ECB Holds Rates, Eyes 25 and 50 bps Hikes in July and SeptemberThe ECB held true to its forward guidance and sequencing whereby it foresaw a rate hik

ECB Holds Rates, Eyes 25 and 50 bps Hikes in July and September

The ECB held true to its forward guidance and sequencing whereby it foresaw a rate hike only after APP comes to an end, meaning July is when we are very likely to witness lift-off.

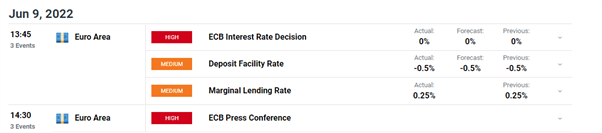

Times are in GMT+2

Customize and filter live economic data via our DaliyFX economic calendar

Pertinent Points of the 9 June ECB Meeting:

- Rates left unchanged but the ECB intends to raise by 25 basis points in July

- ECB intends to reinvest, in full, principal payments of maturing securities under both APP and PEPP. PEPP reinvestments to continue until end of 2024 at a minimum while leaving APP reinvestments open-ended. Purchases under PEPP could be resumed if necessary to counter negative shocks related to the pandemic.

- Real Annual GDP growth: 2.8% 2020, 2.1% in 2023 and 2.1% in 2024

- ECBInflation forecast 6.8% in 2022, 3.5% in 2023 and 2.1% in 2024

- ECB favors 25 bps in July but maintains a data-centric approach and therefore, cannot rule out a 50 bps hike

- If medium-term inflation outlook persists, a larger than 25 bps hike will be appropriate for the September meeting

EUR/USD rose in the lead up to the announcement, shot below 1.070 and subsequently recovered and is trading right where it was moment before the news.

EUR/USD 5 Minute Chart

Source: TradingView, prepared by Richard Snow

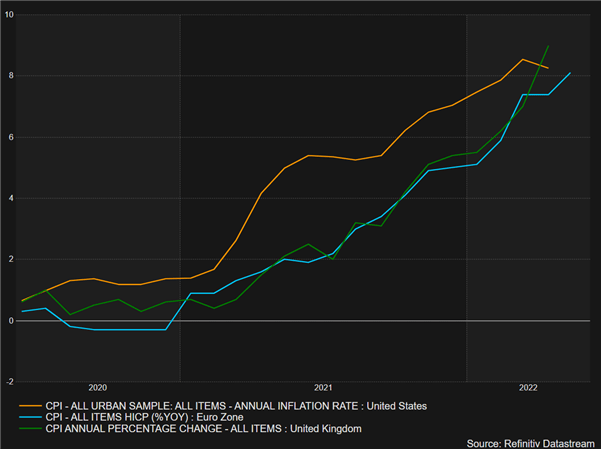

The justification behind a 50 basis point hike in July is gaining momentum by the day as HICP inflation more than doubled the previous high of 4% in 2008. Something that the Bank is trying to avoid is fragmentation in the bond market – a situation where sovereign bond spreads within the EU widen, disproportionately raising borrowing costs for the more heavily indebted nations like Spain, Italy and Greece.

CPI Inflation Data Across Selected Major Economies

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com