The impression of Hurricane Laura’s manufacturing shutdown is now being felt. Earlier this morning, the U.S. Power Data Company (EIA) reported a l

The impression of Hurricane Laura’s manufacturing shutdown is now being felt. Earlier this morning, the U.S. Power Data Company (EIA) reported a large -9.362 million barrel decline in oil shares readily available. A lot of the downturn could also be attributed to final week’s Class Four storm that ceased manufacturing within the Gulf Coast area.

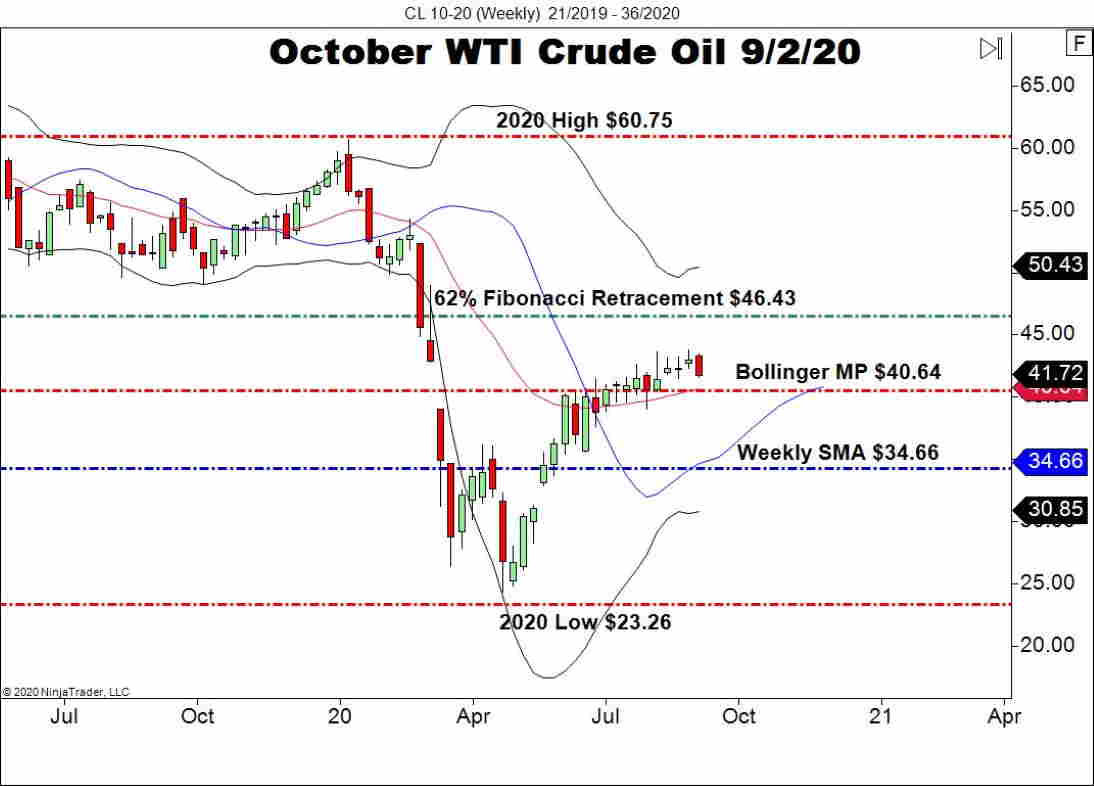

Nevertheless, regardless of the drop in provides, October WTI crude oil is buying and selling a lot decrease. Costs are off by greater than $1.00 per barrel amid lackluster volumes. Because the Labor Day weekend rapidly approaches, it appears to be like like we might have already seen {the summertime} peak for crude oil.

EIA Reviews Extraordinary Week-Over-Week Change

This week’s oil inventories cycle is within the books. Each the API and EIA figures fell dramatically within the wake of Hurricane Laura. Let’s dig into the figures:

Occasion Precise Projected Earlier

API Crude Oil Shares -6.360M NA -4.524M

EIA Crude Oil Shares -9.362M -1.887M -4.689M

It’s tough to overstate how weak WTI pricing has been over the previous seven classes. Within the midst of a hurricane and slumping EIA and API provide figures, October WTI is trending towards the bear. Whereas we are going to study extra within the coming weeks, it might be that WTI is already headed into fall/winter seasonality.

October WTI Plunges Towards $41.00

As you may see beneath, October WTI crude oil has traded sideways for almost all of the summer time. Sentiment has been reasonably bullish as costs have stagnated inside March’s GAP space.

++21_2019+-+36_2020.jpg)

For the remainder of the week, there’s one help stage to observe:

- Assist(1): Bollinger MP, $40.64

Backside Line: If we see October WTI proceed to slip, a protracted commerce will come into play. Till Friday’s closing bell, I’ll have purchase orders within the queue from $40.67. With an preliminary cease loss at $40.42, this commerce produces 25 ticks on a regular 1:1 danger vs reward ratio.