First it was recognized for the Black Friday inventory market crash – then for being the largest buying day of the yr. The which means could have a

First it was recognized for the Black Friday inventory market crash – then for being the largest buying day of the yr. The which means could have advanced, however right this moment, Black Friday remains to be a topic for inventory market scrutiny. Which retailers look set to profit? What can we be taught from the value motion of previous years? And what elements enable you commerce the interval? We’ll discover out. However first, a historical past lesson.

What’s Black Friday?

Black Friday was initially the time period used to explain the inventory market collapse of 1869, when American traders Jay Gould and James Fisk prompted a monetary meltdown after a failed try and nook the gold market.

The trendy idea of Black Friday, nonetheless, took place within the 1940s to entice folks to the shops the day after Thanksgiving. Named for its tendency to contribute to site visitors accidents, Black Friday later took on a brand new which means as firms anticipated to make sufficient gross sales to place them ‘within the black’, or worthwhile, for the yr.

It was not till the 1980s, nonetheless, that retailers started to slowly use the day as a advertising and marketing software, culminating in its widely-held standing as the most well-liked buying day of the yr within the 2000s. At the moment, Black Friday is greater than only a US-based custom; it has unfold to some 20 different nations, together with Mexico, Russia and Pakistan.

Along with Cyber Monday, the Monday after Thanksgiving that pushes on-line gross sales, the buying interval is seen by some analysts and market commentators as offering a measure of financial prosperity. That measure can then be used to foretell the efficiency of different property similar to shares.

The affect of Black Friday

Advertising gimmick or helpful indicator; what’s the general affect of Black Friday? To reply, it’s price inspecting its impact on retail spending and customers, the economic system, and the ensuing impact (if any) on merchants and shares.

1) Retail spending and customers

There isn’t a doubt that Black Friday influences customers to spend. Throughout a variety of nations, the occasion is promoted as a uncommon probability to save cash throughout a gamut of merchandise, from laptops to lawnmowers, and historic media protection of the occasion has featured stampedes in stores as bargain-hungry punters battle for offers. In 2018, Adobe Analytics information reveals $6.22 bn was spent on-line within the US, representing a 23.6% enhance on the earlier yr. Moreover, each Black Friday bar one has seen greater retail gross sales quantity than some other date.

2) Financial system

Black Friday’s affect on the economic system is extra debatable. Some argue in favor of the Keynesian impact of spending driving financial exercise, which places more cash into circulation and probably buoys the economic system. At a time when the US economic system has proven indicators of recession, client spending is likely to be welcomed. However others say that the affect of the occasion is negligible, with solely short-term results noticed. That is due partially to classes from earlier years, when many retailers have seen poor gross sales figures as soon as the discounting has ended.

Nonetheless, if shops resolve to go one other route and extend reductions, revenue margins might be eroded, probably which means workers cuts and elevated unemployment. Knock-on financial results of this might embrace decreased revenue tax receipts and a raised welfare burden, elements which elevate an argument for Black Friday having a web destructive financial impact.

3) Shares/inventory markets

The affect of Black Friday on inventory markets and particular person shares can be lower than easy. Maybe predictably, a variety of retail shares might be anticipated to rise if gross sales expectations are met. Conversely, unexpectedly weak gross sales can recommend poor client confidence and a fragile underlying economic system, giving merchants purpose to go quick. However even when a given firm has loved sturdy gross sales, this efficiency has no bearing on its profitability or general monetary well being, that are elements merchants ought to think about when selecting one inventory over one other.

Analyzing the influence of earlier Black Fridays on monetary markets offers an perception into the tendencies merchants would possibly anticipate to see following this key date sooner or later.

Black Friday and Inventory Market Historical past

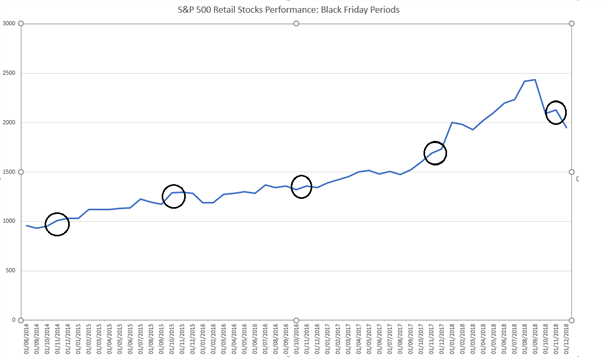

Whereas Black Friday historical past begins with the catastrophic 1869 inventory market crash, the trendy iteration of Black Friday has seen retail shares making sturdy returns across the Black Friday interval. This may be noticed within the S&P 500 the place, in a ten-year timeframe, Bloomberg information reveals a 5% return for retail shares in comparison with a median 3% over a interval of 1 week earlier than Black Friday to at least one week after.

The Black Friday intervals 2014-2018 are circled on the S&P 500 chart under. Nonetheless, whereas such information means that retail shares carry out properly over this era, inventory pickers ought to concentrate on the nuances between retail sub-sectors in addition to the chance of on-line gross sales taking enterprise from extra brick-and-mortar reliant shares, in addition to further elementary elements that may transfer the market.

Black Friday retail inventory efficiency: A snapshot

When measuring Black Friday retail inventory efficiency, right here’s an perception into how 15 main world retail shares did in 2018 over the interval one week earlier than to at least one week after Black Friday:

| Closing inventory value: Nov 16 2018 ($) | Closing inventory value: Nov 30 2018 ($) | Share enhance/lower | |

|---|---|---|---|

| Amazon | 1,502.06 | 1,690.17 | +11 |

| Apple | 193.53 | 178.58 | -8 |

| Greatest Purchase | 66.43 | 64.59 | -3 |

| Burlington Shops | 161.75 | 165.76 | +2 |

| Costco | 231.02 | 231.28 | +0 |

| CVS | 79.33 | 80.20 | +0 |

| H&M | 3.49 | 3.63 | +4 |

| Residence Depot | 177.02 | 180.32 | +2 |

| Lowe’s | 93.25 | 94.37 | +1 |

| Sainsbury’s | 15.90 | 15.60 | -2 |

| Goal | 79.68 | 70.96 | -12 |

| Tesco | 7.82 | 7.51 | -4 |

| TJX | 51.49 | 48.85 | -5 |

| Walgreens | 82.52 | 84.67 | +3 |

| Walmart | 97.69 | 97.65 | -0 |

Amazon reaped the rewards in 2018, having fun with its greatest buying day in historical past on Cyber Monday. Prospects ordered greater than 18 million toys and 13 million style objects on Black Friday and Cyber Monday mixed, in line with Bloomberg information, and noticed its share value rise to the tune of 11% over the two-week interval from November 16 to November 30, because the desk reveals.

On the quick facet, whereas Goal shares noticed a dip of 12% over the identical interval, the autumn can in all probability be attributed extra to a wider fall within the inventory market brought on by commerce wars and issues about world development than some other elements. This underlines the significance of merchants contemplating a variety of elementary causes that may contribute to strikes in the course of the vacation season.

Key concerns when buying and selling shares on Black Friday

As soon as merchants have assessed the market and gained a really feel for the retailers taking a lead in Black Friday gross sales, there are a selection of different concerns to make when buying and selling shares round this era.

- Inventory market liquidity: Buying and selling across the holidays can critically distort liquidity and Black Friday is not any exception. With fewer merchants on the desk, liquidity dries up and the potential for bigger swings can enhance – particularly as cease losses are triggered robotically and positions are ditched.

- Elementary elements: These could give clues as to how client spending could go, permitting merchants to contemplate sure retail shares. For instance, decrease gasoline costs and powerful employment figures might sign extra spending energy and firm gross sales expectations being met. Nonetheless, as talked about above, it’s necessary to pay attention to an entire vary of different elements that may influence the market and overshadow any strikes brought on by client sentiment.

- On-line vs brick and mortar gross sales: Brick and mortar retailers have misplaced floor to their on-line rivals in recent times and Cyber Monday threatens to take the crown by way of complete gross sales. To capitalize on this, it might be price maintaining a tally of shares like Amazon and Greatest Purchase which supply engaging on-line buying offers across the holidays.

- Earnings normally aren’t launched till January: Merchants must also be conscious that firm efficiency is probably not fully clear till earnings, which for a lot of firms will likely be launched in January.

What time does the inventory market shut on black Friday?

The inventory market open on Black Friday is 9:30 ET as regular, however the market closes at 1pm. The market is closed for the entire of Thanksgiving.

Additional studying on shares and buying and selling main indices

When you’re concerned with studying extra about shares, increase your equities data with our useful articles.