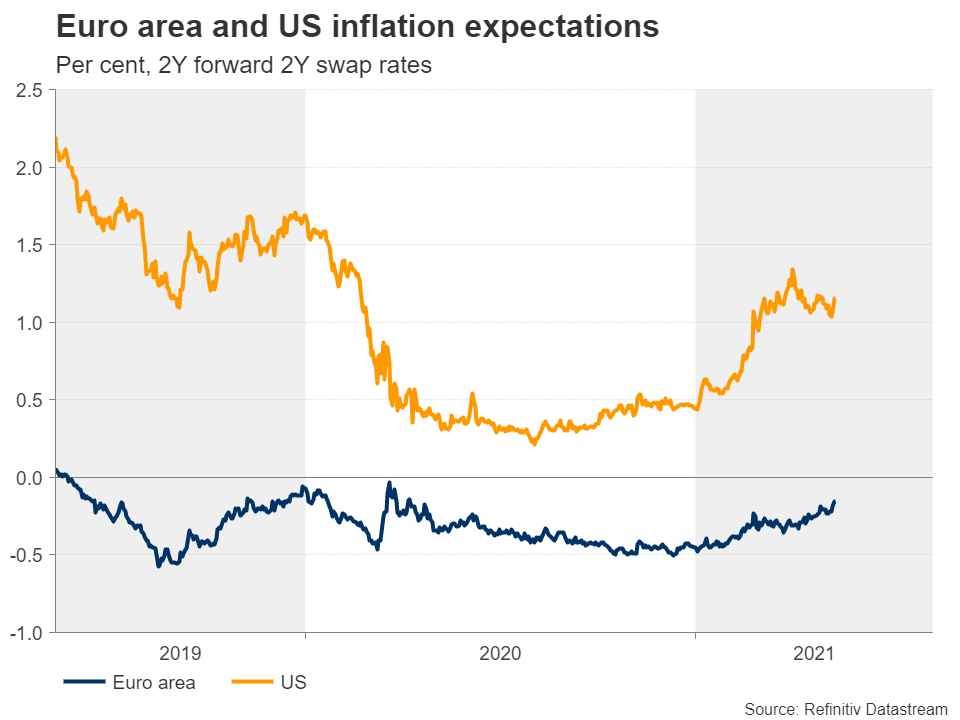

Each the Fed and the ECB consider that any spikes in inflation measures will probably be transitory and might be an final result of base results from final yr’s low costs, hinting that any financial tightening this yr can be untimely. Presently, there may be not sufficient proof to show the alternative, however given the truth that the ECB has a decrease inflation objective of “beneath however near 2.0%” than the Fed, which is keen to permit costs to rise above 2.0% for a while, questions are rising about whether or not the ECB will probably be as affected person because the Fed is that if the eurozone CPI surges past its goal and holds above it within the second half of the yr.

Inflation just isn’t a priority within the eurozone however financial outlook will get promising

For now, inflation pressures aren’t a priority within the eurozone. The headline CPI has picked up steam to a three-year excessive of 1.6% y/y in March however has but to point out any extraordinary powers, whereas the core CPI, which excludes meals and vitality has reversed again to the draw back, dropping from 1.4% y/y in January to 0.9%. Subsequently, the ECB has a very good purpose for now to maintain its coverage accommodative and Friday’s minutes might underline the choice for sustaining a supportive coverage to handle financial vulnerabilities and constrain potential unfavourable long-term results from the pandemic. A fast tapering might end in the next unemployment fee and a depressed inflation, whereas a steady stimulus could damage revenue margins for the banks, which function beneath unfavourable rates of interest, however might steadiness the massive public deficits.

ECB minutes to reiterate the necessity for stimulus; communication type in focus

Therefore, despite the fact that the minutes might simply telegraph what’s already recognized, buyers would carefully scan the minutes for any hawkish changes within the communication type and clues of division amongst policymakers, which can probably open the phasing out discussions, particularly if the restoration fund comes quickly into play. Word that the variety of pro-tapering policymakers have been growing these days, with Latvia’s central financial institution governor Martin Kazaks saying final Friday that the central financial institution might scale back the tempo of its PEPP purchases in June. The Dutch central financial institution chief additionally raised prospects of dialing it down earlier than resuming his dovish tone.

Euro/greenback response

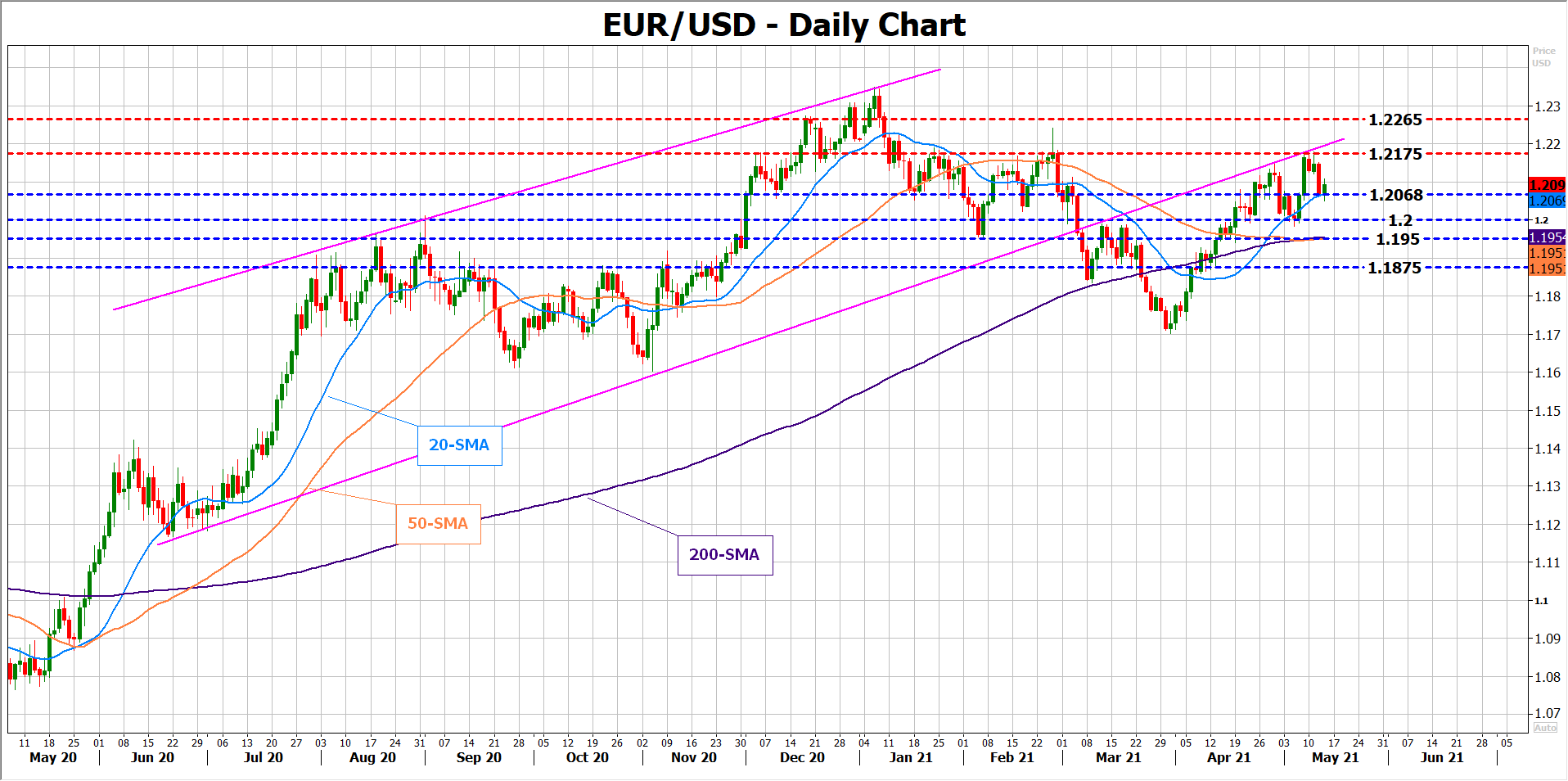

As regards the response within the euro, except analysts detect any shifts within the writing type, the minutes aren’t anticipated to maneuver the foreign money. From a technical perspective, nonetheless, if the 1.2068 assist stage holds agency in opposition to the US greenback, the euro could try and breach the 1.2145- 1.2175 resistance area and push above the restrictive line with scope to achieve the 1.2265 barrier.

In any other case, if the 1.2068 flooring collapses, the 1.2000 mark might instantly come beneath the highlight forward of the 1.1950 stage, the place the 50- and 200-day easy shifting averages are positioned. Decrease, the value might stabilize someplace round 1.1875.

EURUSD