Opposite to traditional seasonal developments, this week’s crude oil stock cycle confirmed a strong construct in provide. A bit earlier, the Vital

Opposite to traditional seasonal developments, this week’s crude oil stock cycle confirmed a strong construct in provide. A bit earlier, the Vitality Data Company (EIA) launched its weekly shares report. The mixture determine got here in at +5.720 million barrels, shattering projections (-1.738 million) and the earlier launch (-2.077 million). This can be a pretty important uptick and one that implies WTI is probably not out of the “provide glut” woods simply but.

In some ways, as we speak’s EIA report is a head-scratcher. The COVID-19 lockdowns are ending and demand is returning to the vitality markets. Has the shutdown of North American fracking been overstated? Is U.S. financial exercise coming again slower than anticipated? Each of those questions are powerful to reply. For now, details are details ― provides are going up as the height demand season approaches.

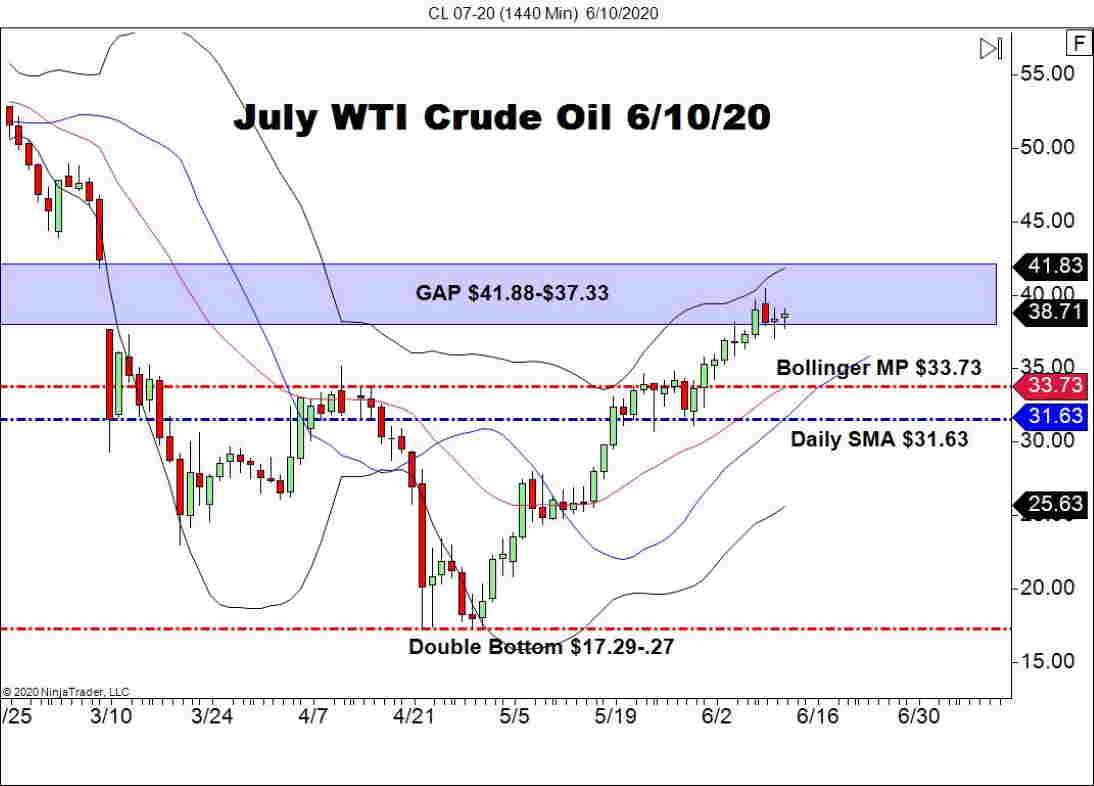

EIA Reviews Construct, July WTI Trades In The GAP

This morning’s volumes in July WTI crude oil are surprisingly mild. With only some hours left within the digital buying and selling day, July WTI has traded a sparse 250,000 contracts. At this level, it appears to be like like vitality gamers don’t know what to make of as we speak’s EIA report.

++6_10_2020.jpg)

Overview: With the June FED Bulletins due up shortly, July WTI crude oil continues to commerce within the GAP space. Within the occasion we see an optimistic tone from the FED, the topside of the GAP ($41.88) is prone to be examined later within the week. Whereas the EIA report from earlier didn’t do a lot for constructive WTI sentiment, costs stay in bullish territory.