It’s Wednesday afternoon and that implies that the weekly crude oil stock cycle is full. At 10:00 AM EST this morning, the EIA reported that U.S.

It’s Wednesday afternoon and that implies that the weekly crude oil stock cycle is full. At 10:00 AM EST this morning, the EIA reported that U.S. oil inventories fell by 0.679 million barrels for the week of 27 November. Whereas not an enormous lower, January 2021 WTI crude futures are on the march above $45.00.

The worldwide oil complicated is in attention-grabbing territory as we roll into the winter season. For a month, costs have risen precipitously. At this level, it seems COVID-19 demand issues are taking a backseat to OPEC+ cuts and perceived Biden fracking bans. Given the pattern of shrinking provides, WTI could hit the vaunted $50.00 stage earlier than Christmas. Right here’s a have a look at this week’s oil shares figures:

Occasion Precise Projected Earlier

API Shares Report 4.146M NA 3.800M

EIA Shares Report -0.679M -2.358M -0.754M

This batch of API and EIA provide figures got here in combined. At this level, it seems like merchants are selecting to bid the EIA quantity as January WTI is up practically $1.00 at the moment.

WTI Futures Rally As EIA Experiences Draw On Provide

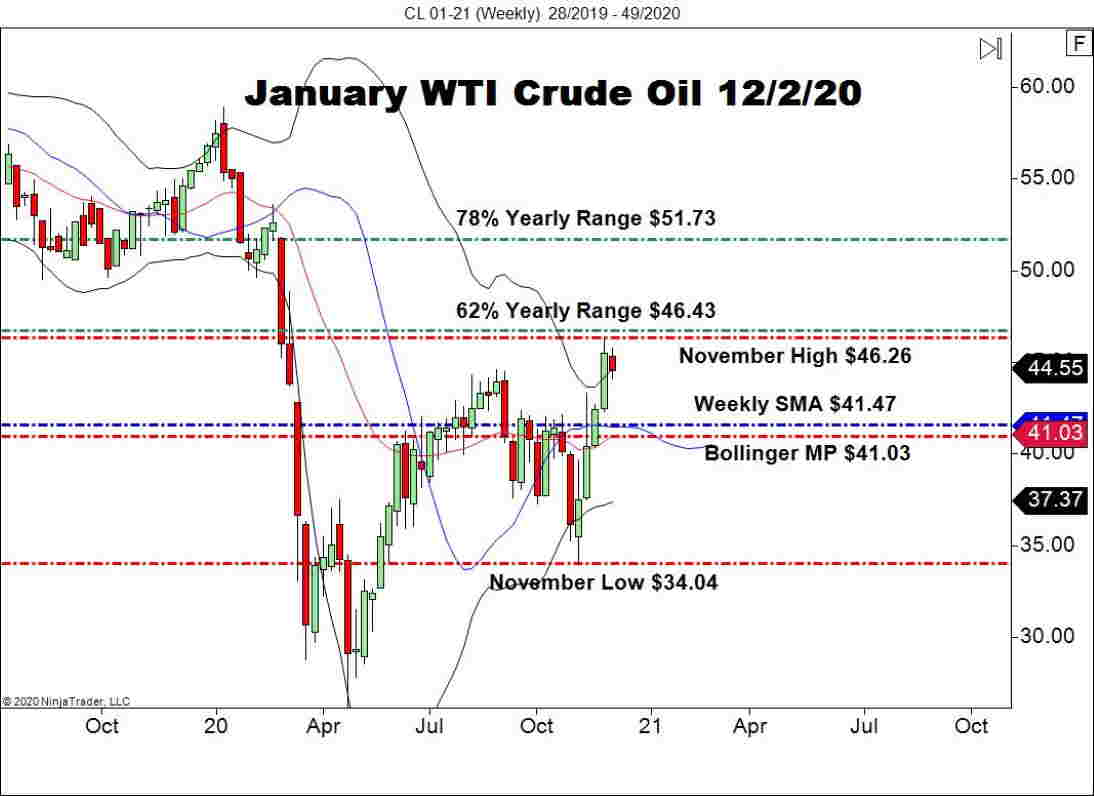

November was a giant month for January WTI. Costs jumped round $10 per barrel extending the uptrend from March’s lows.

++28_2019+-+49_2020.jpg)

Listed below are two ranges to look at on this market forward of the weekend break:

- Resistance(1): November Excessive, $46.26

- Resistance(2): 62% Yearly Vary, $46.43

Backside Line: The important thing stage for January WTI futures is shaping as much as be the 62% Yearly Retracement at $46.43. If we see this space challenged, a shorting alternative could come into play.

Till elected, I’ll have promote orders within the queue from $46.39. With an preliminary cease loss at $46.79, this commerce produces 40 ticks on a normal 1:1 threat vs reward ratio.