Earlier, the U.S. Vitality Data Company (EIA) launched its weekly oil shares report back to the general public. The EIA’s determine got here in at

Earlier, the U.S. Vitality Data Company (EIA) launched its weekly oil shares report back to the general public. The EIA’s determine got here in at -7.493 million barrels, nicely above projections (-2.098M) and final Wednesday’s quantity (5.654M). Whereas not a shock given summertime seasonality, a 10 million barrel week-over-week decline in provide is nothing to sneeze at. As well as, final evening’s API shares report confirmed a -8.322 million barrel draw, down from a 2.000 million barrel construct final week.

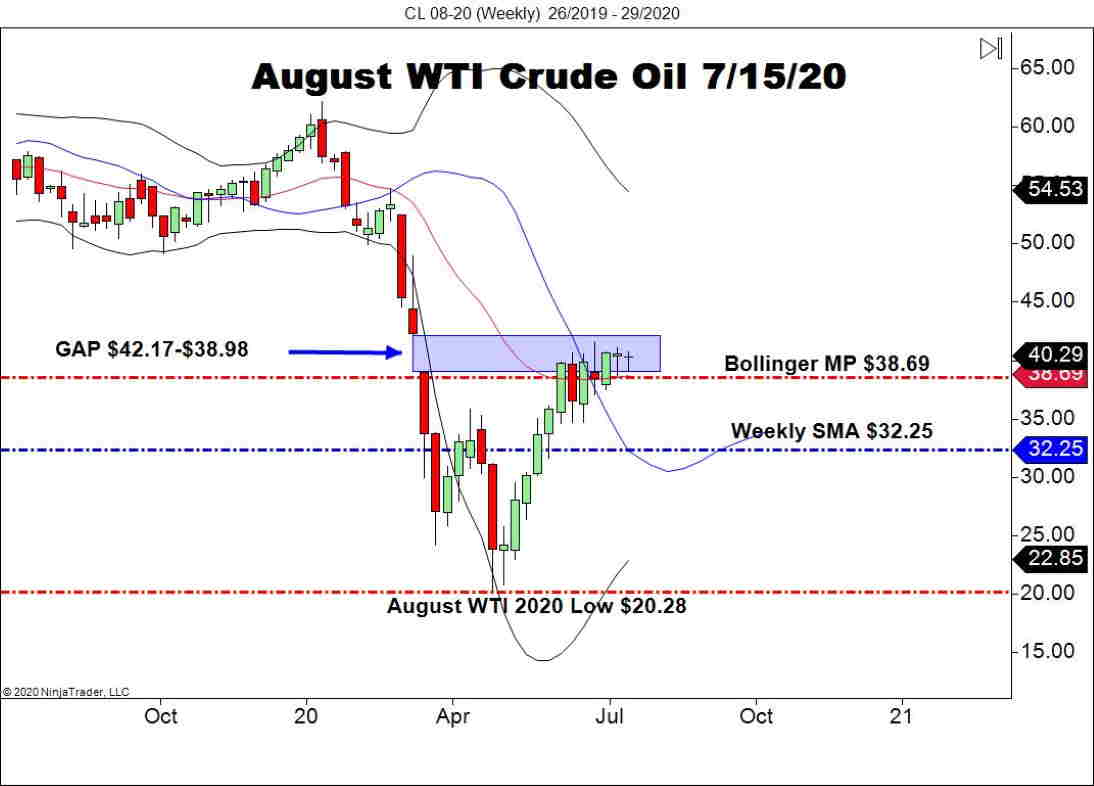

As one would count on with lagging provides, August WTI futures are on the bull north of $41.00. It’s vital to notice that the August/September rollover in WTI futures contracts is on the best way very shortly. August is holding on to a 3/2 quantity edge, however the motion is more likely to change to the September concern by Friday.

WTI Rallies On EIA’s 7.493 Million Barrel Draw On Provide

For the higher a part of the summer season, August WTI has rotated inside final March’s GAP space of $42.17-$38.98. Though a bullish bias continues to be warranted, one has to marvel if this market is ever going to interrupt out.

++26_2019+-+29_2020.jpg)

Listed here are the important thing ranges for August WTI going into late-week commerce:

- Resistance(1): Prime of GAP, $42.17

- Assist(1): Bollinger MP, $38.69

Backside Line: Whereas the ranges stay tight for August WTI, there are numerous causes to keep up a bullish bias. The most important issue is summer season seasonality and lowering barrels available. At this level, shopping for dips isn’t a nasty technique for WTI.

For the remainder of the week, I’ll have purchase orders queued up from $38.76. With an preliminary cease loss at $38.44, this commerce produces 32 ticks on an ordinary 1:1 threat vs reward ratio.